BRITAIN'S CARBON PRICING

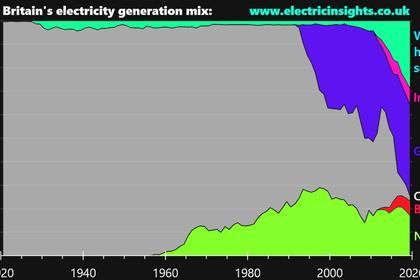

PLATTS - 17 Mar 2021 - The UK government has set out its vision to decarbonize the economy by 2050 and will use carbon pricing as a major tool to help deliver the goal, it said March 17.

The UK's Industrial Decarbonization Strategy sets out how the UK can develop a thriving industrial sector aligned with a net-zero emissions target without pushing emissions and business abroad.

"We will use the actions set out in this strategy to accelerate the green transformation in industry: aiming high with our ambition, as we expect that emissions need to fall by around two thirds by 2035; and ensuring UK businesses expand into new and growing markets in a low carbon world," said UK Minister of State for Business, Energy and Clean Growth Anne-Marie Trevelyan.

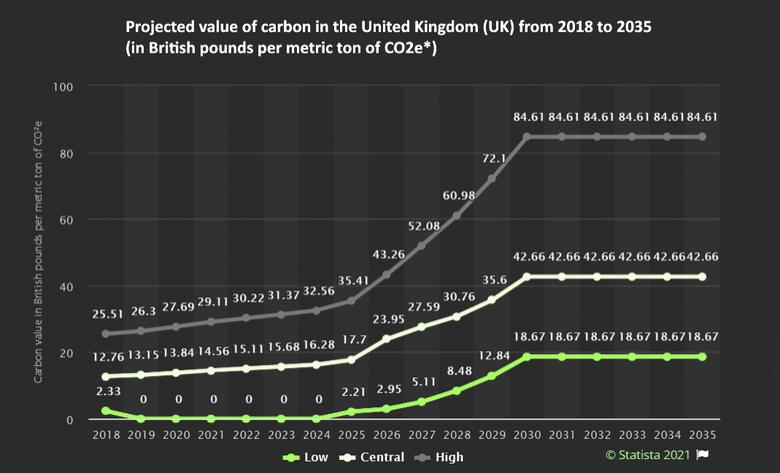

The UK's Department for Business, Energy and Industrial Strategy set out a framework to use carbon pricing to encourage investors and consumers to choose low-carbon options.

"In the long run, markets will be best placed to determine the most cost-effective pathways to decarbonization," BEIS said in the report.

"Throughout the next decade, government will need to help overcome a number of different market failures and barriers to entry that prevent industry from securing investment needed to start the low-carbon transition," said BEIS.

The UK's decarbonization strategy builds on its 10-point plan for a Green Industrial Revolution released in November 2020 and its Energy White Paper unveiled in December 2020.

Three levers for carbon pricing

The government identified three levers that will be key to any policy framework designed to unlock investment in the technologies needed to decarbonize industry.

First, the UK's planned Emissions Trading System will cap CO2 emissions from electricity generation and other emissions-intensive sectors, sending a clear signal to the market that the government is committed to reaching net-zero, it said. The UK's ETS cap will be aligned with the UK's net-zero ambition by January 2024, BEIS said.

The government will review the UK ETS in 2021, including consulting on a net-zero emissions cap; reviewing the long-term role of free allowances; exploring and expanding the scope of the system to cover more sectors of the economy and linking with other schemes internationally; and considering the case for a supply adjustment mechanism, it said.

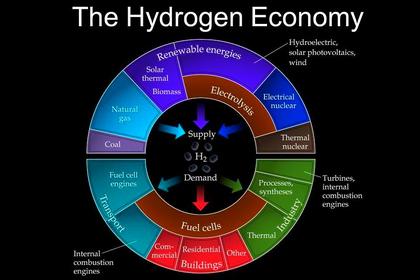

Second, targeted government funding mechanisms will be used to help overcome barriers to securing private sector investment. This is expected to target carbon capture, use and storage and low-carbon hydrogen production – two technologies at early stages of development that will need government intervention to share the risks and costs of scaling up deployment, BEIS said.

Third, a reformed approach to mitigating carbon leakage, adapting over time to reflect a tighter ETS cap alongside increased deployment of low carbon technologies, will ensure the UK's global and domestic climate goals are met, while supporting the growth of low-carbon manufacturing in the UK, it said.

Carbon leakage refers to the risk that companies try to cut costs by moving operations to areas where carbon pricing has not been implemented.

Negative emissions technologies

The government's modelling suggests there will be a small volume of residual emissions by 2050 – about 6 million mt – that will need to be offset through various greenhouse gas removal (GGR) measures, it said.

These are expected to include afforestation as well as innovative technologies such as direct air carbon capture and storage and bio-energy with carbon capture and storage, it said.

In June 2020, the government announced up to GBP100 million ($139 million) of new research and development funding to support GGR technologies to help them achieve commercialization. The government will use responses to a December 2020 call for evidence to inform its future policy in this area, it said.

The UK government will also work with stakeholders to understand how a planned EU Carbon Border Adjustment Mechanism could affect the UK, BEIS said in the report.

The CBAM aims to avoid competitive distortions arising for EU carbon-intensive industries due to Europe's carbon pricing policies and to encourage the EU's trading partners to adopt equivalent levels of climate protection ambition.

Little detail has been provided on what the mechanism would look like in practice, and options include a tax on imports; an extension of the EU ETS to non-EU operators; and a new consumption-level tax.

"The EU plans to discuss carbon leakage with WTO members, including the UK, with a view to agreeing a ministerial statement at the WTO Ministerial in December," BEIS said.

The European Parliament voted in favor of a CBAM March 10 in a non-legally binding formal opinion, and the European Commission is expected to make a legislative proposal in the second quarter of 2021.

-----

Earlier: