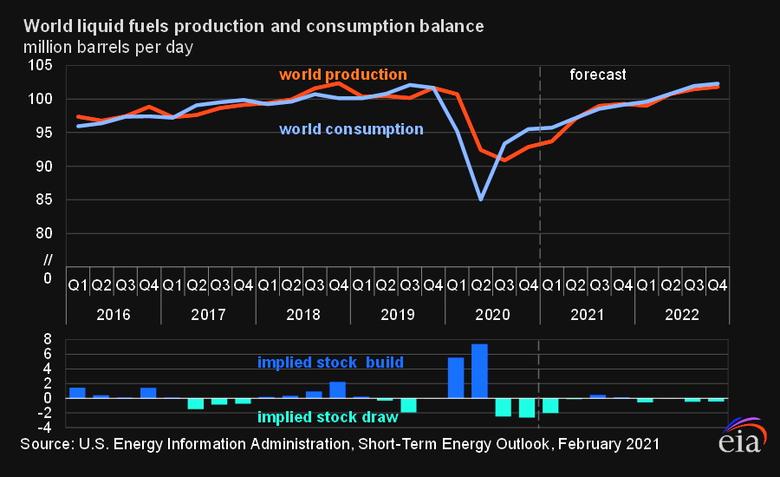

GLOBAL OIL DEMAND WILL UP TO 99 MBD

PLATTS - 02 Mar 2021 - Abu Dhabi National Oil Co., the UAE's biggest energy producer, expects oil demand to be "robust" and crude consumption to return to pre-COVID-19 levels by the end 2021 amid economic recoveries in key oil importers such as India and China, its CEO said March 2.

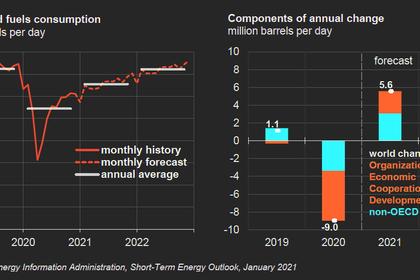

Sultan al-Jaber, who estimated current global consumption is hovering around 94 million-95 million b/d, expressed optimism in the economic recovery in China, India and the US.

"We expect it [oil consumption] to rise to above pre-COVID levels by the end of this year," Jaber told the CERAWeek by IHS Markit conference. "While we remain and we should remain very cautious, there is in fact good reason for optimism and positivity."

His comments echoed that of Saudi Aramco CEO Amin Nasser, who told the conference that he saw current demand of 94 million b/d, rising to 99 million b/d in 2022.

The remarks come two days before OPEC and its allies are scheduled to meet online to decide on production quotas for April. The UAE has previously pushed the OPEC+ alliance to relax its quotas more quickly to recapture market share, running into opposition from Saudi Arabia, which has favored a more constrained approach on production to prevent oil prices from backsliding.

The alliance is currently cutting a combined 7.2 million b/d of crude production and under the rules of its agreement can shrink the cuts by up to 500,000 b/d each month as the global economy recovers.

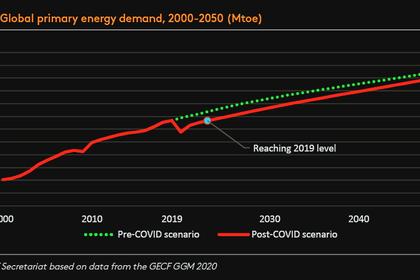

Beyond the pandemic, ADNOC is also bullish about long-term demand for oil and gas and expects to benefit from through its "low-cost, low-carbon" production, Jaber added.

"In order for us to remain competitive and to ensure the sustainability of our businesses in such market dynamics, we must continue to do everything we can to keep lowering our cost," Jaber said.

"We also understand that the world will still need oil and gas for many decades to come. There is no question about that."

Energy transition

ADNOC plans to boost its oil production capacity by 25% to 5 million b/d by 2030 despite the slump in oil prices and global trends in energy transition.

At the same time, ADNOC has pledged to lower its carbon intensity by 25% by 2030.

Carbon capture and storage and utilization can be a game changer for the oil and gas industry, Jaber said.

"There is no credible way of reaching global climate goals without seriously advancing and ensuring the wide spread adoption of CCS," Jaber said.

Currently, ADNOC has the ability to capture 800,000 tons/yr of CO2 from Emirates Steel and inject it into its reservoirs.

ADNOC is also on track to expand its CCUS capacity at least five-fold to 5 million tons/yr of CO2 by 2030 through capturing emissions from its own gas plants. The company's Shah gas plant has the potential to enable the capture of 2.4 million tons/yr of CO2, while the Habshan and Bab plants could enable the capture of almost 2 million tons/yr of CO2.

-----

Earlier: