OPEC+ OIL PRODUCTION UP 440 TBD

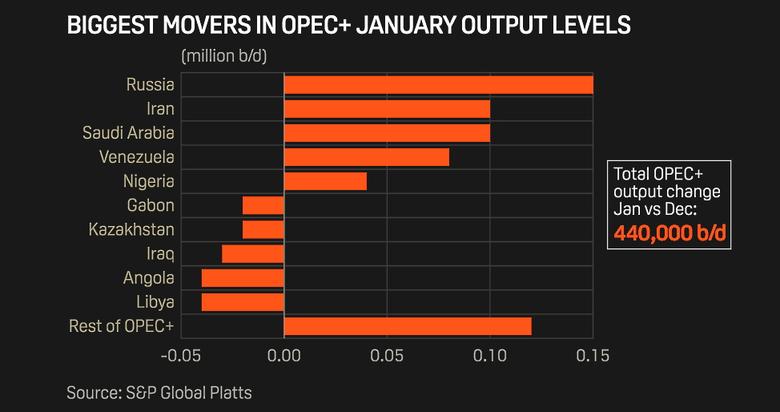

PLATTS - 08 Feb 2021 - OPEC and its allies boosted their crude oil production for the seventh straight month in January, according to the latest S&P Global Platts survey, as the coalition continued to unwind its pandemic-prompted output cuts and take advantage of rebounding global demand.

OPEC's 13 members pumped 25.70 million b/d in the month, up 270,000 b/d from December, while their nine non-OPEC partners, led by Russia, produced 12.91 million b/d, a rise of 170,000 b/d, the survey found.

The volumes bring the alliance's total output rise close to 2 million b/d since May, when it first started record cuts to pilot the oil market out of its coronavirus nosedive.

January's boost was mainly attributed to ramp-ups by heavyweights Russia, Saudi Arabia, the UAE and Kuwait, along with a rebound in Iran and Venezuela, two of the three members exempt from quotas.

Under a deal agreed in early December, quotas were eased by almost 500,000 b/d in January, which helped lift the group's collective compliance to 101% from 98.5% in December.

Looking ahead, February and March should see total OPEC+ production go down, with price hawk Saudi Arabia having announced it would unilaterally cut its own output by an additional 1 million b/d in both months, more than offsetting the 75,000 b/d monthly rise granted to Russia and Kazakhstan. All other members are set to hold their volumes steady.

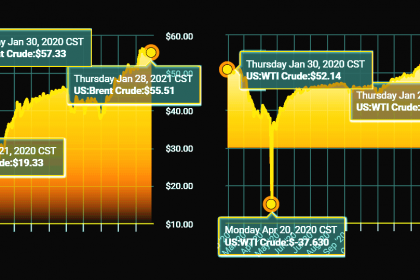

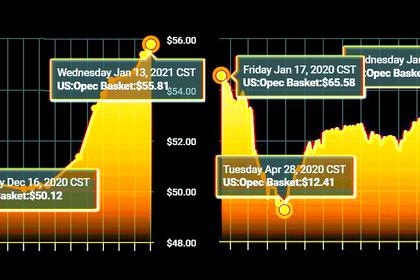

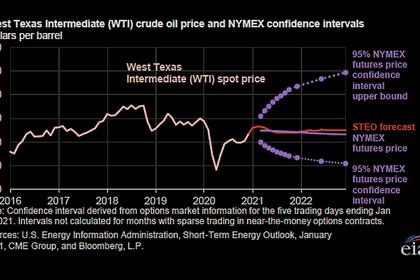

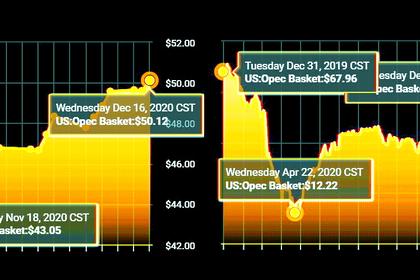

A key OPEC+ monitoring committee on Feb. 3 reaffirmed the plan, saying it was encouraged by the rollout of coronavirus vaccines in bolstering the global economic recovery, which pushed crude prices to one-year highs of over $60/b on Feb. 8. The full coalition will meet March 4 to decide on April quotas.

Barrels return

Russia posted the largest increase among the group in January, raising output by 170,000 b/d to 9.25 million b/d, the Platts survey found.

Despite being a co-chair of the monitoring committee, which is tasked with assessing member compliance, Russia continues to be the worst quota violator, according to OPEC+ data seen by Platts. It pumped 130,000 b/d above its January cap.

However, Russian crude exports are poised to dip in February as it directs more of its oil to domestic refineries to address soaring gasoline prices ahead of its driving season, along with tepid European demand for its crude.

Saudi Arabia, OPEC's largest producer and de facto leader, boosted its output by 100,000 b/d in January to pump 9.11 million b/d, just 10,000 b/d below its new quota.

Exports from the kingdom fell last month, but domestic consumption rose as the 400,000 b/d Jazan refinery started test runs, among other factors, according to survey panelists.

Saudi Arabia's extra cut for February and March has tightened the availability of medium sour crudes, prompting many refiners to scramble for other supplies.

Fellow Gulf producers UAE and Kuwait also posted monthly increases of 40,000 b/d and 20,000 b/d, respectively, the survey found, largely in line with their January allocation.

Reclaiming market share

Iran and Venezuela -- both of which are exempt from the cuts due to US sanctions targeting their crude exports – added 180,000 b/d to the market in January.

Iranian crude production rose sharply by 100,000 b/d to 2.14 million b/d, its highest since November 2019, according to the survey.

Iranian crude exports have started to climb in recent months as the country pins its hopes on improving relations with the US under the Joe Biden administration.

Iran's government has targeted 2.3 million b/d of exports if the sanctions are lifted and has recently ordered its domestic oil operators to begin increasing production, largely from the South Azadegan and West Karun fields. Pre-sanctions production capacity was 4 million b/d.

Similarly, Venezuela produced a seven-month high of 500,000 b/d, up 80,000 b/d from December.

The increase mainly came from state-owned PDVSA's joint ventures in the country's Orinoco Belt, which contains some of the world's largest reserves.

PDVSA has undertaken a well maintenance plan to repair some of its oil infrastructure, which has deteriorated due to a lack of investment, exacerbated by US sanctions.

Libya, the third country exempted from OPEC+ quotas, produced 1.14 million b/d in January, according to the survey, a fall of 40,000 b/d, marking its first month-on-month production fall since May.

The decline was due to pipeline maintenance that affected the Waha oil fields, and some exports were also disrupted briefly by strikes at some of Libya's key eastern terminals.

Iraq, Nigeria stay compliant

Iraq produced 3.82 million b/d of crude in January, a fall of 30,000 b/d from the previous month, as southern exports dipped slightly.

That puts Iraq comfortably below its OPEC+ production quota of 3.857 million b/d, which is effective through March.

The country's energy ministry has pledged to remain "resolute" to its OPEC+ commitments but it has struggled to comply in recent months due to fiscal and political pressures.

Nigeria maintained its recently strong compliance, mainly due to more involuntary outages.

Nigeria produced 1.47 million b/d last month, a 40,000 b/d rise from December, but below its January quota.

A pipeline closure affected Forcados exports, but this was offset by the return of Qua Iboe output mid-month. Platts figures are compiled by surveying oil industry officials, traders and analysts, as well as reviewing proprietary shipping, satellite and inventory data.

-----

Earlier: