OIL DEMAND WILL UP

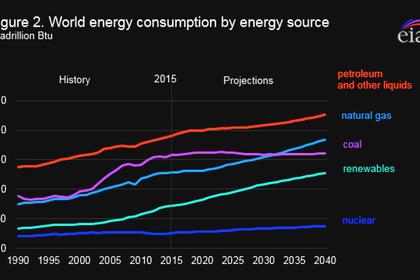

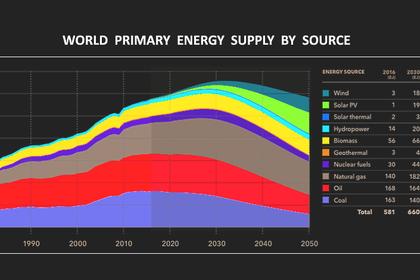

REUTERS - MARCH 1, 2021 - Oil company executives at CERAWeek by IHS Markit were adamant on Monday that crude demand will rise over the coming decade and that the fossil fuel will remain a crucial part of the energy mix even as renewables draw increasing attention.

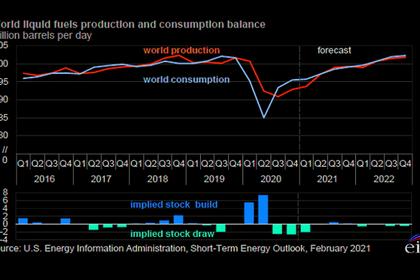

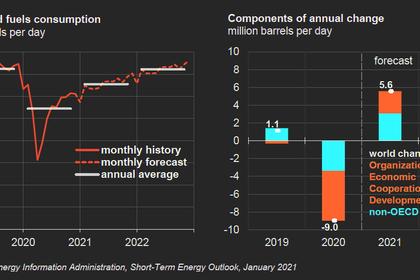

Climate change and renewable fuels are taking center stage at this year’s gathering of energy leaders, investors and politicians from around the globe, with oil companies trying to reorient their portfolios after the coronavirus pandemic eroded demand and caused the loss of thousands of jobs.

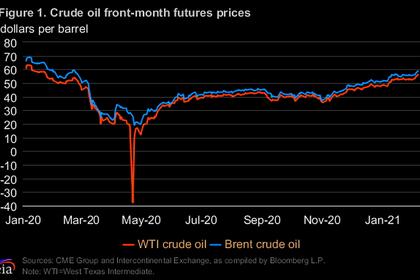

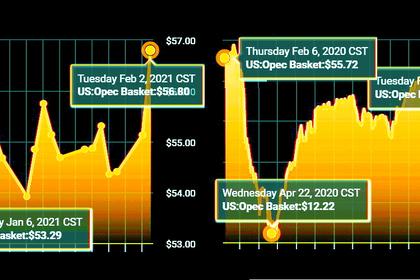

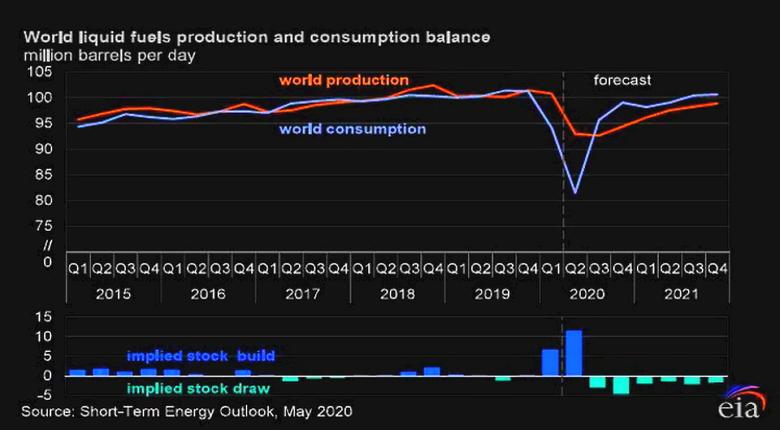

The industry scaled back investments and cut budgets as prices crashed in 2020, but investments are likely to rebound by next year, said Lorenzo Simonelli, chief executive officer of oil services company Baker Hughes.

“Hydrocarbons are still going to be essential for providing energy to the world,” Simonelli said. “Especially as you look at the near-term future.”

Oil demand may continue to climb over the next decade even as countries work to comply with the Paris climate agreement’s goals for cutting emissions, said Hess Corp CEO John Hess.

“We don’t think peak oil is around the corner - we see oil demand growing for the next 10 years,” said Hess.

“We’re not investing enough to grow oil and gas in the future,” he said, saying that prices would need to rise to support that investment.

An emphasis on renewable investment could trigger an oil price spike, Maynard Holt, CEO of investment bank Tudor, Pickering, Holt & Co, told a panel.

“The possibility that the world pulls a California is really high: you take the ball off of affordability and reliability and have a crunch,” Holt said, referring to California’s electricity shortage from 2000 to 2001.

United Airlines CEO Scott Kirby was similarly bullish, saying he expects business travel to return, boosting the demand for jet fuel.

Jet fuel is likely to be a continued source of demand for fossil fuels. While renewable jet fuel has been formulated, it is still available at a high premium to conventional fossil fuel, making it less commercially viable, said Microsoft co-founder Bill Gates, a top buyer of renewable jet fuel.

-----

Earlier: