GLOBAL GAS DEMAND WILL UP 50%

GECF - 24 February 2021 Doha, Qatar - GECF Global Gas Outlook 2050’s fifth edition unveiled

The Gas Exporting Countries Forum (GECF) today unveiled the 5th edition of its annual GECF Global Gas Outlook 2050 (Outlook) at an online event attended by energy ministers and senior representatives from the Forum’s Member Countries together with a bevy of dignitaries and gas industry stakeholders.

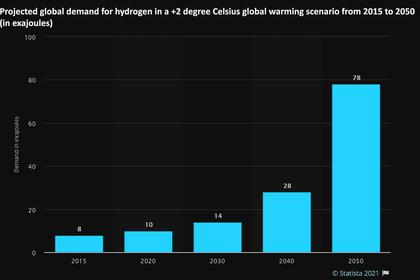

The Outlook is the most extensive forecast of the global gas industry and presents multiple forward-thinking scenarios, from COVID-19 recovery to hydrogen economy, up to 2050 – a year by when gas is expected to firmly become the primary fossil fuel of the XXI century. The Outlook’s detailed quantitative assessments account for national energy strategies, environmental and climate policies, and investments and business decisions.

The forecast remains the flagship publication of the association of 19 member countries, which together represent 70% of the world’s proven gas reserves, 44% of its marketed production, 52% of pipeline, and 51% of LNG exports in the world.

Addressing the gathering via a statement, HE Viktor Zubkov, Special Representative of the Russian President for Cooperation with the GECF and Chairman of the Board of Directors of Gazprom, said: “The Global Gas Outlook, being launched today, presents a quality assessment of how macroeconomic conditions, energy policies, prices and investment decision have their influence on the development of natural gas markets (worldwide).”

“At the same time, this new edition closely examines the effect of the COVID-19 pandemic on global energy markets and focus on the strengthening role of natural gas in the energy transition.”

Commending the GECF for developing a rigorous forecasting and analytical potential in-house, HE Alexander Novak, Deputy Prime Minister of the Russian Federation said: “The weight and reputation of the GECF in the gas industry is steadily growing and we expect that it will continue to play a key role in shaping further vectors for the development of the gas industry, establishing mechanisms to ensure the stable and safe functioning of the gas market.”

“The development of the global gas market largely depends on the BRICS countries, whose energy balance will witness natural gas’ growth by almost 50% by 2040. In addition, the potential for the LNG market is growing. Already, Russia is fourth among the world's largest producers. We intend to increase production from the current 29 million tons to 120-140 mt of LNG per year and take up to 15-20% of the market by 2035,” added HE Novak.

In his overview of the latest findings of the Outlook 2050, the GECF Secretary General HE Yury Sentyurin highlighted the vital role natural gas will play in the global energy mix by raising its share from currently 23% to 28% by 2050, thanks to its remarkable features of abundance, flexibility, affordability, and environmental efficiency.

HE Sentyurin said: “The complexity of factors and the multiplicity of stakeholders within the energy sector results in myriad shifting strategies that are shaping the new architecture of the future. Nevertheless, the mid- and long-term fundamental factors that favour natural gas remain unchanged. This plentiful, adaptable and, crucially, clean source of energy will expand across Asia Pacific, North American and Middle Eastern markets.”

In his statement, HE Mohammad Barkindo, OPEC’s Secretary General said: “The publication of the Global Gas Outlook today and OPEC’s contribution to it, are just another sign of the ever-expanding cooperation and dialogue between our two organisations.”

“The potential of this dialogue is unlimited, and even that much more essential now, as, together, we unite with all of our industry stakeholders to accelerate the recovery from the ravages brought on by the COVID-19 pandemic.”

Joining from Riyadh, where the International Energy Forum (IEF) is headquartered, Secretary General HE Joseph McMonigle said: "As the only natural gas focused outlook by the major energy organizations, the GECF’s Global Gas Outlook makes a valuable contribution to global understanding of future energy trends.”

"As a cleaner alternative to other fossil fuels, natural gas offers the world a real chance to mitigate climate change and meet shared goals faster together. The IEF is committed to helping advance the role of readily available gas resources, new infrastructure solutions, and innovative technologies to facilitate smart stable and secure energy transitions in partnership with the GECF and other organisations.”

The high-ranking officials praised the necessary competencies achieved by the Forum, which, according to them, are increasingly sought-after at some of the world’s most authoritative platforms such as the United Nations, G20, ASEAN, BRICS, among others.

The GECF Global Gas Outlook 2050 is divided in six main sections, with Chapters I and II examining the global economic and energy price prospects and energy policy developments, respectively, in light of changing demographics, carbon price projections, post-COVID-19 recovery plans, and policy drivers. Chapter II explores the energy and gas demand with an in-depth look at the global and regional trends. Chapter IV provides a vantage point on natural gas production, the changing profile of gas production sources, as well as the steps being taken by the GECF members to remain the leading producers in the world. Chapter V shines the light on the important subject of gas trade and investment, whilst Chapter VI chalks out the role of natural gas in energy-related CO2 emissions with alternative scenarios on carbon mitigation.

Several of these topics were elaborated further at the event during a panel discussion, with the participation of a group of experts from the GECF, who served as the Outlook’s co-authors.

These experts highlighted the value of the Global Gas Model (GGM) – a unique highly granular tool developed in-house at the GECF Secretariat, which has been serving for modelling the GECF Global Gas Outlook. They mentioned that the GGM boasts the ability to focus on all segments of the gas value-chain such as production, pipelines, LNG, transportation, regasification, contracts, in an exclusive manner.

- The GGM is characterised by its high granularity in covering:

- 140+ country-level forecasts, with over 85 regional and economic aggregations

- Complete energy balance estimates, covering 34 sectors and 35 fuels p.a., from 1990 to 2050

- 4,157 gas supply entities representing gas supply potential at a global scale, divided into:

- 573 existing production facilities that are in operation – including aggregates

- 106 associated gas projects linked to oil production facilities

- 60 sanctioned projects that are under development

- 1,255 new projects based on existing reserves

- 1,697 yet-to-find entities based on USGS resource base

- 394 unconventionals (existing, new, and yet-to-find) – global shale gas, tight gas and coal bed methane

The infrastructure database contains:

- 600 liquefaction plants

- 803 regasification plants

- more than 4,400 gas pipeline and shipping routes

Select findings from the latest edition of the GECF Global Gas Outlook 2050:

Population growth and economic prospects

- Africa will lead the way in population growth, accounting for half of the total increase in 2050, with Asia following in second place. India will become the world’s most populous country by 2030

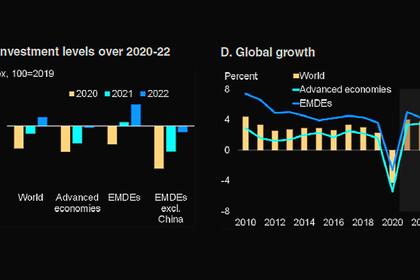

- Global real GDP is forecast to be 7% lower in 2050 than pre-COVID-19 projections

- China has recovered much faster than any other country from COVID-19

- The U.S. is experiencing an unprecedented decline in its GDP, at 4.3%, due to the uncontrolled spread of the virus

Energy price projections

- Over the longer term, the expectation is that an average level for oil prices of around US$60/bbl should be achievable, as oversupply is driven out of the market by lower prices and demand starts to recover

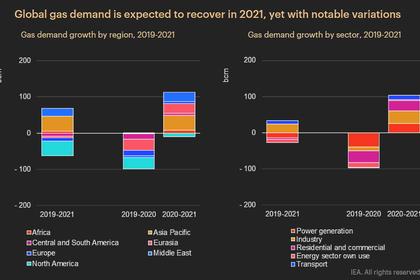

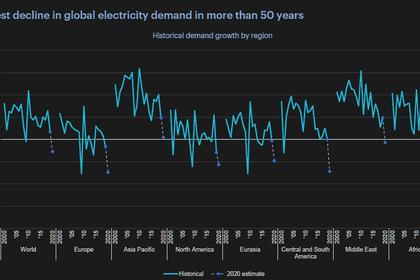

- In the gas market, a combination of excess LNG supply, high storage utilisation in Europe, a warm winter and the effects of COVID-19 caused a collapse in prices across the globe in 2020

- As for gas prices, there is a trend towards increasing regional natural gas market integration and price convergence, though at a generally lower level than 2019 projections.

- Volatility in gas prices will continue due to the investment cycles for LNG but increasing globalisation of trade will help to keep inter-regional prices competitive

- The challenge of decarbonisation (and carbon taxes) will have an important impact in Europe, which will be the balancing market for LNG

- In Asia, demand growth will likely see the continuance of the “Asian premium”

Energy policy developments and emissions trends

- Natural gas continues to receive positive policy support in several countries as an alternative to polluting and carbon-intensive fuels and as a flexible option complementing intermittent renewables

- However, this policy support is being challenged, especially by governments setting more ambitious renewables targets and decisions by several lenders, including the World Bank, to discontinue financing gas projects

- The post-COVID-19 stimulus measures are still largely supportive of hydrocarbons

- The reliance on higher carbon-intensive fuels, particularly coal, contributes to an anticipated gap between the emissions forecasts and the Paris Agreement targets. Further penetration of natural gas enables the capture of more carbon mitigation potential.

Energy and natural gas demand trends

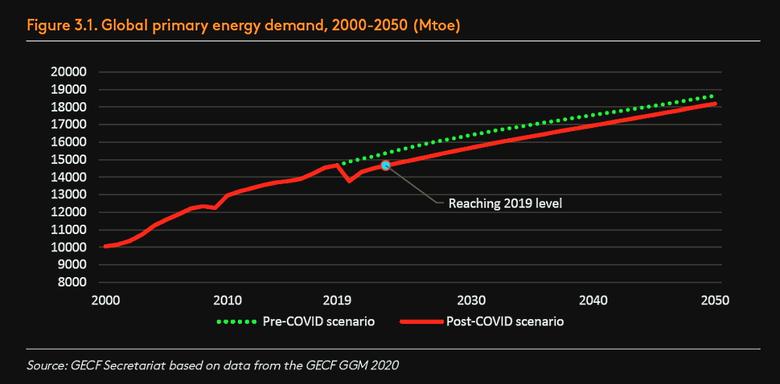

- Global primary energy demand grows by 24% over the Outlook period, returning to its 2019 levels by late 2023, but by 2050 it remains 2.5% lower than our pre-pandemic forecast

- The energy transition is underway, and natural gas together with renewables will gain in importance and will be the major contributors to incremental growth in global energy demand, together accounting for more than 90% of the additional 3,520 Mtoe through to 2050

- Natural gas and renewables will make up 60% of the electricity supply, changing the global power generation mix by 2050

- Natural gas will overtake coal in 2025 and become the largest global primary energy source by 2047, with oil plateauing around 2040 and then beginning its irreversible decline

- Renewables’ share in the global energy mix rises from 2% in 2019 to 10% in 2050

- Natural gas demand will rise by 50%, reaching 5,920 bcm in 2050, and will expand specifically across the Asia Pacific, North America and Middle Eastern markets, which together will provide more than 75% of additional gas volumes through to 2050

- Asia Pacific region, given its enormous potential, will become the largest gas consumer, doubling its consumption to 1,660 bcm by 2050

Natural gas supply

- Global natural gas production is forecast to grow by around 1,900 bcm to reach more than 5,900 bcm by 2050

- In Asia-Pacific, only China, Australia and India are expected to significantly expand production. Total Asia-Pacific production growth to 2050 is forecast to be 224 bcm

- In North America, all three countries (the US, Canada and Mexico) are expected to increase their production. Total production is expected to grow by 560 bcm to reach 1,670 bcm by 2050

- Gas production in Eurasia is expected to increase by almost 40%, amounting to just under 1,300 bcm by 2050

- Middle East gas production is expected to rise to 1,150 bcm by 2050

- Europe’s downward trend is expected to continue with production falling from over 200 bcm in 2019 to around 70 bcm in 2050

- Africa will grow from 250 bcm (6.4% of global production) in 2019 to around 600 bcm (just over 10% of global supply) by 2050

- Natural gas production in Latin America is expected to increase by over 110 bcm to reach 280 bcm by 2050

Gas trade and investment

- The share of traded LNG will increase to approximately 48% of all traded gas in 2030 and 56% in 2050, respectively

- LNG regasification from existing, under construction, potential, proposed, stalled and speculative projects is expected to be around 1,398 mtpa

- It is projected that over the Outlook period, 1,990 bcm out of around 5,920 bcm global natural gas demand will be imported, including 1,105 bcm from the GECF Member Countries (or more than half)

- Total gas investment (including upstream and midstream activities) between 2020 and 2050 will reach a cumulative US$10 trillion

Energy-related CO2 emissions

- The impact of COVID-19 in 2020 is estimated to have led to around a 7% reduction in global energy-related CO2 emissions

- In the GECF Global Gas Outlook 2050’s reference case scenario (RCS), emissions grow moderately until 2030 before stabilising and plateauing at around 33.7 GtCO2 over the 2030-2050 period.

- Natural gas will contribute the least to emissions by 2050 (32%), despite its higher role in the hydrocarbons mix (39%), while coal will still account for a high share (33%)

- The GECF Global Gas Outlook 2050’s carbon mitigation scenario (CMS) outlines the potential to mitigate emissions by 6.8 GtCO2 in 2050 with an increasing penetration of gas and renewables

- These two fuels are set to increase their shares to 14% and 30%, respectively, by 2050, from 10% and 28% in the RCS

GLOBAL GAS OUTLOOK 2050 full PDF version

-----

Earlier: