EUROPEAN INDEXES UP

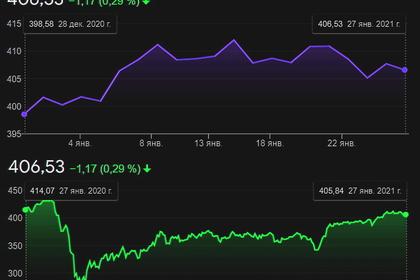

REUTERS - MARCH 11, 2021 - European stocks hit a new one-year high on Thursday as worries about a spike in inflation eased, while investors awaited the European Central Bank’s policy decision for its views on a recent rise in bond yields.

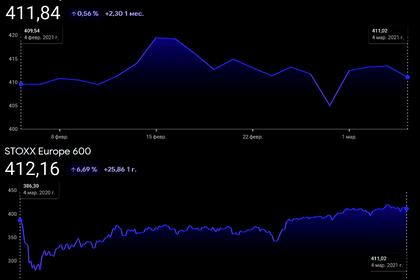

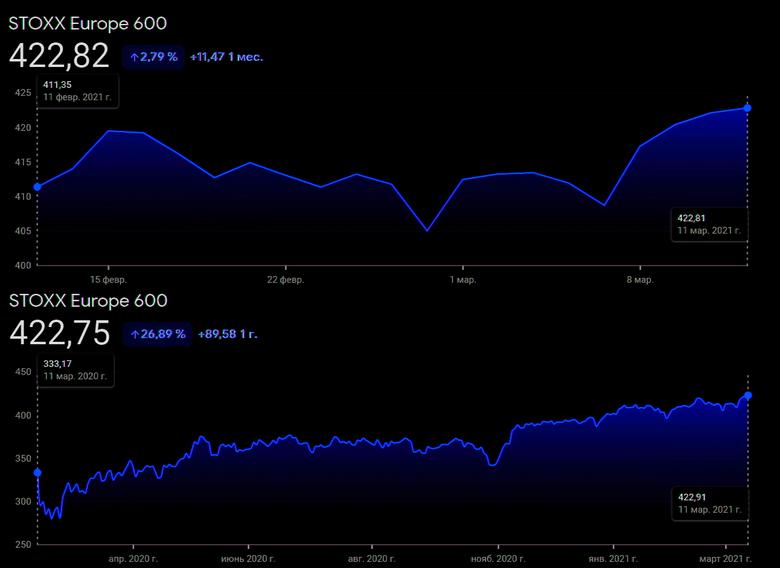

The pan-European STOXX 600 index rose 0.3%, up for a fourth straight session as Wall Street stocks rallied overnight on tame inflation data and as the U.S. Congress approved one of the largest economic stimulus measures in history.

Technology, mining and retail sectors were the top gainers in Europe, rising between 1.2% and 2%.

Banks fell the most, with UK-based lender HSBC’s shares falling 3.9%.

“Fears regarding higher inflation and policy tightening have been reduced and the consequence is a continued recovery in sentiment,” said Sebastien Galy, senior macro strategist at Nordea Asset Management.

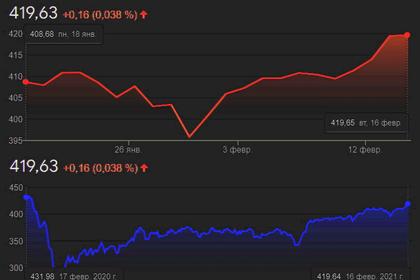

Euro zone stocks gained 0.4% to trade at their highest level in over 13 years ahead of the ECB meeting where policymakers will be keen to calm markets by signalling faster money printing to keep a lid on borrowing costs and recommit to rock-bottom rates until well into a recovery.

The policy decision is due at 1245 GMT, followed by ECB chief Christine Lagarde’s news conference at 1330 GMT.

“Lagarde will have to convince markets that the central bank remains strongly committed to securing favorable financing conditions and how she communicates this will be particularly important for financial markets,” Unicredit analysts said in a note.

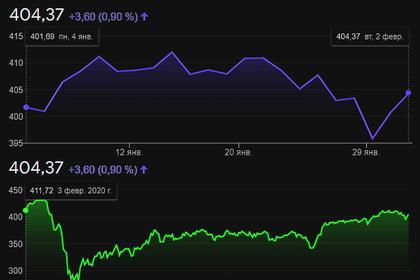

European stock markets are on course to record strong weekly gains on hopes that massive stimulus measures and vaccination programmes will spur a recovery in global economy, while calmer bond markets boosted appetite for riskier assets like equities.

Among individual stocks, France’s state-controlled power group EDF jumped 5.7% after Finance Minister Bruno Le Maire told a local TV that there will be no break-up of the company as negotiations between Paris and Brussels over an overhaul of the company enter a final stage, sources told Reuters.

Rolls-Royce edged up 0.9% as the British engine-maker stuck to its forecast to burn through less cash this year after posting a worse-than-expected 2020 loss.

German fashion house Hugo Boss AG dropped 2.9% after saying it expects coronavirus restrictions to keep weighing on its business in the first quarter.

German speciality chemicals maker Lanxess fell 4.1% after providing a disappointing 2021 earnings outlook.

-----

Earlier: