EUROPEAN INDEXES DOWN

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

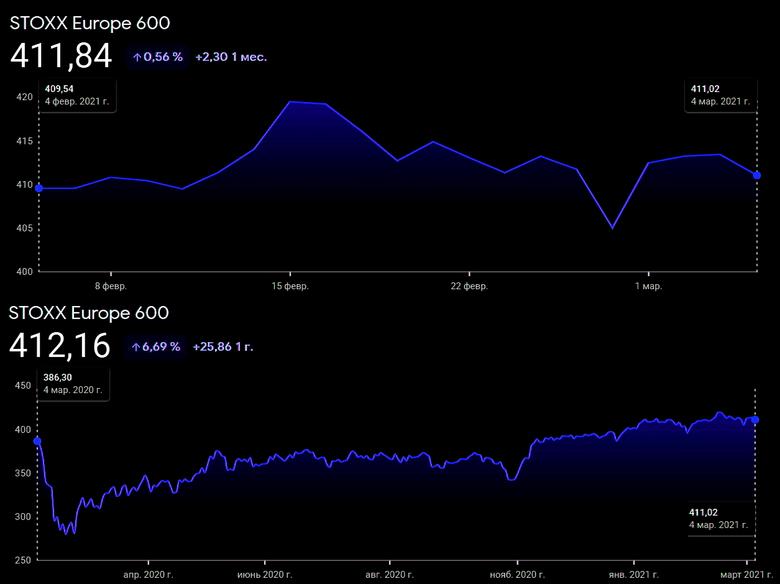

EUROPEAN INDEXES DOWN

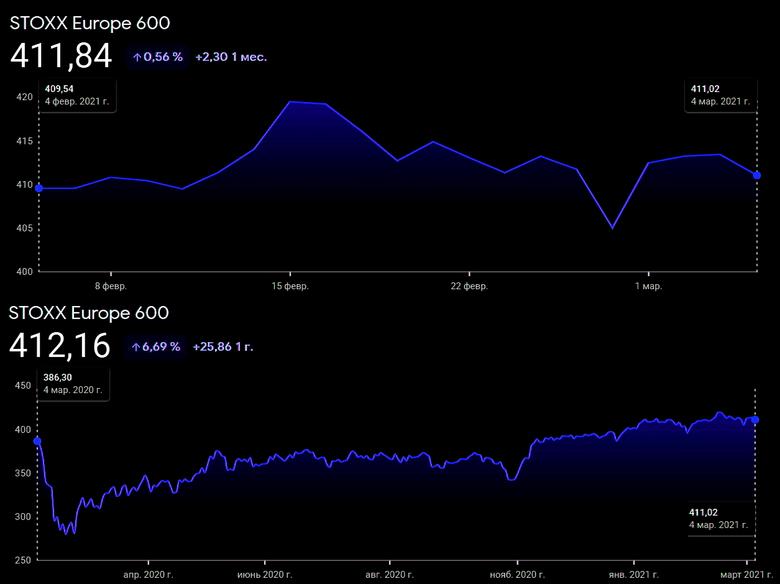

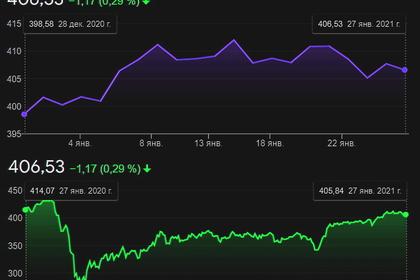

REUTERS - MARCH 4, 2021 - European stocks fell on Thursday after three straight sessions of gains as a jump in U.S. bond yields knocked risk appetite globally, with heavyweight miners and travel stocks leading the retreat.

The pan-European STOXX 600 index fell 0.5% in early trading, with miners dropping 2.8% and travel & leisure stocks down 1.6%.

UK-listed shares of Rio Tinto and BHP Group shed 5.2% and 4.3% respectively, after their Australia-listed stocks were hit by ex-dividend trading.

German airline Lufthansa dropped almost 2% after it posted record losses for 2020 and trimmed its 2021 capacity plans as COVID-19 disruption drags on.

The 10-year U.S. Treasury yield, the benchmark for global borrowing costs, rose past 1.45% on Wednesday as investors anticipated a rise in inflation with governments continuing to pump money into the global economy and as vaccination programmes progress.

Investors are waiting to see if Federal Reserve Chairman Jerome Powell will address concerns about the risk of a rapid rise in long-term borrowing costs later in the day.

-----

Earlier:

2021, February, 16, 12:15:00

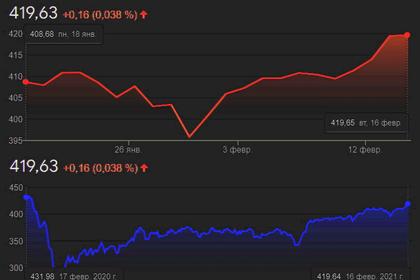

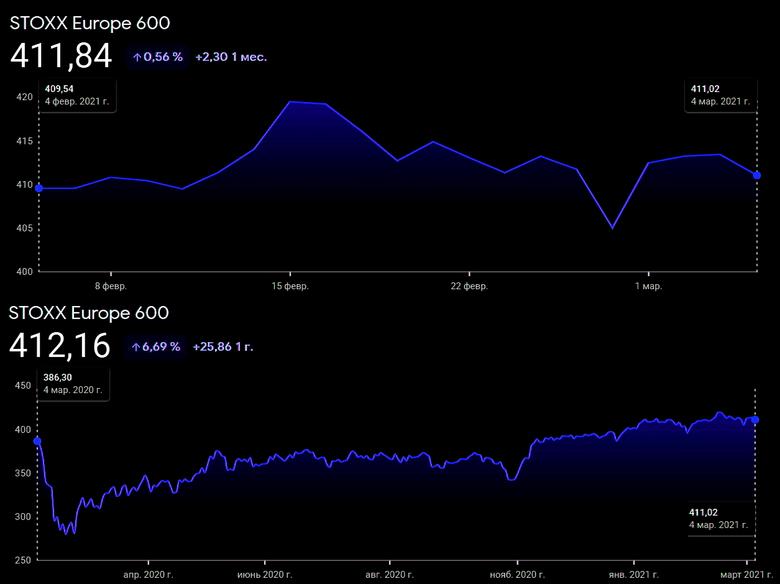

EUROPEAN INDEXES UP ANEW

The pan-European STOXX 600 was up 0.2% by 0802 GMT, after jumping 1.3% in the previous session to its highest level since February 2020.

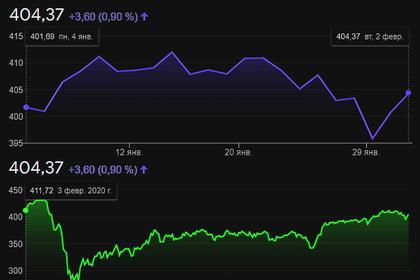

2021, February, 2, 12:10:00

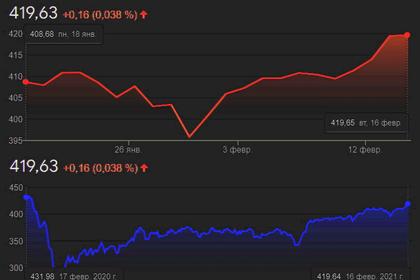

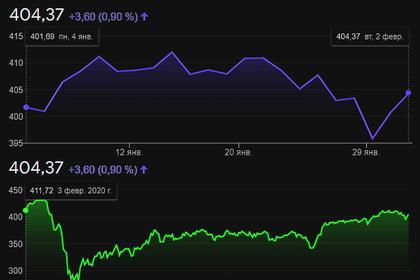

EUROPEAN INDEXES UP

The European technology sector rose 1.4%, while the STOXX 600 index gained 0.8%.

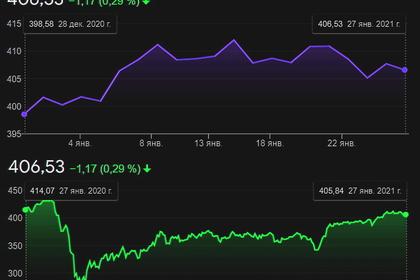

2021, January, 27, 14:00:00

EUROPEAN INDEXES DOWN

European share indexes opened in the red. The STOXX 600 was down around 0.3% on the day

2021, January, 6, 13:30:00

EUROPEAN INDEXES UP

The pan-European STOXX 600 index was up 0.2%, while UK’s FTSE 100 rose 0.7% and Germany’s DAX gained 0.2%.

All Publications »

Tags:

EUROPE,

INDEXES,

SHARES,

STOCKS,

BONDS