LNG PRODUCTION DOWN

NGI - February 4, 2021 - The pandemic discombobulated the timeline for the massive natural gas export project underway in British Columbia, but Royal Dutch Shell plc has been able to recoup some of the lost time because most of the construction is in Chinese yards, which are “back and running,” CEO Ben van Beurden said Thursday.

The CEO and CFO Jessica Uhl updated investors about the progress for LNG Canada, the liquefied natural gas (LNG) export project that Shell is leading on the west coast in Kitimat. The executive team also provided some details about the performance of the Integrated Gas segment and the outlook for 2021.

Progress on LNG Canada is “reasonable,” van Beurden said, “considering the fact that it’s a large, complex project.”

The $30 billion project, initially tracking to be online and shipping to Tokyo Bay by the mid-2020s, was waylaid last spring by Covid-19. Around half of the 2,000 people working on site were let go as work was paused. LNG Canada initially is to consist of two trains that together would provide 14 million metric tons/year of gas.

While LNG Canada is “a bit behind the construction…the overall project…is only a few percentage points behind…low single-digit percentage points,” said the CEO. “I do believe we have been able to, to keep pace with that project, largely, of course, because most of the construction takes place in Chinese yards. At this point in time, they are back up and running again.”

Shell has its fingers in gas trading and in export projects around the world, including Australia’s Prelude, a floating LNG project, and the Chevron Corp.-led Gorgon facilities. Both have had maintenance issues. Other projects are in the queue. Last May, subsidiary Shell Gas BV said all conditions to sanction a processing unit at Nigeria LNG had been met, including formal commitments to provide financing.

Slumping LNG Prices

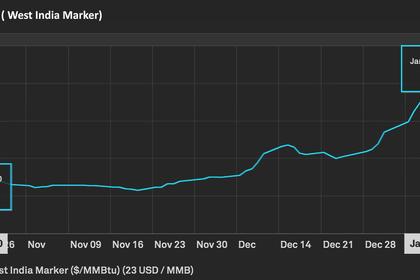

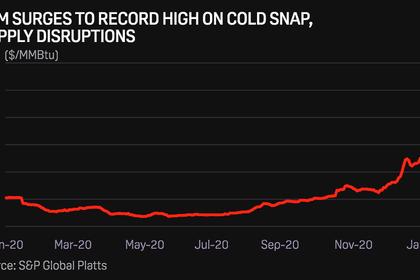

The CEO was asked how LNG trading is expected to perform this year, considering how prices of late have been swinging. Realized prices in the final three months of 2020 were “significantly below” the year-ago levels, “with some recovery seen during the quarter.”

LNG sales volumes in 4Q2020 declined 16% year/year to 16.89 million metric tons (mmt). For the year, they were down 6% from 2019 at 69.67 mmt. Liquefaction volumes fell from 4Q2019 by 11% to 8.21 mmt. Liquefaction production for 2020 declined 6% from 2019 to 33.25 mmt.

The Integrated Gas segment’s output in 1Q2021 is expected to be 900,000-95,000 boe, with liquefaction volumes estimated at 8.0-8.6 mmt.

“Most of the LNG that we sell we sell on term contracts,” van Beurden noted. LNG results “move with the oil price by and large,” and the results are based on an oil price typically four to six months ago. The delay effect in the oil price macro then feeds into the quarterly Integrated Gas segment results.

Those factors often set a bit of a “mousetrap” of sorts for LNG traders. However, Shell’s management team has “very significant intelligence into the market, where we try to take advantage of transience that may be there.” Last year was no different.

There weren’t as many “mice” darting about last year as in previous years, “or maybe not as many big mice,” said the CEO. “There has indeed been an interesting spike,” in gas prices, “and you’ve seen that we could take some advantage in that.

“But, of course, you will also have seen that it was actually relatively short lasting” he said of the gas price increase. Because of the volatility, van Beurden demurred from offering a “definitive outlook” on how the Integrated Gas segment may fare through March.

“I think it’s a bit too early for that, but indeed, we have been able to be on the right side of many of the developments that we have seen in the early part of January.”

The pandemic also further slowed construction of the Pennsylvania petrochemicals facility underway in western Pennsylvania. The cracker as of last September was around 70% complete.

The facility “had its challenges last year, but there, we are back to almost full complement,” van Beurden said. “It will probably be impossible to catch up the delays that we’ve had, but nevertheless, I think it is going very, very well at the moment.” Completion now appears to be set for sometime in 2022, he told investors.

Spending Retreat

The lack of progress at LNG Canada and in Pennsylvania was indicative of 2020, and Shell sharply retreated on capital expenditures (capex).

“We were indeed quite stringent on how we were going to deploy capex… for obvious reasons,” van Beurden said. “It was not just our desire to preserve cash as much as possible, but quite often it was also helped along by the inability to spend.” For example, for the “very large onshore projects, we simply could not sustain having 8,000 people on the construction side.”

The capex that was trundled to the side should be funneled into facilities beginning this year. However, “quite a few investment decisions we did delay or did not take, and some of them even went out the window altogether.”

The fact that fewer projects on the drawing board were not sanctioned last year meant Shell could not book any reserve additions. It also sold “quite a few positions during the year that we did not see fitting our portfolio anymore. Therefore, indeed we have a triple whammy…but it doesn’t necessarily mean that we are going to quickly run this portfolio down,” van Beurden said.

“We see our upstream portfolio as an essential cash engine, not just for this decade, but well into the next decade.” Primarily, the portfolio is to support shareholder distributions and second, to “help us with accelerating our strategy of the transition into New Energy,” the Shell segment that houses the energy transition business.

Even with the contracted environment and “very low macro over the last 12 months” with oil prices averaging $42/bbl, Shell still generated around $34 billion in cash flow from operations, Uhl said.

“Now, in terms of what happens with the macro, clearly oil and gas prices help our upstream business refining margins — important for oil products — but we also have an important piece of our business, our marketing business. It’s not as impacted by oil and gas prices on the macro side…”

Management has been “very clear in terms of priorities,” she said. Last March, Shell reduced capex to $18 billion from $24 billion in 2019. This year, capex is set at $22 billion tops, with spending around $19-22 billion.

Impaired Results

Management plans to offer more detail about future plans at a strategy conference next Thursday (Feb. 11). In addition, the LNG outlook and Integrated Gas strategy is expected to be discussed in detail on Feb. 25.

For Shell, the losses in the final period of 2020 and for the year were deep and difficult. The supermajor reported its first full-year headline loss since Royal Dutch Petroleum Co. merged with Shell Transport & Trading Co. in 2005.

Mostly because of one-time charges to reduce the value of the assets, Shell reported a loss in 4Q2020 of $4.0 billion (minus 52 cents/share), down 516% year/year when profits were $965 million (12 cents).

The post-tax impairment charges were $2.7 billion in 4Q2020, and there were charges of $1.1 billion mainly from “onerous contract provisions.” The results “reflected lower realized prices for oil and LNG,” along with lower output and realized refining margins.

The Upstream segment lost $2.1 billion in 4Q2020, which included a one-time charge of $1.3 billion related to a partial impairment of the Appomattox platform in the deepwater Gulf of Mexico. Total production in Upstream decreased by 14% year/year. Upstream production in 1Q2021 is expected to be 2.4-2.6 million boe/d.

For 2020, profits collapsed year/year by 237%, with a loss of $21.7 billion (minus $2.78/share) from a 2019 profit of $15.8 billion ($1.97).Revenue in 4Q2020 fell year/year to $45 billion from $85 billion. For the year, it was down at $183 billion from $352 billion in 2019.

-----

Earlier: