OPEC+ OIL WILL UP

PLATTS - 18 Feb 2021 - Oil supplies from OPEC and its key producer allies are set to begin flooding back to the market this year, triggering a shift in global crude quality which could bring welcome relief to swathes of embattled refiners struggling to turn a profit in the wake of the pandemic-trigged demand collapse.

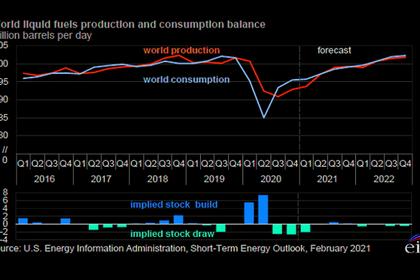

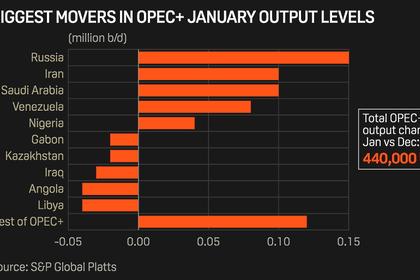

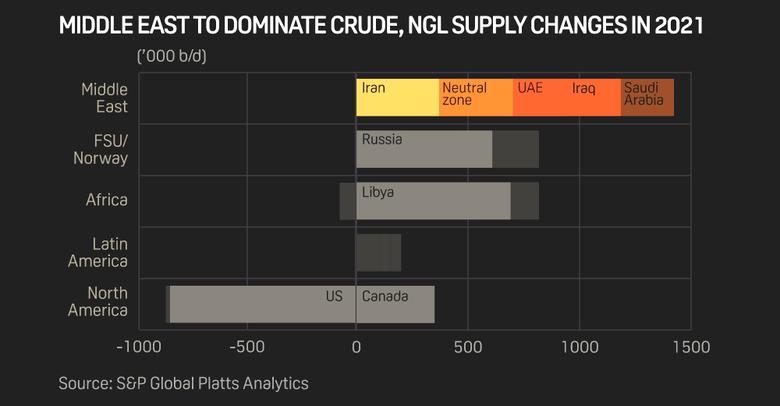

Global liquids supplies are expected to climb by 3.2 million b/d on average in 2021, according to S&P Global Platts Analytics, with almost all of the total coming from crudes pumped by the OPEC+ group led by Saudi Arabia and Russia where medium, sour crude grades dominate.

The Biden administration in the US has also raised the prospect of a swift return to the market of Iran's and Venezuela's mostly medium and heavy crudes. At the same time, an expected rebound in light, sweet crudes from Libya will be more than offset by shrinking light sweet crude from the US.

Production cuts, both voluntary and involuntary, by OPEC members alone since 2017 have slashed the global supply of medium-sour and heavy-sour crudes by more than 5 million b/d, or 13% of 2016 levels for those grades, according to Platts Analytics.

Outages in Canada and production declines from Mexico have further reduced the regional footprint of medium and heavy sour crudes available to global refiners.

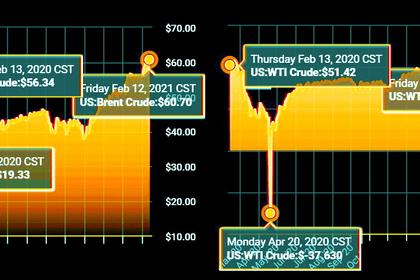

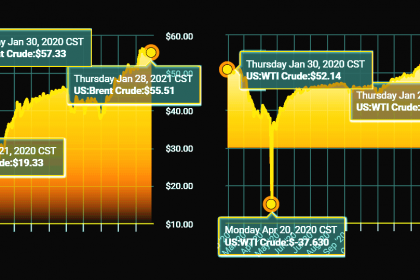

By contrast, supplies of light crude and condensate have risen by 1.7 million b/d over the 2017-2020 period led by the growth of light, sweet US shale oil. That's despite a 3.25 million b/d collapse of light oil supplies in 2020 due to pandemic-related shut-ins after oil prices hit near 14-year lows.

But things are going to change this year. Far from getting lighter, the return of OPEC's barrels means a wave of medium and heavy sour crudes will become available, with an impact on oil price differential and refining economics.

More than 4 million b/d of medium and heavy sour crudes are set to return to the market over the next two years, according to S&P Global Platts Analytics, or 62% of the incremental production between 2021 and 2022.

Assuming a swift wind-down of US sanctions, Venezuela and Iran supplies will be key to the shift in global crude quality dynamics.

Platts Analytics is upbeat that an Iran nuclear deal will be reestablished by mid-2021, allowing for 1 million b/d of its oil returned to the market by year-end. Combined, supplies of Venezuelan and Iranian medium to heavy sour crudes alone could swell by more than 1.7 million b/d over the 2020-2021 period, Platts Analytics estimates.

Light-heavy spread

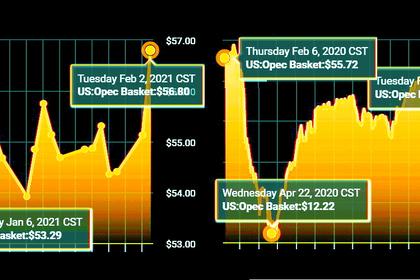

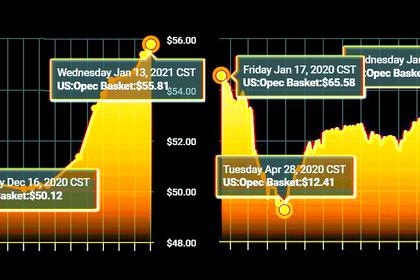

The loss of heavy crudes has already had a market impact. After a steadily narrowing price differential since 2018, last year saw Saudi Arabia and other Mideast Gulf producers price their heavier sour crudes above lighter grades for the first time in years.

Saudi Arabia's prices for Asian buyers of its Arabian Heavy and Arabian Extra Light grades are currently close to parity but this could change later this year as the world's biggest exporter turns its oil wells back on to meet recovering demand. Before OPEC+ began to constrain supplies in late 2016, the price differential for the grades averaged around $4.5/b.

The Brent-Dubai Exchange of Futures for Swaps, or ETS, another key indicator of the spread between light, sweet and heavy, sour crudes, has risen sharply since late 2020 to hit its highest in over a year on Feb 17. Typically at a premium, the Brent-Dubai ETS flipped to a discount a few times last year, after a glut of Atlantic basin supplies dragged down Brent futures against the medium sour Dubai crude. A robust recovery of Asian oil demand, additional Saudi output cuts in February and March, and a harsh cold spat have helped push the spread marker into positive territory. A wide EFS makes crude priced against Dubai more economically attractive for Asian refiners, which are configured to process heavy, sour crude from the Middle East, compared with Brent-linked ones from the Atlantic basin.

At the other end of the crude quality spectrum, supplies of light, sweet grades typically produced in the North Sea, Nigeria, Libya, and the US will struggle to make such an impact.

US production is expected to shrink by almost a further 1 million b/d on average this year as pandemic drilling cutbacks feed through to higher decline rates. That would more than swamp the expected rebound of 670,000 b/d of Libya's light, sweet barrels, Platts Analytics believes.

Refining economics

Refiners traditionally see margins improve when the light-heavy differential is wide due to the lower input costs of medium and heavy crudes compared to high-value products such as gasoline and diesel. A lot depends on how a particular refinery is configured, however, and its ability to access and process different regional crudes streams.

Typically lighter crudes yield more gasoline, naphtha, and middle distillates such as diesel and jet while heavier crudes would produce more fuel oils.

But with meager or non-existent discounts on heavier, sour crudes, most refiners have been unable to optimize their crude slates and have seen margins turn negative in late 2020 as a result. A return to wider crude quality spreads will benefit mostly complex refineries which are able to capture value from a more diverse slate of crudes.

Valero, the second-biggest refiner in the US, has said it is banking on the return of OPEC+ barrels and the potential easing of sanctions on Venezuela and Iran later this year.

"If you look at most forecasts, they're showing global oil demand growing to the point where you'll need at least 3 million b/d of additional OPEC production online by the end of the year," Valero's chief commercial officer Gary Simmons said at the end of January. "Our view is probably the back half of the year is where you'll see quality differentials begin to widen out."

Even Valero acknowledges that a return to wider discounts for heavy sour crudes will be unlikely to trigger a swift reversal of fortunes for refiners suffering from pandemic-hit fuel markets. An acceleration in refining closures in the US and Europe and a return to widespread travel may do more to prop up margins than wider crude quality spreads.

A raft of major new refining projects in the Middle East could also muddy the picture. The UAE's massive Ruwais plant is ramping up, while Jazan in Saudi Arabia and Al-Zour in Kuwait will absorb more than 1 million b/d when completed this year. Those plants alone will soak up some of OPEC's returning barrels as the pandemic retreats.

-----

Earlier: