GLOBAL COAL INVESTMENT $1 TLN

PEI - March 15, 2021 - Many utilities and nations around the developed world may be announcing accelerated moves away from coal-fired power projects, but a new report indicates that financing support for this resource is still robust despite political pressures.

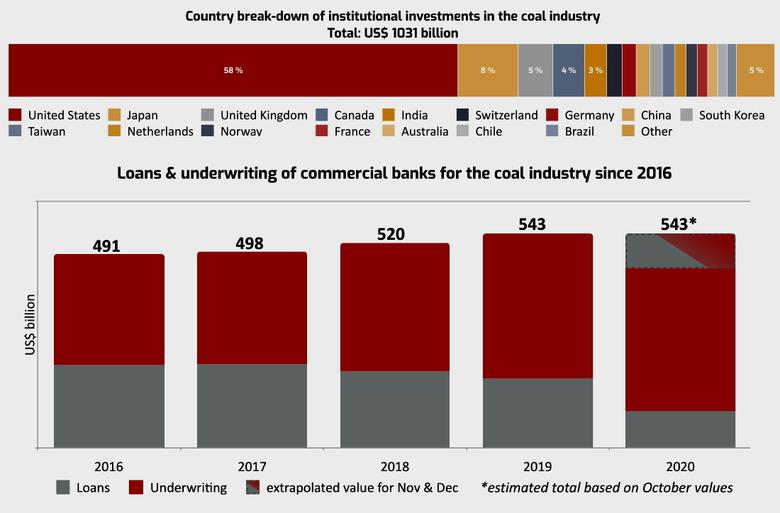

Coal watchdog Urgewald recently released findings that, as of January, the thermal coal value chain still claimed nearly 4,500 institutional investors totaling $1 trillion in operations. U.S. mutual fund firm Vanguard was tops globally with coal-related holdings of almost $86 billion.

Private equity investor BlackRock was a close second with some $84 billion coal-fired financial support. Overall, U.S. investors collective accounted for 58% of institutional investment in the global coal industry, according to Urgewald.

The sentiment is changing, of course, with many money firms around the world and particularly in Europe. London-based HSBC recently announced that it was phasing out coal financing by 2030, following intense pressure from many of its shareholders.

Urgewald said its research identified 381 commercial banks which provided $315 billion in loans to finance coal projects over the past two years. During that period, Japanese banks Sumitomo Mitsui and Mitsubishi UFJ Financial led the way.

“The coal policies adopted by Japanese banks are among the weakest in the world,” Eri Watanabe, of 350.org Japan, was quoted as saying in the Urgewald report. “They only cover a small portion of banks’ lending and do not rule out corporate loans or underwriting for companies that are still building new coal plants in Japan, Vietnam, the Philippines and elsewhere.”

Urgewald is a German, non-profit advocacy group with focus on the U.S. Europe, Asia and Africa. The report is part of its Coal Exit campaign. The report was a partnership with Urgewald, Reclaim Finance, Rainforest Action Network, 350-org Japan and other partners.

The Paris Climate Accord, to which the U.S. recently returned after Joe Biden’s presidential victory over Donald Trump, was supposedly the global turnaround in the fight against carbon pollution and climate change. Since that accord was first signed in 2016, Urgewald pointed out, commercial banking support for the coal industry has increase from $491 billion in loans and underwriting to an estimated $543 billion.

“These numbers provide a sobering reality check on bank’s climate commitments,” says Yann Louvel, policy analyst for the NGO Reclaim Finance, in the Urgewald report. “Reclaim Finance maintains an online “Coal Policy Tool” that tracks and ranks all coal policies announced by financial institutions. According to its tool, 88 commercial banks have now adopted a coal policy, but out of this total only 4 banks have adopted “robust” coal exclusion policies.”

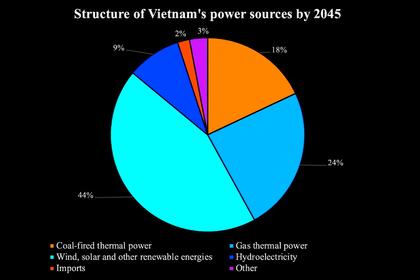

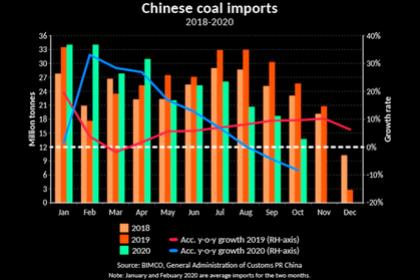

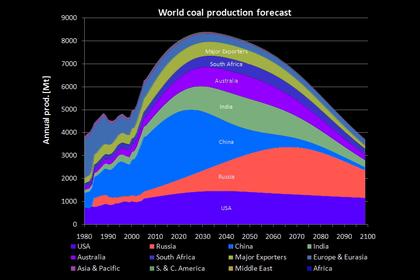

The report advocates higher public pressure on financing institutions, but Asian leaders such as China and Japan are backing coal-fired projects both domestically and in other nations. China is working hard to electrify all of its areas by numerous means, while Japan, which shut down most of its carbon-free nuclear capacity following the Fukushima meltdown in 2011, is adopting coal both to create jobs and round up its generation mix.

Coal-fired power provides more than 60% of China’s electricity generation mix although that portion is declining as the nation embraces more utility-scale renewables.

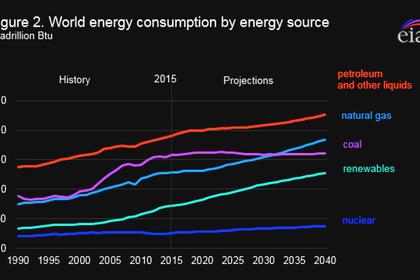

Globally, coal-fired power accounts for 36% of the generation mix and remains the leading resource, especially in developing nations working to energize their poorer areas.

And, in the U.S., the Energy Information Administration just reported Thursday that coal exports declined 26% last year, to 69 million short tons from 93 million in 2019. Steam coal exports, tellingly, dropped more than one-third.

Even so, coal still fuels at least 20% of the U.S. electricity generation despite dozens of power plant retirements in recent years. The levelized cost of electricity for coal, however, is now higher than gas, wind and solar, according to some reports.

The Trump Administration promised to better support coal-fired power and even offered potential FERC rulemaking to benefit on-site supply resources. During those four years, however, some 79 plants were shut down.

The Biden Administration has vowed to raise more stringent carbon-reduction goals both in the transportation and power sectors. Coal-fired generation emits twice as much carbon as gas, while wind, solar and nuclear are carbon free during the electricity production phase.

-----

Earlier: