OIL PRICE: ABOVE $63 YET

REUTERS - FEBRUARY 17, 2021 - Oil prices advanced further on Wednesday, underpinned by major supply disruption in the south of the United States this week caused by a winter storm in Texas.

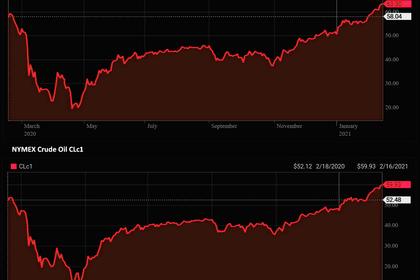

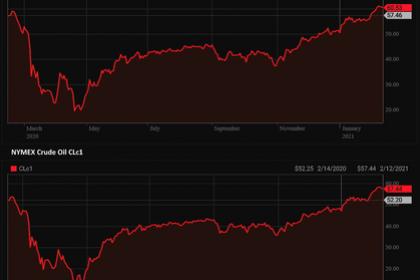

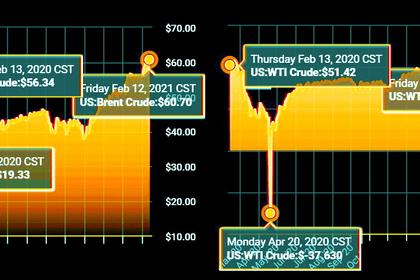

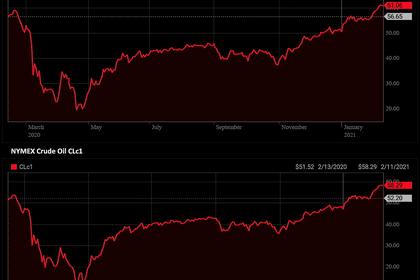

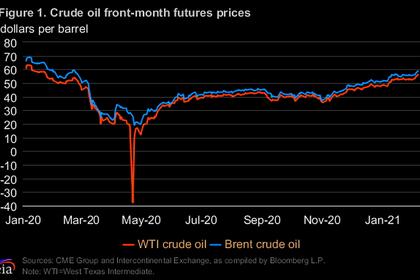

Benchmark Brent crude gained 38 cents, or 0.6%, to $63.73 a barrel at 0939 GMT. U.S. West Texas Intermediate (WTI) crude rose 21 cents, or 0.4%, to $60.26 a barrel.

“WTI clocked in at $60 a barrel this week, joining its transatlantic peer (Brent) above the psychological level for the first time since January 2020. At this price point, any oil production is profitable,” said Stephen Brennock of broker PVM.

Oil has been supported in recent weeks by OPEC+ supply curbs and hopes a demand rebound due to COVID-19 vaccinations, but severe cold weather in Texas, the country’s largest oil producing state, has boosted the prices in recent days.

The U.S. deep freeze is expected to disrupt production for several days if not weeks, industry experts, as wellheads have frozen and refineries have been shut.

ANZ and Citigroup analysts estimated at least 2 million barrels per day (bpd) of U.S. shale oil production had been curtailed. Citi estimated a cumulative production loss of around 16 million barrels through early March.

The stronger price environment has put more attention on OPEC+, which groups OPEC, Russia and allied producers. It meets to set policy on March 4.

“The impact on crude oil prices will largely depend on how long the power crisis will last, but eventually prices will likely return to the fundamentals with a focus on the global energy demand and OPEC+,” said Margaret Yang, a strategist at Singapore-based DailyFX.

OPEC+ oil producers are likely to ease curbs on supply after April given a recovery in prices, OPEC+ sources told Reuters.

“We believe that OPEC+ will likely take a more conservative approach, and ease output more modestly,” said ING analyst Warren Patterson.

U.S. oil inventory data from the American Petroleum Institute and the U.S. Energy Information Administration (EIA) will be released on Wednesday and Thursday respectively, a one day delay for each after this week’s U.S. holiday.

Analysts polled by Reuters estimated, on average, that crude stocks fell 2.2 million barrels in the week to Feb. 12.

-----

Earlier: