U.S. GAS MORATORIUM

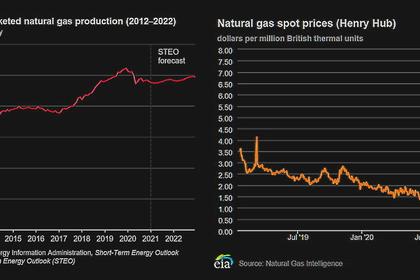

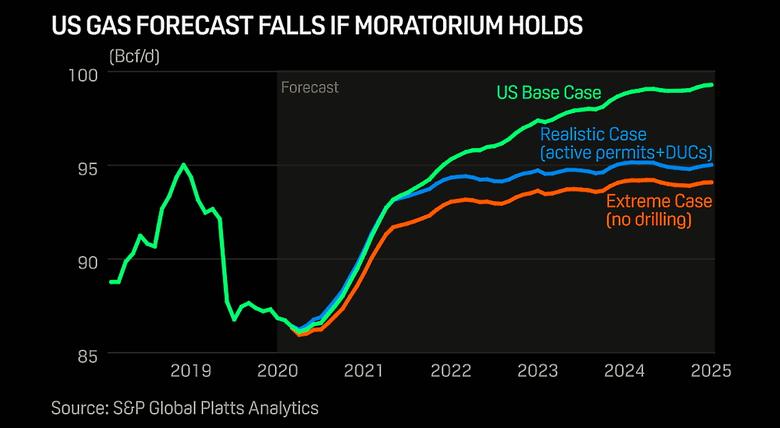

PLATTS - 29 Jan 2021 - If the recent moratorium on the issuance of federal drilling leases holds, most US production losses would occur in New Mexico, where up to 3 Bcf/d of new natural gas supply could be at risk over the next three years.

Following the recent issuance of a 60-day moratorium on new drilling permits and land leases on federal land, President Joe Biden Jan. 27 signed an executive order that would suspend all new federal oil and gas leases, both onshore and offshore, while the Department of the Interior reviews all existing leasing and permitting practices.

The executive order avoids an outright ban on federal land drilling permits. However, it does pose longer-term risks for production growth in some producing basins, specifically the New Mexico portion of the Delaware Basin of the Permian, which is expected to see the largest impact from any legislation that limits drilling activity on federal lands.

In a scenario developed by S&P Global Platts Analytics, a ban on federal drilling permits could place as much 3.7 Bcf/d of US gas production at risk by the end of 2024, with roughly 3 Bcf/d of those losses coming solely from the New Mexico Delaware Basin.

Operators have been preparing for Biden to make good on his campaign promise by stockpiling permits that they can drill over the course of the next couple years.

US Bureau of Land Management permits for onshore drilling last for two years, with an option to extend them a further two years, though the commonplace extension could also be at risk. Operators have stockpiled nearly 4,000 permits on federal lands, over 60% of which are in New Mexico's portion of the Delaware Basin. In any scenario that does not include an outright ban on drilling, which is unlikely from a legal perspective, operators will be able to continue to drill over the course of the next two to four years.

"A federal leasing moratorium is effectively a blockade around New Mexico's economy, impacting our state more than any other in the country," said Ryan Flynn, president of the New Mexico Oil and Gas Association. "We share the new administration's commitment to reducing emissions and combating climate change, but we do not make progress by sacrificing New Mexico communities like Carlsbad, Farmington or Hobbs."

Platts Analytics believes a surge of drilling and completion activity on federal lands is likely in the coming months as operators attempt to drill as many existing permits as possible before expiration. Overall Permian production is forecast to grow to an average of 19.4 Bcf/d by 2025, an increase of 7.5 Bcf/d from current levels, with 3 Bcf/d of that growth expected to come from the New Mexico Delaware.

Because drilling permits are valid for at least two years, initially there is likely to be a pop in production out of the Delaware as operators execute on the previously approved permits. But as natural declines start to take hold, production out of that portion of the basin is expected to flatten and steadily decline.

The potential for 3 Bcf/d less production from the Permian would cause the US Southwest and Southern California markets to see significant price premiums as the region's two main supply sources, the Permian and the Rockies, stand to lose the most following a federal permitting ban.

-----

Earlier: