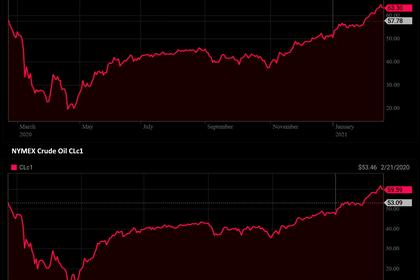

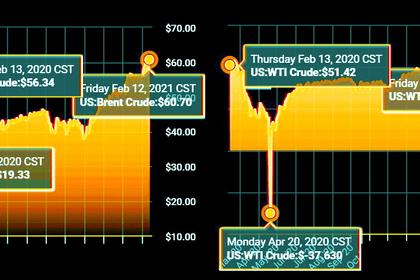

OIL PRICE: NEAR $65 ANEW

REUTERS - FEBRUARY 24, 2021 - Oil prices fell on Wednesday after industry data showed a surprise build in U.S. crude stocks last week as a deep freeze in the southern states curbed demand from refineries that were forced to shut.

Crude stockpiles rose by 1 million barrels in the week to Feb. 19, the American Petroleum Institute (API) reported on Tuesday, against estimates for a draw of 5.2 million barrels in a Reuters poll.

API data showed refinery crude runs fell by 2.2 million bpd.

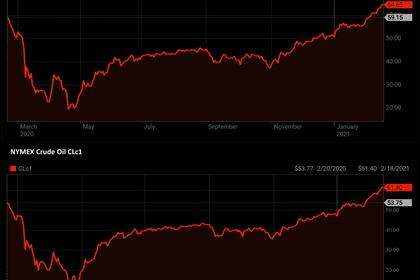

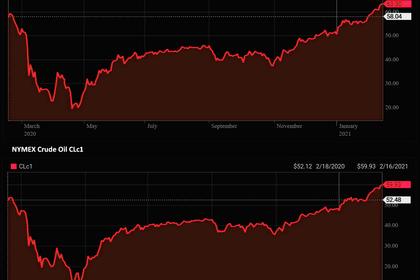

U.S. West Texas Intermediate (WTI) crude futures were down 56 cents or 0.9% at $61.11 a barrel at 0506 GMT, after slipping 3 cents on Tuesday.

Brent crude futures fell 35 cents, or 0.5%, to $65.02 a barrel, erasing Tuesday’s 13 cents gain.

But Brent may rise into a range of $66.45-$66.97 per barrel again, as suggested by its wave pattern and a projection analysis, said Reuters technical analyst Wang Tao.

“The key question is how quickly does U.S. oil supply recover,” Commonwealth Bank analyst Vivek Dhar said.

“It looks like supply will recover faster than refineries, and supply is going to outpace demand in the next few weeks. That will give negative weight to the market.”

Investors will be awaiting confirmation from the U.S. Energy Information Administration later on Wednesday that crude inventories rose last week, despite the hit to shale oil production amid the unprecedented icy spell in the U.S. south.

Traffic at the Houston ship channel was slowly coming back to normal but terminals were still facing several issues due to last week’s freezing weather in Texas.

The price retreat is being seen as a pause following a rally of more than 26% to 13-month highs in both Brent and WTI since the start of the year.

“This rally has certainly overshot itself... We are at levels much higher than pre-Covid and demand nowhere near those levels,” said Sukrit Vijayakar, director of energy consultancy Trifecta.

Prices have jumped due to the U.S. supply disruption and supply discipline by the Organization of the Petroleum Exporting Countries and allies, together called OPEC+, led by an extra 1 million bpd cut by Saudi Arabia.

-----

Earlier: