LNG DEMAND UP

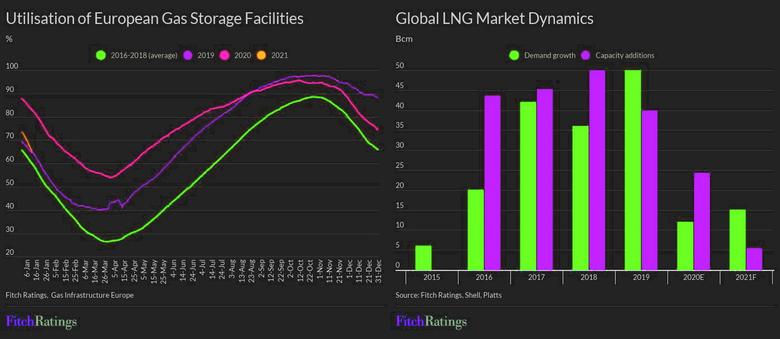

HSN - 15/02/2021 - Growing liquified natural gas (LNG) demand will reduce market oversupply in 1H21, with volumes of gas in European storage facilities already normalised due to the cold winter in the northern hemisphere, Fitch Ratings says. This has led to a price rally in Europe and Asia, benefiting gas producers’ performance. However, the LNG deficit is temporary and we expect excess liquefaction capacity to weigh on prices later this year when weather conditions improve and demand reduces.

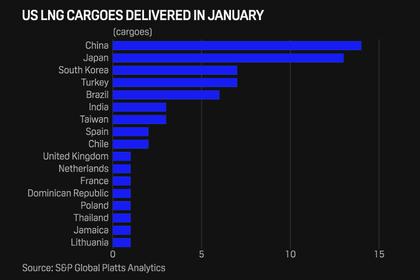

Title Transfer Facility (TTF) gas prices in Europe started to recover in 4Q20, averaging USD5.2 per thousand cubic feet (mcf) compared with USD1.7/mcf in 2Q20 and USD2.7/mcf in 3Q20 due to a seasonal increase in demand, as well as a supply response from US LNG producers, which dramatically reduced capacity utilisation in May-October 2020. US LNG plants have been running at full capacity since November, with most cargoes going to Asia.

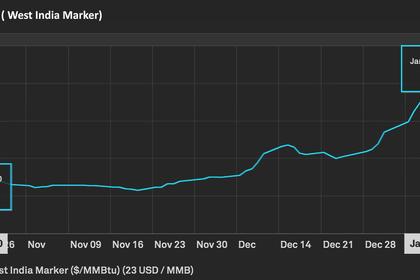

TTF peaked at about USD10/mcf on 12 January 2021, while Asian spot LNG prices skyrocketed to above USD30/mcf the same day. Recent production and logistical glitches have contributed to the price rally, in addition to cold weather in Asia and parts of Europe. Local natural gas markets have become more interconnected thanks to growing LNG trade. We expect the spread between European and Asia prices to reduce due to arbitrage opportunities and supply flexibility. However, the markets will remain subject to seasonal demand and price fluctuations.

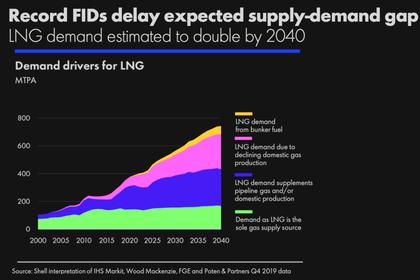

LNG oversupply could return later this year. We estimate that global LNG imports continued to increase by about 2%-3% in 2020 despite the pandemic. Assuming similar growth rates in 2021, the global market should tighten compared with 2020 given a lack of significant capacity additions, but is likely to remain well supplied. We expect prices to moderate as a result, although not to the lows seen in 2Q20-3Q20. Another wave of capacity additions that we expect from 2023 onwards will reduce a potential for the market to tighten further in the medium to long term. It will also weigh on prices in Europe and Asia, but it will also largely depend on Asian-Pacific market dynamics, particularly on China’s coal-to-gas transition policies, which were eased in 2019.

Companies with significant gas production and exposure to Europe and Asia should benefit from the current increase in prices, although we rate through the cycle and some price recovery is already incorporated into our forecasts. In our modelling, we assume TTF to rise from USD3.75/mcf in 2021 to USD5.0/mcf from 2023 onwards.

Neptune Energy Group Midco Limited (BB/Negative) has a significant exposure to spot natural gas prices and higher prices could help bring the company’s leverage metrics in line with our sensitivities for the Outlook stabilisation in 2021, but its rating also depends on the company’s ability to replenish reserves. Russia’s Gazprom (BBB/Stable) is also benefiting from the price recovery and could face reduced competition from US LNG given more cargoes are likely to be diverted to Asia than in 2020. We expect Gazprom’s exports to Europe to recover to 190 billion cubic metres (bcm) in 2021 from 174bcm in 2020. Contracts of Novatek’s (BBB/Stable) Yamal LNG project are mainly linked to oil indices, so the project’s performance is more dependent on oil prices, although Novatek’s trading division is likely to benefit from higher spot prices.

-----

Earlier: