EUROPE'S INDEXES DOWN ANEW

REUTERS - MARCH 17, 2021 - European stocks ticked lower on Wednesday as most investors stayed on the sidelines ahead of the U.S. Federal Reserve’s policy decision, while German carmaker BMW jumped after forecasting significant profit growth in 2021.

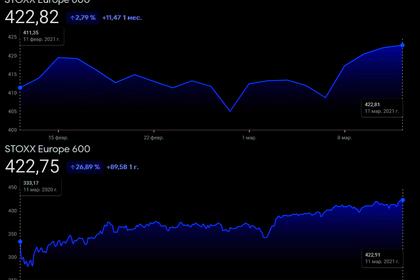

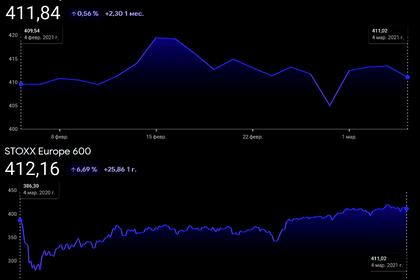

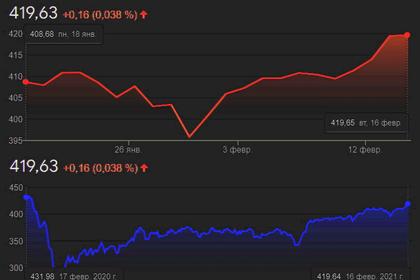

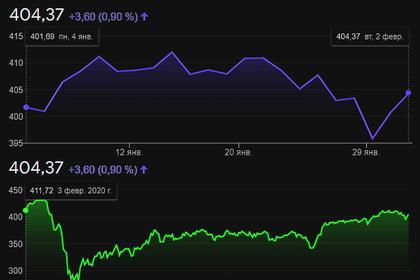

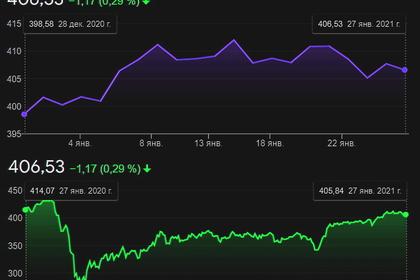

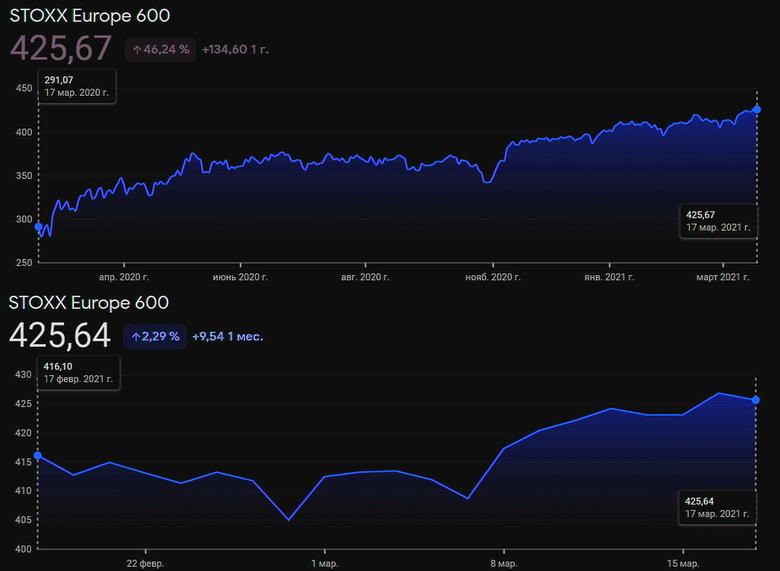

The pan-European STOXX 600 index edged 0.3% lower, trading below a one-year peak after a cautious session in Asian markets.

The Fed’s monetary policy stance will be closely watched after a recent run-up in Treasury yields stoked concerns about a pick-up in inflation as the U.S. economy rebounds from pandemic lows. The central bank’s policy statement and economic forecasts are due at 2 p.m. EDT (1800 GMT).

“The Fed at this point probably thinks that the impact of the high yield is relatively modest on the stock market,” said Dhaval Joshi, chief strategist at BCA Research in London.

“They will stick to their narrative, and only if there is a big sort of pushback in the market crisis, would they intervene aggressively.”

A move into some of the cheaply valued sectors such as banks and energy has pushed European stocks closer to record levels hit last year, with investors counting on vaccination drives and stimulus measures to spur a strong global rebound this year.

BMW rose 4.4% after it said it expects a significant annual increase in group pre-tax profit in 2021 as it forecast a strong performance in all its segments.

Europe’s automobiles & parts index gained 1.5% to hit a fresh 2018 high, with Volkswagen rising 3.1% after it forecast its 2021 deliveries, sales and earnings to come in above the previous year’s level.

German airport operator Fraport jumped 3.9% after HSBC upgraded the stock to “buy”, saying the pandemic has forced the company to become “better”.

Austrian hydropower producer Verbund slid 4.3% as it expects 2021 profit to fall after a 14% rise in 2020, thanks to lower electricity prices.

Real estate, oil & gas and retail stocks were the top decliners.

-----

Earlier: