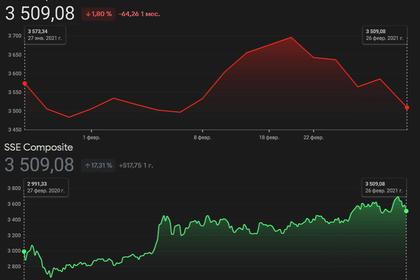

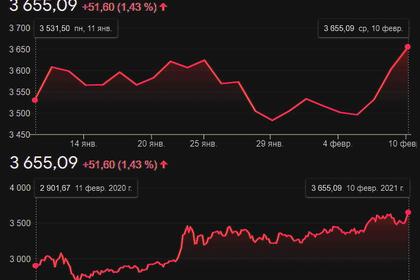

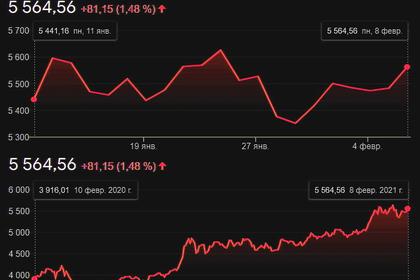

CHINA INDEXES UP

REUTERS - MARCH 3, 2021 - Thai, Chinese and Indian stock markets rose more than 1% each on Wednesday, as investors placed their bets back on a global economic recovery, while regional currencies inched higher as U.S. Treasury yields retreated.

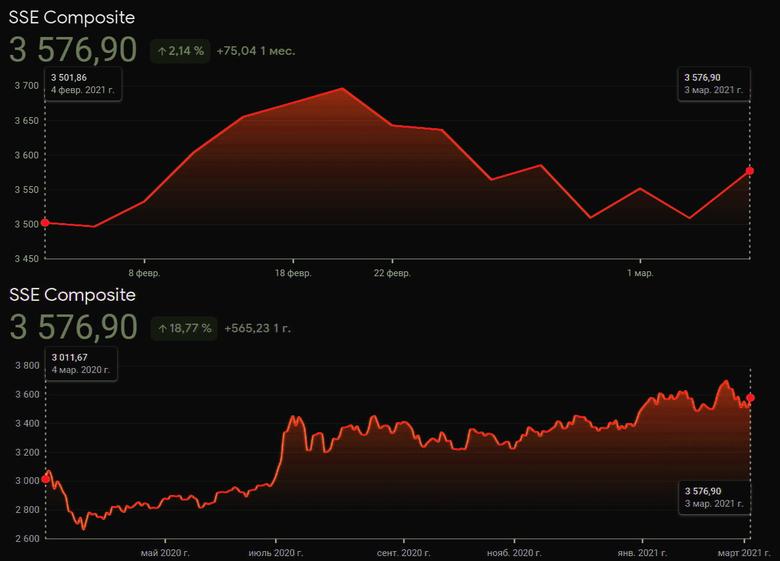

Shares on Shanghai's Composite Index climbed 1.6% ahead of Friday's annual parliamentary gathering, while Bangkok and Mumbai markets rose 1.6% and 1.1%, respectively.

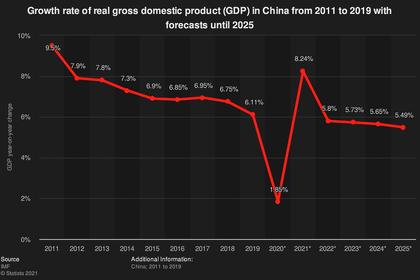

China will chart out a five-year plan at Friday's political conference, setting macroeconomic policy targets beyond the COVID-19 pandemic. The world's second-largest economy has steadily recovered from the coronavirus shock.

"We expect these targets to revert partly or fully to pre-pandemic norms, and to be less constraining than in the past," Goldman Sachs analysts said, adding the policies would have substantial implications for the rest of Asia.

Earlier this week, data across the region showed manufacturing activity continued to expand, with export-reliant economies showing the greatest strength.

Asia's emerging currencies edged higher as lower U.S. yields sapped some demand for the dollar. The ringgit gained 0.2% while the rupiah advanced 0.1%.

Indonesia will hold a greenshoe option debt auction on Wednesday after Tuesday's bond sale raised a below-target 17 trillion rupiah ($1.19 billion). The weighted average yields of the bonds sold on Tuesday were higher than the comparable bonds sold at the previous auction in mid-February.

"If there is still no reversal in sentiment, the government may need to accept higher bid yields, or cut down on planned spending," OCBC analysts wrote in a note.

Thai shares were led by technology and consumer stocks, while an uptick in oil prices supported PTT PCL and its energy peers ahead of a meeting by the Organization of the Petroleum Exporting Countries (OPEC) and allies, known as OPEC+, on Thursday.

Demand is recovering as economies reopen, with the market expecting OPEC+ to ease sharp production cuts announced last year during the worst of the pandemic to boost prices.

-----

Earlier: