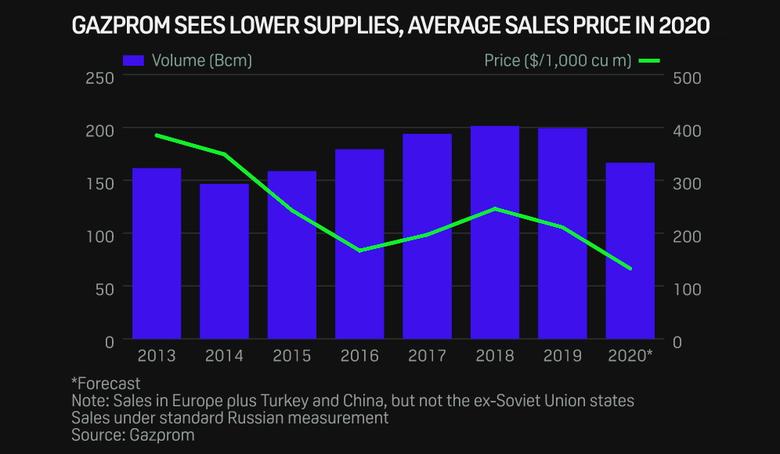

GAZPROM SALES DOWN: 2020

PLATTS - 16 Feb 2021 - Russia's Gazprom saw its total gas sales dip by 8.1% in 2020 as the coronavirus pandemic hit demand -- particularly in the second quarter -- but strong growth in Q4 rounded out a tumultuous year for European gas.

Gazprom sold a total of 209.7 Bcm last year across all of its pipeline markets, down from 228.2 Bcm in 2019, according to an analysis of sales data published in the company's full-year earnings statement late on Feb. 15.

The report gives the first breakdown of sales by country across all of Gazprom's pipeline markets, including countries of the former Soviet Union and -- for the first full year -- China.

Sales were down by 17% in both the first two quarters of 2020, which bore the brunt of the demand hit from the lockdowns across Europe, but supplies rebounded in the second half to leave total sales down by 8.1%.

Germany remained Gazprom's biggest market by far, though 2020 saw a sharp fall in sales of 14.3% to 45.8 Bcm on lower demand and increased imports from Norway.

German long-term contract holders also likely nominated their take-or-pay volumes down to minimum levels on very low European hub prices especially in Q2.

There was also again limited storage demand in Germany as stocks remained elevated from the end of the withdrawal season in April last year.

Gazprom's next two biggest markets are Italy and Belarus, which saw year-on-year declines of 5.9% and 7.4%, respectively.

Turkey jump

Turkey was Gazprom's fourth-biggest market, and the only one of the top four to see sales rise, after a rollercoaster year that saw supplies grind almost to a halt in Q2 before maxing out in the final months of the year.

Gazprom Export CEO Elena Burmistrova said in December that Russian gas supplies to Turkey were lagging in Q2, prompting the expectation of "issues" with the take-or-pay rule. "But now it is record volumes via both Blue Stream and TurkStream," she said at the time.

In June, Turkey's imports of Russian gas fell to a long-term low of just 0.16 Bcm as Botas failed to restart imports via the Blue Stream pipeline which had been closed by Gazprom for maintenance during May and cheap spot LNG imports displaced pipeline gas.

Sales for the year ended at 16.4 Bcm, up 5.7% year on year.

Much of the Russian gas imported by Turkey is also under oil-indexed contracts, meaning buyers likely topped out imports in the second half of 2020 as prices became competitive versus LNG.

Ankara has also been able to reduce its Russian imports since the startup in mid-2018 of the TANAP pipeline, bringing more gas from Azerbaijan into the Turkish market.

Dutch rise

Another market that saw significant increases in Russian supply in 2020 was the Netherlands, whose purchases rose by 38.8% to 11.8 Bcm.

The Netherlands is increasingly dependent on imports of gas as production at the giant onshore Groningen gas field is gradually phased out.

The Groningen quota for the current gas year is 8.1 Bcm, with the quota for the next gas year starting in October reduced to just 3.9 Bcm.

The field is expected to be effectively closed in mid-2022, though with parts of it kept open in the event of a supply emergency in the country.

It was a mixed bag elsewhere in Europe, with some big increases in countries such as Slovakia (+34.6%), Greece (+25.1%), and Denmark (+10.5), with the latter increasing imports due to the temporary shutdown of its Tyra gas field.

On the other hand, there were big falls in gas purchases in the UK (-41.6%), the Czech Republic (-37.8%), Serbia (-37%), Croatia (-34.8%), Finland (-34.5%), and Hungary (-17.9%).

All Gazprom data are for volumes according to Russian standard conditions (calorific value of 8,850 kcal per cu m at 20 degrees Celsius).

Full-year China

In 2020, Gazprom also sold 4.1 Bcm through the Power of Siberia pipeline to China, it said.

Gazprom started gas exports to China via the 38 Bcm/year capacity pipeline in December 2019, meaning 2020 was the first full year of gas supplies through the route.

It is expected that the pipeline will ramp up gradually, with around 10 Bcm expected to flow in 2021.

-----

Earlier: