U.S. LNG GROWTH FOR CHINA

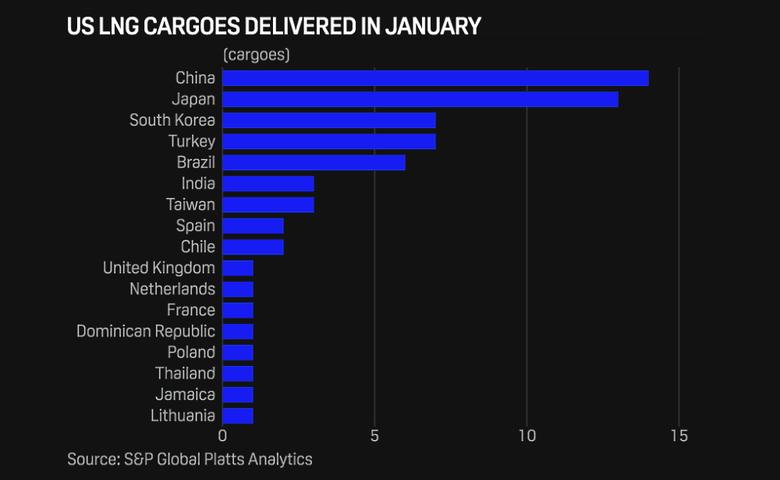

PLATTS - 01 Feb 2021 - China was the top destination for US LNG in January for the second month in a row, amid a historic run-up in Asian spot prices and despite ongoing constraints at the Panama Canal, S&P Global Platts Analytics data Feb. 1 showed.

The 14 cargoes delivered to China last month tied China's December mark as the highest number of cargoes ever delivered from the US in a single month to one country.

December was the first time China had been the top monthly US destination since deliveries resumed in April 2020 following a 13-month pause due to tariffs. While tariffs remain, China has been granting waivers to its importers since an initial trade agreement between Beijing and Washington.

Booming demand for LNG in Asia due to frigid winter weather put LNG carrying capacity at a premium in January. With LNG shipping rates having retreated from record highs last month and with low stocks in Europe, the market dynamics could shift in February toward the latter part of the month, putting Europe back into focus for some US suppliers.

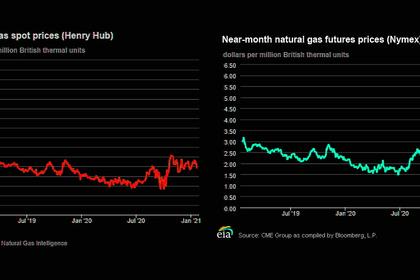

After hitting a record $32.50/MMBtu on Jan. 13, less than nine months after plunging to a record low of $1.825/MMBtu, the Platts JKM, the benchmark price for spot-delivered LNG to Northeast Asia, has moderated substantially as the market rolled to March. Platts assessed the JKM at $8.738/MMBtu on Feb. 1.

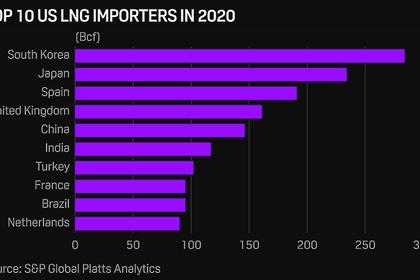

The 14 US cargoes delivered to China in January compared with none during the same month a year earlier. Four of those January cargoes were delivered to the Zhoushan LNG terminal -- the most to any Chinese terminal last month. The facility just recently opened up to third-party access. Behind China, Japan was the No. 2 destination for US LNG last month, with 13 cargoes delivered, more than double the number delivered during the same month in 2020, Platts Analytics data showed. South Korea and Turkey were tied for third with seven cargoes each, followed by Brazil with six.

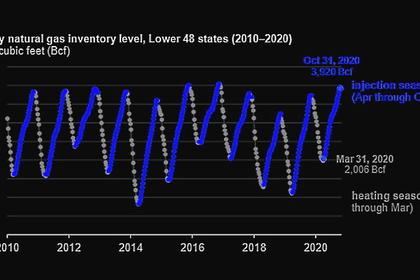

Feedgas demand at the six major US liquefaction terminals remains robust, even as extended wait times that began in October continue at the Panama Canal for LNG tankers passing through without a reservation.

Gas deliveries to US terminals topped 11 Bcf/d on Feb. 1 for the fifth day in a row. Demand still remains below the record deliveries of 11.58 Bcf/d set on Dec. 13, Platts Analytics data showed.

A massive winter storm slamming the US Northeast could impact feedgas deliveries in the days ahead to at least one of the two LNG export facilities on the East Coast.

A spokeswoman for the Berkshire Hathaway-operated Cove Point terminal in Maryland declined to say if operations would be reduced. On Feb. 1, the facility appeared to be operating slightly below capacity, based on feedgas deliveries. At Kinder Morgan's Elba Liquefaction facility in Georgia, the smallest of the major US LNG export terminals, feedgas levels were stable compared with levels over the previous week.

-----

Earlier: