GREEN HYDROGEN STRATEGIES

POWER - Feb 1, 2021 - Countries are increasingly embedding green hydrogen’s potential to decarbonize hard-to-abate sectors within ambitious strategies. In December, Canada joined a long list of countries, which includes France, Japan, Australia, Norway, Germany, Portugal, Spain, Chile, and Finland, as well as the European Union, with plans to stimulate the production of hydrogen.

The policies take into account an explosion of global interest in the gas, which is dominantly being produced with methane and coal today. According to the International Energy Agency’s Hydrogen Projects Database, nearly 320 green hydrogen production demonstration projects have been announced worldwide—a total of about 200 MW of electrolyzer capacity—with new projects being added on almost a weekly basis.

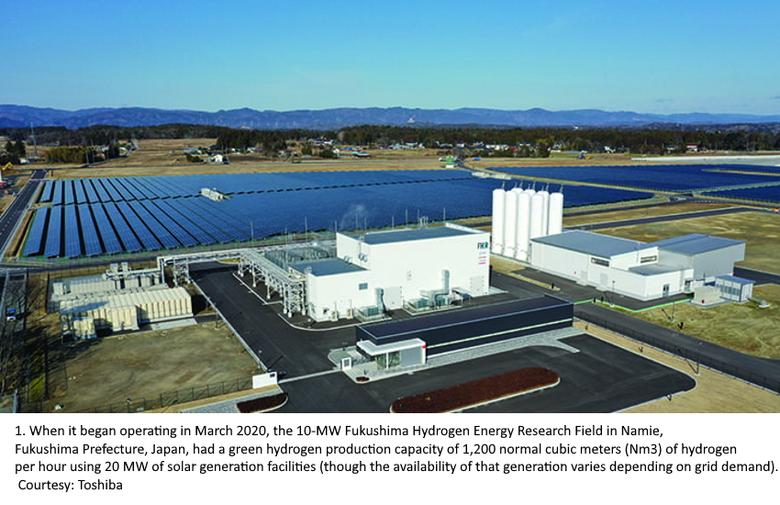

In March 2020, Japanese research entities New Energy and Industrial Technology Development Organization (NEDO) and companies Toshiba Energy Systems & Solutions, Tohoku Electric Power Co., and Iwatani Corp. put online what continues to be the largest-class green hydrogen production alkaline electrolyzer project the 10-MW Fukushima Hydrogen Energy Research Field (FH2R, Figure 1). Hydrogen from the field is being used mostly to power stationary hydrogen fuel cell systems and fuel cell vehicles, but in August 2020, Toshiba also installed a 3.5-kW H2Rex “pure hydrogen fuel cell system” at the nearby Michinoeki-Namie community square, which produces power and heat at the facility using hydrogen supplied by FH2R.

Bigger projects are in view, however. Air Liquide is gearing up to put online a 20-MW proton exchange membrane (PEM) electrolyzer in Becancour, Canada, a project it envisions will supply North American markets for industrial use and mobility. Also under construction is Shell, ITM Power, and SINTEF’s 10-MW PEM REFHYNE project at the Rhineland refinery in Germany. Meanwhile, Australian company Infinite Blue Energy last April secured funding for its AU$300 million 52.2-MW Arrowsmith Hydrogen Project near Perth, which is slated to begin operating in 2022.

In 2022, a 310-MW alkaline electrolyzer could also begin operating at a biofuel plant in Paraguay, and the first of two 100-MW H2V industry production units could come online in Normandy, France. In 2023, several more mega-projects spanning 17 MW to 538 MW may mark major milestones, including in Utah, the Netherlands, France, Norway, Sweden, and Germany. The goal of developers and their ambitious investors is clear: Economies of scale will bring down costs and improve hydrogen’s competitive profile.

Targeting Electrolysis Costs

According to a pivotal report released by the International Renewable Energy Agency (IRENA) last December, green hydrogen production costs have already begun to tumble largely owing to a decline in falling renewable power costs but further reductions, particularly in the costs of electrolysis facilities, will need to fall from 40% in the short term to 80% in the long term.

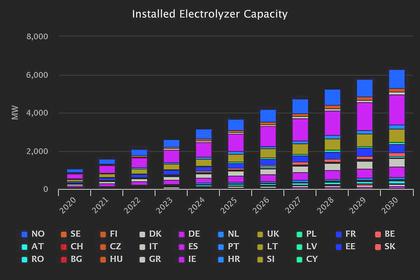

It suggests that combined with low electricity costs, “an aggressive” electrolyzer deployment pathway could help to tamp down costs associated with electrolyzer design and construction (Figure 2); standardization of system components and plant design; and procurement of materials, including scarce materials such as iridium and platinum for PEM electrolyzers, for example. “Current production of iridium and platinum for PEM electrolysers will only support an estimated 3 GW to 7.5 GW annual manufacturing capacity, compared to an estimated annual manufacturing requirement of around 100 GW by 2030,” IRENA said.

The economics of green hydrogen electrolyzer technologies is also currently limited by large conversion efficiency losses at low load, and compression may present a bottleneck for power system flexibility, but emerging technologies (such as solid oxide technology), and modular and integrated plant designs, which for example integrate power and hydrogen storage, may help provide significant value for power systems, but only if they are “remunerated adequately” in power markets, it said.

Beyond green hydrogen’s value-chain cost challenges—from electrolysis to transport to fuel cells—it faces a glaring lack of existing infrastructure for transport and storage. Green hydrogen is “already close to being competitive” in regions where favorable conditions align, IRENA noted, but these are usually at a considerable distance away from demand centers. For example, in Patagonia, wind energy could have a capacity factor of almost 50%, with an electricity cost of $25–30/MWh. This would be enough to achieve a green hydrogen production cost of about $2.50/kilogram (kg), which is close to the blue hydrogen cost range, it said.

In most locations, however, green hydrogen is still two to three times more expensive than blue hydrogen. “The cost of the former is defined by electricity costs, investment cost, fixed operating costs and the number of operating hours of the [electrolyzer] facilities,” IRENA said. However, if gaps in cost and performance are addressed, and a rapid scale-up takes place over the next decade, green hydrogen could begin to compete with blue hydrogen by 2030 in countries with electricity prices of $30/MWh, it suggested. Still, IRENA expects that a wide range of system costs will remain because they are “very much dependent on the scale, application, and scope of delivery,” it noted.

Some Countries Already Have Hydrogen Targets

For now, at least, to provide clear long-term investment signals in green hydrogen, a number of countries have begun to address these challenges strategically.

Japan. Japan became one of the first countries to roll out a basic hydrogen strategy in 2017, and it has since set out specific plans to become a “hydrogen society.” The strategy notably seeks to achieve cost parity with competing fuels, such as liquefied natural gas for power generation. It has also set out concrete cost and efficiency targets per application, targeting electrolyzer costs of $475/kW, efficiency of 70% or 4.3 kWh/Nm 3, and a production cost of $3.30/kg by 2030. It also has multiple projects underway for international trade in hydrogen. The Hydrogen Energy Supply Chain, for example, is committed to delivering hydrogen converted from coal gasification from Victoria’s Latrobe Valley in Australia. The first liquid hydrogen ship was delivered in December 2019, and the first blue ammonia (ammonia from gas reforming with carbon capture) shipment arrived in September 2020.

South Korea. In January 2019, South Korea announced its Hydrogen Economy Roadmap, which outlines a goal of producing 6.2 million fuel cell electric vehicles, rolling out at least 1,200 refilling stations by 2040, and supplying 15 GW of fuel cells for power generation by 2040.

Australia. Established in November 2019, Australia’s national hydrogen strategy launched the “H2 under 2” target, which sets a production cost of below AU$2/kg of hydrogen. The strategy has already triggered AU$370 million in state support and consideration in the country’s Technology Investment Roadmap.

Netherlands. In April 2020, the Dutch government noted that a completely sustainable energy supply in 2050 requires that at least 30% and up to 50% of final energy consumption be via gaseous energy carriers, such as biogas and hydrogen.

Norway. Unveiled in June 2020, Norway’s strategy seeks to expand the use of hydrogen as an energy carrier in the maritime sector, but it also funds innovation for subsea storage of hydrogen from offshore wind under the Deep Purple project.

Germany. In June 2020, Germany rolled out a national hydrogen strategy that eyes a 200-fold increase in electrolyzer capacity—of up to 5 GW by 2030. “This corresponds to 14 TWh of green hydrogen production and will require 20 TWh of renewables-based electricity,” it said. An additional 5 GW of capacity may be added by 2035 and no later than 2040.

European Union. A hydrogen strategy published in July 2020 sets explicit electrolyzer capacity targets of 6 GW by 2024 and 40 GW by 2030, as well as production targets of 1 million and 10 million tonnes of renewable hydrogen per year for those two milestone years.

France. A September 2020 national hydrogen strategy provides an investment of €7.2 billion by 2030 and a hydrogen production capacity target of 6.5 GW by 2030. About €1.5 billion will be spent on construction of electrolysis plants.

Spain. Issued in October 2020, Spain’s hydrogen strategy foresees installations of 4 GW of electrolyzer capacity by 2030, with near term goals of at least 300 MW to 600 MW by 2024.

Chile. Chile launched its national strategy in November 2020, seeking to become the world’s cheapest green hydrogen producer and a leading exporter by the 2030s. Its strategy sets a target of 25 GW by 2030 with a remarkable hydrogen production cost of less than $1.50/kg.

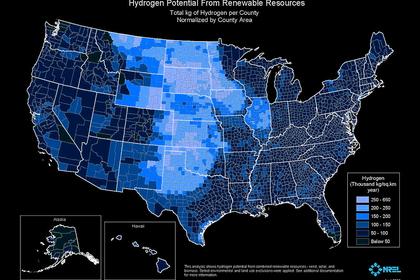

Canada. Launched in December 2020, Canada’s hydrogen strategy anticipates that by 2050 hydrogen will deliver up to 30% of Canada’s end-use energy. It envisions a hydrogen supply network that could include both large-scale centralized plants in its natural gas–rich provinces or regions with high penetration of low-cost renewables, as well as smaller-scale distributed electrolytic production near demand centers. “Delivered hydrogen costs of CA$1.50–3.50/kg are projected to be achieved as production scale is realized and investment is made in distribution infrastructure,” it says.

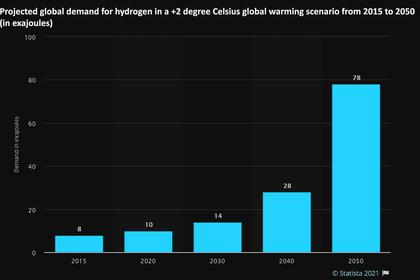

While these recent targets already meet IRENA’s planned energy scenario 2030 target of 100 GW for electrolysis, the agency noted that they are not yet compatible with a well-below-2-degree-Celsius trajectory, which would require at least 270 GW of capacity deployed by 2030. Going further, a net-zero world by 2050 would require an even larger role for hydrogen and a faster pace of deployment, IRENA said.

-----

Earlier: