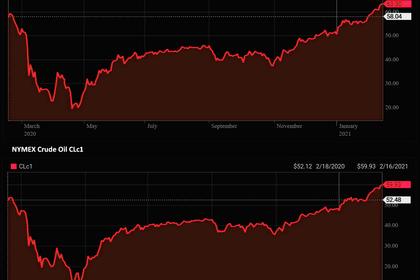

OIL PRICE: NOT ABOVE $67

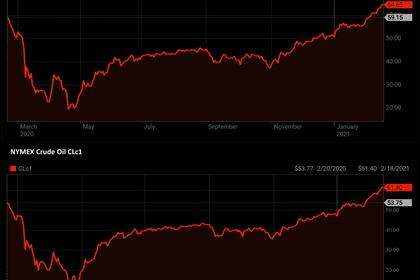

REUTERS - FEBRUARY 26, 2021 - Oil prices dropped on Friday as a collapse in bond prices led to gains in the U.S. dollar and expectations grew that with oil prices back above pre-pandemic levels, more supply is likely to return to the market.

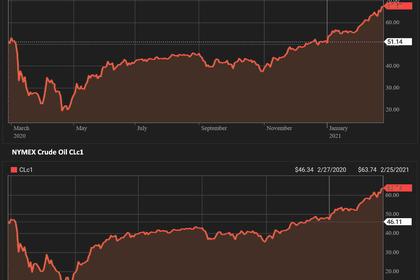

U.S. West Texas Intermediate (WTI) crude futures dropped 72 cents, or 1.1%, to $62.81 a barrel at 0516 GMT, giving up all of Thursday’s gains.

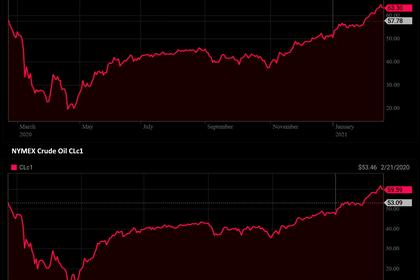

Brent crude futures for April, which expires on Friday, fell 63 cents, or 0.9%, to $66.25 a barrel, following a 16 cent loss on Thursday. The more active May contract was down 77 cents, or 1.2%, to $65.34 a barrel.

“Crude oil retreated modestly from recent highs amid a ‘risk off’ sentiment as Asia-Pacific equities pulled back broadly following a sour lead from Wall Street,” said Margaret Yang, a strategist at Singapore-based DailyFX.

The sell-off in bond markets, leading to a stronger U.S. dollar and rising yields, are weighing on commodities, which are non-yielding, she added.

A stronger greenback makes U.S.-dollar priced oil more expensive for those buying crude in other currencies.

Despite the drop in prices on Friday, both Brent and WTI are on track for gains of nearly 20% this month, as markets have grappled with supply disruptions in the United States, while optimism has built for demand to improve with vaccine rollouts.

Investors are betting that next week’s meeting of the Organization of the Petroleum Exporting Countries (OPEC) and allies, together called OPEC+, will result in more supply returning to the market.

“The stakes at play this time around are particularly large (for OPEC+) insofar as oil prices have more than recovered to pre-pandemic levels, global inventories are continuing to trend down, and vaccine rollouts are accelerating,” said Lachlan Shaw, National Australia Bank’s head of commodity research.

“The market’s probably right to think at this price level and given what the fundamentals are doing, there’ll be more supply coming into the market over time.”

U.S. crude prices also face headwinds from the loss of refinery demand after several Gulf Coast facilities were shuttered during the winter storm last week.

Capacity of about 4 million barrels per day is still shut and it may take until March 5 for all of the shut capacity to resume, though there is risk of delays, analysts at J.P. Morgan said in a note this week.

-----

Earlier: