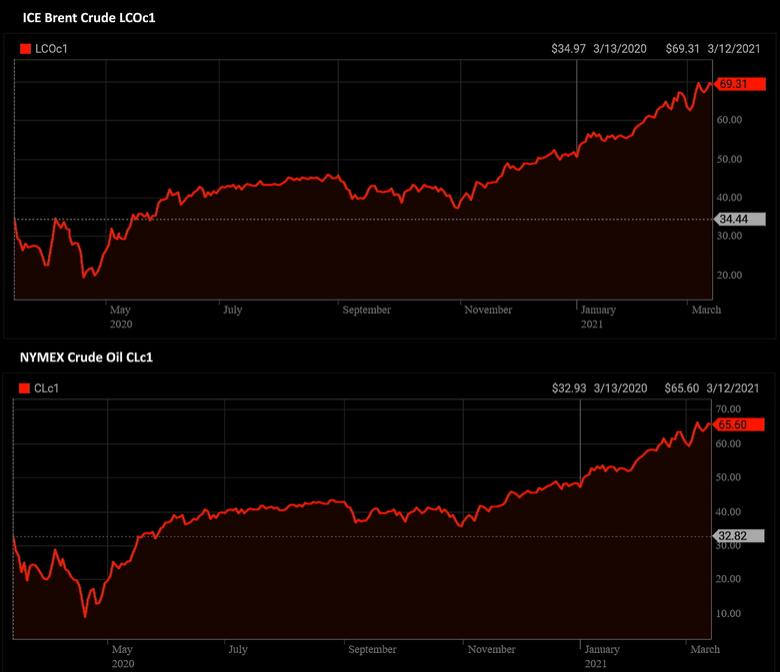

OIL PRICE: ABOVE $69

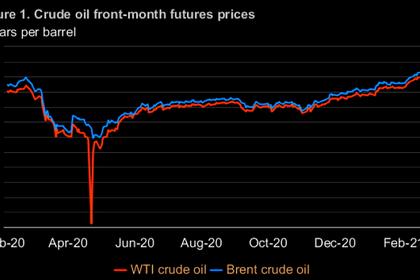

REUTERS - MARCH 12, 2021 - Brent crude prices eased on Friday but hovered near $70 a barrel as production cuts by major oil producers constrained supply, with optimism about a recovery in demand for the resource in the second half of the year also lending support.

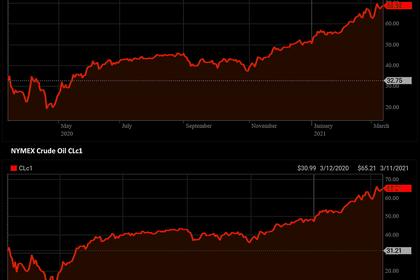

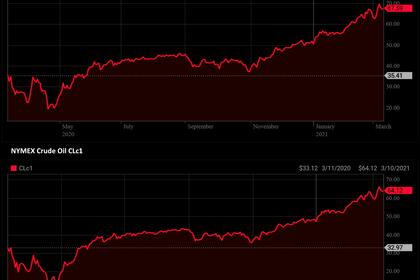

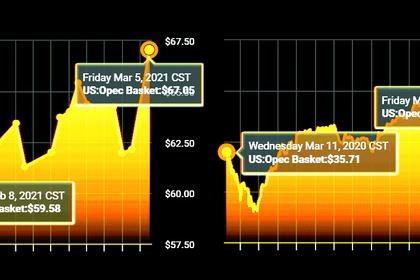

Brent crude futures for May slipped 33 cents, or 0.5%, to $69.30 a barrel by 0749 GMT while U.S. West Texas Intermediate crude for April was at $65.65 a barrel, down 37 cents, or 0.6%.

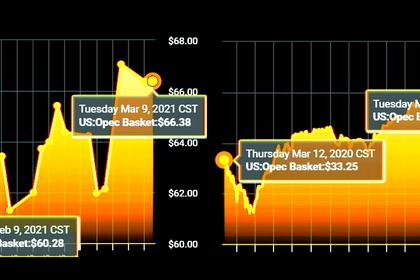

After seven straight weeks of gains, front-month Brent could close this week little changed as investors took profit after prices touched a 13-month high on Monday following attacks on Saudi Arabian oil facilities.

Sentiment was also buoyed by the decision of the Organization of Petroleum Exporting Countries (OPEC) and its allies, a group known as OPEC+, earlier this month to largely hold production cuts in April.

Investors have been pumping funds into commodities such as oil on expectations of a demand recovery in the second half of the year as the global economy grows, while a wider rollout of vaccines against the COVID-19 pandemic allows more people to travel this summer.

“Assuming vaccination programmes are successful, we expect pent-up demand for gasoline to be released this summer during the U.S. and European driving season,” FGE analysts said in a note.

RBC Capital analysts said the fundamentals for summer gasoline is the most bullish in nearly a decade.

“We think this will support the entire oil complex this summer and beyond.”

OPEC said on Thursday a recovery in oil demand will be focused on the second half of the year.

The United States, world’s largest oil consumer, saw a massive draw on U.S. gasoline stocks last week as the winter storm in Texas disrupted refining output.

Oil prices sustained at higher levels are expected to draw U.S. producers to increase output, JP Morgan analysts said in a weekly note.

“At current prices, most U.S. onshore operators are economic, leaving a vast group of operators, from large public companies to private players, in good position to ramp up activity in 2H21 and build solid momentum for higher volumes in 2022,” JP Morgan said.

The bank now expects U.S. crude oil production to average 11.78 million barrels per day (bpd) in December 2021, up 710,000 bpd annually, with the full year volume to average 11.36 million bpd compared with 11.32 million bpd in 2020.

-----

Earlier: