NUCLEAR POWER COMPETITIVENESS

SA - March 9, 2021 - Nuclear power faces a wobbly future 10 years after an earthquake and tsunami triggered a triple reactor meltdown at the Fukushima Daiichi plant in Japan. But the industry’s unstable footing has less to do with the Fukushima accident—and more to do with how a natural gas glut and the rise of renewable power have transformed the global energy landscape.

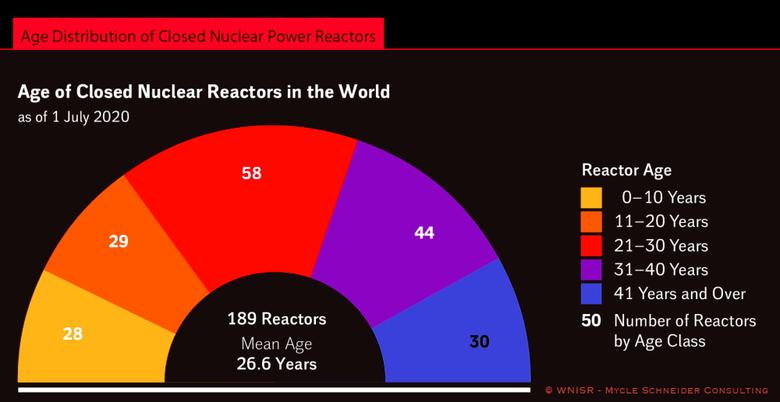

Fukushima has certainly left its mark on the nuclear industry. When the Tohoku earthquake and tsunami occurred on March 11, 2011, there were 54 nuclear reactors in Japan. Since then about a third of them have been permanently shut down, and only nine have resumed operation. “In Japan, [the accident is] still an outsize event,” says Edwin Lyman, director of nuclear power safety at the Union of Concerned Scientists. “It not only had direct and indirect environmental consequences that they’re still dealing with—and a price tag of hundreds of billions of dollars to clean it up—but also it shattered the confidence of the Japanese people in nuclear power, which the authorities had always assured them was totally safe.”

Additionally, the accident spurred regulatory reviews of nuclear power worldwide and accelerated a preexisting plan in Germany to completely phase out nuclear power by the end of 2022. Other countries, including Spain, Belgium and Switzerland, are in the process of doing so within the next 14 years.

By comparison, no U.S. nuclear reactors shut down for precautionary reasons in the wake of Fukushima. Four months after the disaster, a Nuclear Regulatory Commission (NRC) task force issued a report recommending updates to the regulatory standards for protecting U.S. nuclear plants against earthquakes and floods. But NRC commissioners voted against adopting a draft rule requiring extra measures to be taken against such hazards in a split decision in 2019.

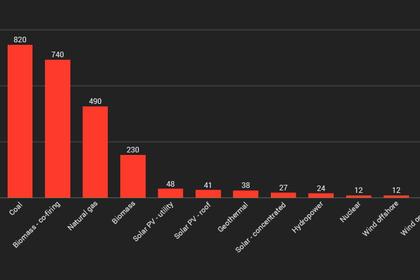

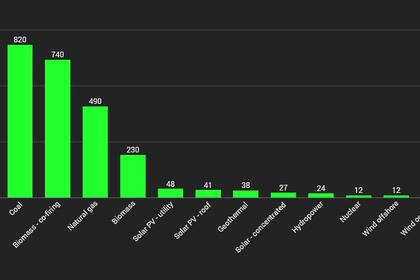

Instead of fear, activism or political oversight, what has profoundly weakened the outlook for nuclear power is a shift in the economics of electricity generation that favors cheaper natural gas and renewables, such as wind and solar energy. But nuclear power advocates—and some environmentalists—still see nuclear power as a cornerstone of clean-energy policies meant to address climate change. And they tout a new generation of nuclear reactors designed to be safer and perhaps more cost-competitive.

“We certainly can and should be investing in absolutely everything until we get to net-zero [carbon emissions],” says Josh Freed, senior vice president of the climate and energy program at Third Way, a public policy think tank based in Washington, D.C.

The U.S. still leads the world in nuclear energy output by a large margin, followed by France, China, Russia and South Korea. But two out of every three nuclear power reactors worldwide are scheduled for retirement in the foreseeable future, and new construction seems unlikely to replace all of them. For the handful of new U.S. nuclear power projects now being built, high up-front price tags have often been compounded by cost overruns and project delays. After a five-year delay, the first of two new reactors at the Vogtle nuclear power plant in Georgia is scheduled to begin commercial operation in November 2021. The project’s original cost estimate doubled to $28 billion.

Beyond the capital investment required to build them, nuclear power plants also have considerable expenses associated with their lifetime operations—including the storage and disposal of radioactive waste. “Nuclear energy is too expensive, more than twice as expensive as renewable energies,” says Claudia Kemfert, an energy economist at the German Institute for Economic Research in Berlin. “The costs of final waste disposal and the dismantling of nuclear power plants are already gigantic.”

Given existing trends, nuclear power’s share of U.S. electricity generation could fall from about 19 percent in 2020 to just 11 percent by 2050, according to the U.S. Energy Information Administration. “The decrease of U.S. nuclear power generating capacity is a result of historically low natural gas prices, limited growth in electricity demand, and increasing competition from renewable energy,” wrote Suparna Ray, a survey statistician at EIA, in a recent article on the agency’s Web site.

Globally, the International Atomic Energy Agency estimates that nuclear power’s share of electricity production could fall from 10 percent to 6 percent by 2050 if current market, technology and resource trends continue. If there is any growth, most would likely come from countries, such as Russia and China, where the national government subsidizes nuclear power for domestic electricity generation and exports reactor technology abroad. “The so-called nuclear renaissance is a myth,” Kemfert says “Only a few countries are building new nuclear power plants with huge subsidies.”

Still, nuclear power currently represents just more than half of all low-carbon electricity generation in the U.S. and 30 percent of the world’s low-carbon electricity. Government officials in countries such as the U.K., France—and even Japan—have argued that maintaining nuclear power is necessary to meeting national and international goals for reducing carbon emissions that contribute to climate change.

“We may very well look back at this year, and the next several years, as the determining moment of whether nuclear really does play the role that we think it needs to for climate—or whether it falls by the wayside,” Third Way’s Freed says.

The U.S. government is still investing in nuclear power with considerable bipartisan support among Republicans and Democrats. Under both the Obama and Trump administrations, the U.S. Department of Energy provided up to $12 billion in federal loan guarantees for the construction of the Vogtle plant reactors in Georgia. The DOE has also teamed up with companies to develop small modular nuclear reactors, which have a far less extensive physical footprint than the standard one-gigawatt nuclear plants and would more flexibly provide power on the order of tens or hundreds of megawatts. The new small reactors could potentially offer lower costs and faster assembly-line manufacturing of components. And they could be designed for stronger protection against the risk of a reactor meltdown.

The DOE’s Idaho National Laboratory has partnered with a company called NuScale Power to demonstrate the U.S.’s first small modular nuclear reactor by 2029. The lab is also investigating how both new and existing reactors could use their steam and electricity output to produce hydrogen—a possible green energy source for electricity generation and vehicles. Heat from the reactors could also enable seawater desalination through evaporation and condensation.

“It’s not just about bringing advanced reactors to market. Sustaining the current fleet is hugely important to meeting these decarbonization goals,” says Shannon Bragg-Sitton, a nuclear engineer and lead of Integrated Energy Systems at the Idaho National Laboratory.

Meanwhile five existing nuclear reactors in Illinois and New York State are scheduled to shut down in large part because of the unfavorable economics. If these plans proceed as scheduled, 2021 would set a record for the most annual nuclear capacity retirements in the U.S.

The nation’s government could offer production tax credits or impose clean-energy standards that mandate a certain amount of power come from nuclear sources. But it is unclear why clean-energy policies should prioritize supporting nuclear power over cheaper renewable power if the main goal is to promote low-carbon electricity generation, says Gregory Jaczko, who was chair of the NRC in 2009–2012. He points out that a more neutral clean-energy policy, such as carbon pricing, would favor cheaper renewables over nuclear power.

“If you do carbon pricing, all you do is make it even easier for renewables to compete with gas,” Jaczko says, “because that’s where the race is: between renewables and gas.”

The pace of nuclear technologies’ progress could also be a factor in clean-energy strategies turning away from such power generation. Small modular reactors, along with other experimental designs, are not expected to begin commercial operations (or even testing) until the 2030s at the earliest, according to the DOE. This suggests that small reactors are unlikely to make a meaningful difference in reducing carbon emissions within the next 20 years. And at that point, they will have to compete in a future energy landscape that has been transformed even further by cheaper renewables and energy-storage technologies.

“One imagines that solar will be more ingrained and cheaper, wind may be more ingrained and cheaper, the offshore wind will be developed, maybe batteries will be better developed, and storage will be better developed,” says Allison Macfarlane, who was chair of the NRC in 2012–2014. “That’s the market nuclear will have to compete in.”

-----

Earlier: