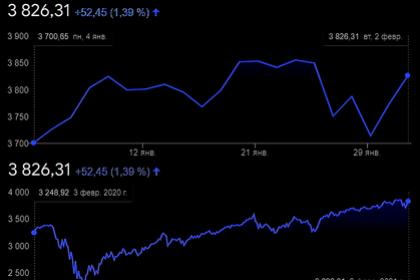

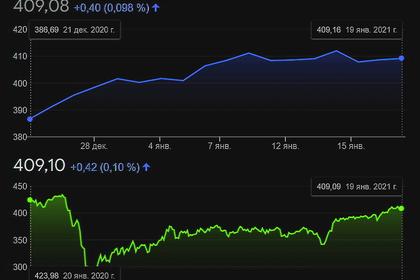

GLOBAL INDEXES UP ANEW

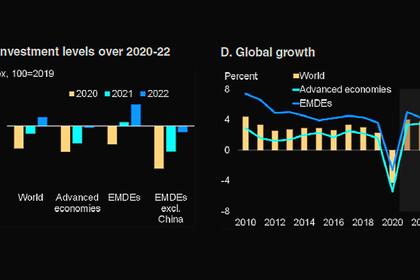

REUTERS - FEBRUARY 5, 2021 - Global shares closed in on their record peak on Friday, with Asian shares taking their lead from Wall Street, as progress in vaccine distribution prompted bets on further normalisation in the global economy and earnings recovery.

MSCI’s gauge of Asian shares outside Japan rose 0.4% while Japan’s Nikkei rallied 1%.

An index of the world’s major 50 markets, MSCI ACWI, extended its gains into a fifth straight day to come within reach of a record high touched about two weeks ago.

On Wall Street, each of major indexes rose more than 1% on Thursday, with the Nasdaq Composite Index and S&P 500 setting record highs.

“What’s driving the market is corporate earnings are posting a strong recovery,” said Jumpei Tanaka, strategist at Pictet.

“And there are piles of money saved in MMF (money market funds) and elsewhere that are likely to be invested in stocks once the economy normalises as vaccination programmes progress.”

Expectations of a large stimulus by the Biden administration also supported risk sentiment while better-than-expected data on U.S. job markets published in the past two days is fanning a bullish mood on the upcoming payroll report due later in the day.

Longer-term U.S. Treasury yields rose in anticipation of a large pandemic relief bill from Washington as well as on heightening inflation expectations.

The benchmark 10-year yield stood at 1.136%, having risen to a three-week high of 1.162% the previous day while the 30-year bonds yielded 1.929%, near its 10 1/2-month high of 1.951% touched on Thursday.

Bond yields rose in Europe as well, with Germany’s 30-year government bond yield climbing back in positive territory for the first time since September.

A market gauge of future U.S. inflation was at its highest since October 2018 while that for the euro zone hit its highest since May 2019.

In the currency market, the dollar strengthened against most of its peers as traders’ focus appeared to shift to the relative strength of the U.S. growth.

Until recent weeks, the dollar had been sold on expectations that global economic recovery will promote outflows of funds to riskier currencies from the safe-haven dollar.

The U.S. dollar index stood near a two-month high, having risen 1.1% so far this week, on course for its biggest weekly increase since October.

The euro changed hands at $1.1964, having hit a two-month low of $1.1955 overnight while the yen hit a 3-1/2-month low of 105.70 per dollar.

“It seems markets are now trying to trade on economic normalisation based on progress in vaccination,” said Arihiro Nagata, general manager of global investment at Sumitomo Mitsui Bank.

“The fact that the only currencies that are doing better than the dollar over the past two days are the British pound and the Israeli shekel, the two countries that are going further ahead in vaccination, seems to support that.”

The British pound stood at $1.3678 not far from its 2 1/2-year peak of $1.3759 hit late last month.

The shekel rose over the past two days, reversing its decline since mid-January after the Bank of Israel intervened to stem the shekel’s strength after it had hit a 24-year high.

Strength in the dollar pushed gold to a two-month low of $1,785.10 per ounce on Thursday. The metal was last traded at $1,797.40.

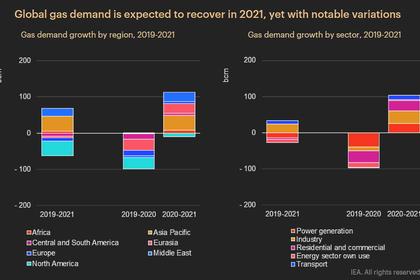

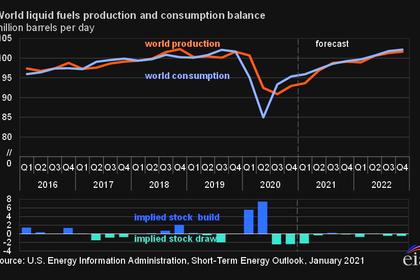

Oil extended its gains on upbeat economic mood, falling inventories and the OPEC+ decision to stick to its output cuts.

U.S. crude rose 1% to $56.80 per barrel and Brent was at $59.38, up 0.9%.

-----

Earlier: