INDIA OIL DEMAND WILL UP

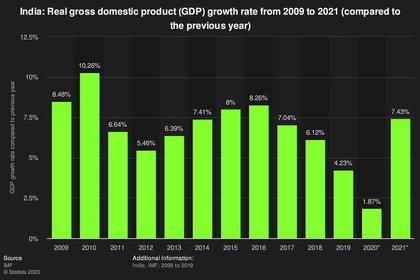

PLATTS - 05 Feb 2021 - India's peak oil demand will come much later than what the rest of the world might anticipate, creating enough room to pursue refinery expansions and secure crude supplies through diversification drives, speakers at the S&P Global Platts South Asia Commodities Virtual Forum said Feb. 4-5.

To meet incremental demand and prepare for smoother business operations, it is imperative that Indian state-run oil and gas companies hedge a bigger share of their portfolio to cushion from the kind of shock that COVID-19 provided, they added.

"India's peak oil demand will be much later than what many analysts predict. So we will be seeing handsome demand numbers going into 2030s and 2040s, if not 2050s," Debanjan Saha, who works in the commodities risk management team at Bharat Petroleum Corp. Ltd., or BPCL, told the forum.

"So we have some time to go before we see a real decline in products demand. This calls for sizable growth in refinery activity."

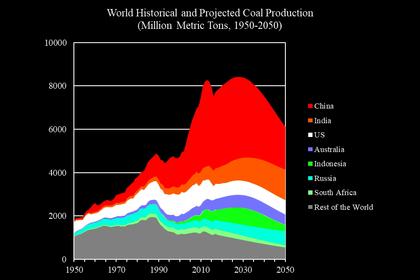

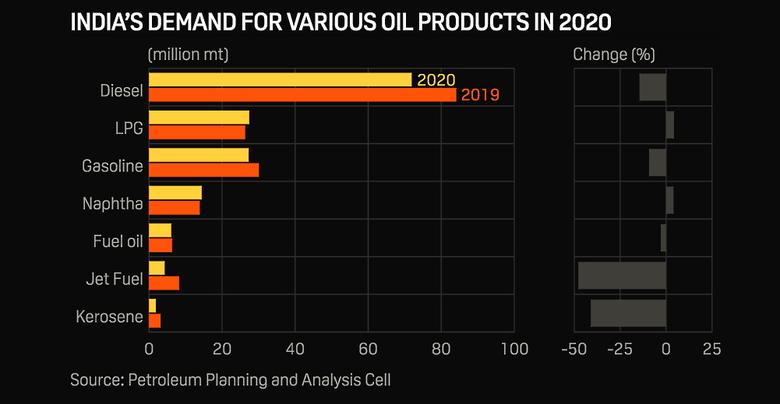

Indian oil and steel minister Dharmendra Pradhan told the forum Feb. 4 that with the country's oil demand expected to double by 2040, India would look to boost refining capacity from the current 250 million mt/year to 450 million mt/year.

'I think at least over the next four-five years there will be a lot of refinery augmentation programs coming up," Saha said. "Our domestic crude production growth is not happening, while growth in products demand is coming up every year. This calls for more refinery expansion and crude imports."

Saha added that BPCL was aiming at growing its capacity at the Numaligarh refinery to nine million mt/year by 2025 from about three million mt/year. Capacity at the Kochi refinery would be expanded to 20 million mt/year by 2025 from 15.5 million mt/year.

Appetite for hedging

"We are extremely optimistic that by end of the first half of this calendar year, oil demand will actually surpass 2019 levels. The silver lining is that vaccination drive has started off in a big way in India," Saha said.

Officials from state-run energy companies added that COVID-19 had offered strong lessons to be prepared for the worst at every point -- and that included boosting dependence on domestic supply chains rather than being solely dependent on overseas supplies. In addition, both currency and product hedging need to figure prominently in the portfolios.

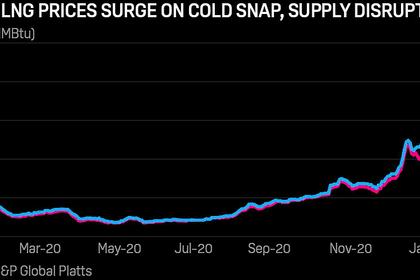

"Managing price volatility was a key challenge during the pandemic," Saha said. "We were more prepared for the IMO implementation but that never came. A couple of months into the pandemic, we took some short positions and saved ourselves to some extent. And when crude prices crashed and the market offered a good contango, we had additional inventories which we put on floating storages. These two measures helped us."

RK Singhal, executive director for marketing, shipping and international LNG at GAIL, said the company started commodity hedging from 2017.

"Before that we only were doing currency hedging. From 2017 onward, GAIL has come a considerable way if you look at our hedging portfolio. Without that, we would have been hit very hard. So we are further enhancing our risk hedging scope," he added.

Energy transition push

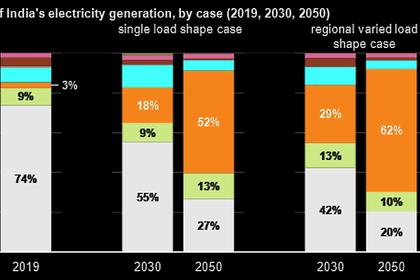

Pradhan told the forum that India sees gas as a transition fuel while hydrogen and solar power would play key roles in the country's energy mix.

"While energy consumption is expected to grow at an annual rate of 2.6%, we expect gas demand to grow at double the rate -- at around 5%-6% percent," Singhal said.

He added that GAIL currently has an annual portfolio of 14 million mt of LNG, of which it sells about 2 million-2.5 million mt in the international markets.

"Although there is some surplus for the time being, these volumes are being tied up with customers who are coming up in the future. So going forward, we are confident of meeting the RLNG demand in the country. We will start reducing sales in the international market and start bringing more and more to the domestic market," he said.

Singhal said GAIL was looking at investing in renewables and specialty chemicals, which would offer synergy with the company's existing petrochemicals business. The company has some presence in wind and solar power and intends to grow in those areas, once it secures the right projects.

Saha said BPCL had started a pilot project called e-Drive, under which the company plans to set up battery swapping facilities -- exchange discharged batteries with charged ones -- at its retail fuel stations. The project would be gradually rolled out across the country, as and when demand picks up.

"Also, we have made massive investments in compressed natural gas facilities and network," Saha said, adding that BPCL would be aiming to grow in the solar and biofuels space too in the foreseeable future.

-----

Earlier: