OIL PRICES 2021-22: $58-$59

U.S. EIA - March 9, 2021 - SHORT-TERM ENERGY OUTLOOK

Forecast Highlights

Global liquid fuels

The March Short-Term Energy Outlook (STEO) remains subject to heightened levels of uncertainty because responses to COVID-19 continue to evolve. Reduced economic activity related to the COVID-19 pandemic has caused changes in energy demand and supply during the past year and will continue to affect these patterns in the future. U.S. gross domestic product (GDP) declined by 3.5% in 2020 from 2019 levels. This STEO assumes U.S. GDP will grow by 5.5% in 2021 and by 4.2% in 2022, compared with an assumption of 3.8% in 2021 and 4.2% in 2022 in last month’s STEO. The U.S. macroeconomic assumptions in this outlook are based on forecasts by IHS Markit.

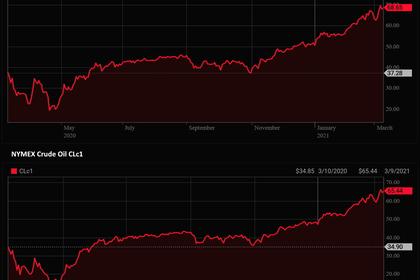

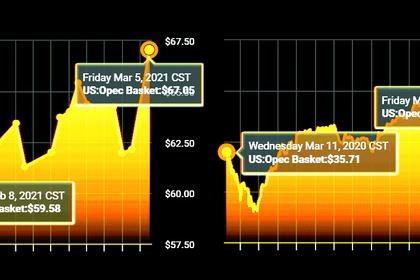

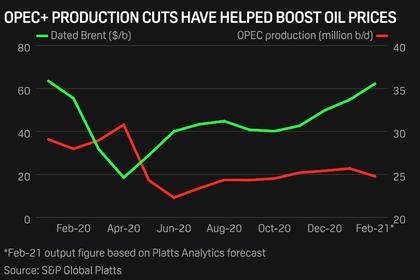

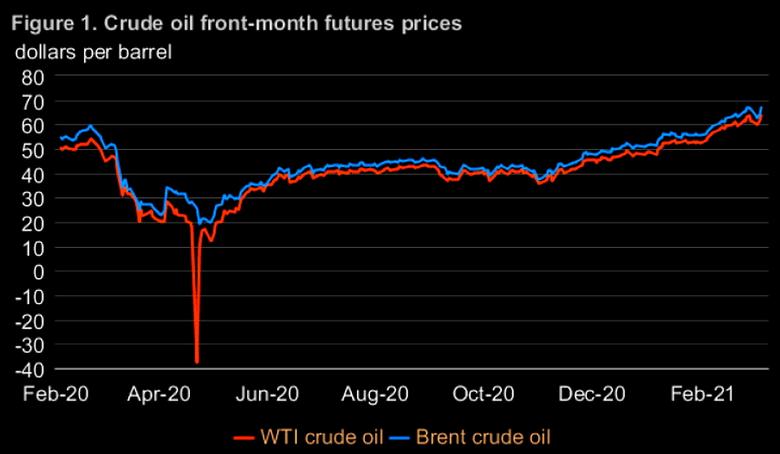

Brent crude oil spot prices averaged $62 per barrel (b) in February, up $8/b from January’s average and up $7/b from February 2020. Rising Brent prices in February continued to reflect expectations of rising oil demand as both COVID-19 vaccination rates and global economic activity have increased, combined with ongoing petroleum supply limitations by the Organization of the Petroleum Exporting Countries (OPEC) and partner countries (OPEC+). In addition, disruptions to petroleum supply from extreme winter weather in the United States (notably in Texas) put upward pressure on crude oil prices during February.

The U.S. Energy Information Administration (EIA) expects OPEC crude oil production will average 25.3 million barrels per day (b/d) in April, which is similar to expected production for March and down 1.6 million b/d from EIA’s forecast for April OPEC production in last month’s STEO. EIA expects OPEC crude oil production will rise to 26.6 million b/d in May. This increase reflects Saudi Arabia ending voluntary cuts of 1.0 million b/d, along with the relaxation of cuts that were extended through April at the March 4 OPEC+ meeting. This forecast assumes OPEC will produce 27.9 million b/d on average in the second half of 2021, as OPEC+ generally increases crude oil output to supply rising global oil consumption.

The OPEC+ extension of existing supply cuts through April added significantly to near-term upward oil price pressures. Following the meeting, the Brent crude oil spot price settled at $67/b on March 4, up 4% from the day before. EIA expects Brent prices will average between $65-$70/b during March and April, more than $10/b above EIA’s expectation last month. EIA continues to expect downward crude oil price pressures will emerge in the coming months as the oil market becomes more balanced. Brent crude oil prices in the forecast average $58/b in the second half of 2021.

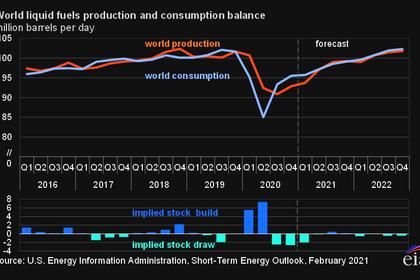

EIA’s forecast of declining crude oil prices and a more balanced oil market reflect global oil supply surpassing oil demand during the second half of 2021. Although EIA expects inventories to fall by 1.2 million b/d in the first half of 2021, increases in global oil supply will contribute to inventories rising by almost 0.4 million b/d in the second half of 2021 and a mostly balanced market in 2022. However, the forecast depends heavily on future production decisions by OPEC+, the responsiveness of U.S. tight oil production to higher oil prices, and the pace of oil demand growth, among other factors. EIA expects Brent prices will average $59/b in 2022.

EIA estimates that the world consumed 95.9 million b/d of petroleum and liquid fuels in February, which is down 1.6 million b/d from February 2020. If confirmed by final consumption data, the 1.6 million b/d decline would represent the smallest year-over-year decline since the COVID-19 outbreak began affecting oil consumption in January 2020. EIA forecasts that global consumption of petroleum and liquid fuels will average 97.5 million b/d for all of 2021, which is up by 5.3 million b/d from 2020. EIA forecasts that consumption will increase by another 3.8 million b/d in 2022 to average 101.3 million b/d.

EIA estimates that U.S. crude oil production averaged 10.4 million b/d in February, which is down 0.5 million b/d from estimated January production. Most of the decline reflects the cold temperatures that affected much of the country, particularly Texas. Unlike the relatively winterized oil production infrastructure in northern areas of the country, infrastructure in Texas, such as wellheads, gathering lines, and processing facilities, are more susceptible to the effects of extremely cold weather. Following the freeze-offs, EIA forecasts crude oil production will rise to almost 11.0 million b/d in March. EIA expects U.S. crude oil production will average 11.1 million b/d in 2021 and 12.0 million b/d in 2022. In 2020, production averaged 11.3 million b/d, down from 12.2 million b/d in 2019. EIA’s current forecast for U.S. crude oil production in 2022 is 0.5 million b/d higher than in last month’s STEO because of higher expected crude oil prices.

Natural Gas

In February, the Henry Hub natural gas spot price averaged $5.35 per million British thermal units (MMBtu), which was up from the January average of $2.71/MMBtu and the highest nominal monthly average Henry Hub spot price since February 2014. Higher prices in February reflect increased demand for natural gas because of much colder-than-normal temperatures throughout most of the country. Price effects were amplified because the rise in demand occurred amid a drop in natural gas production due to well freeze-offs. EIA expects Henry Hub spot prices to decline to an average of $2.88/MMBtu in the second quarter of 2021. EIA expects that Henry Hub spot prices will average $3.14/MMBtu in 2021, which is up from the 2020 average of $2.03/MMBtu. EIA expects that continued growth in liquefied natural gas (LNG) exports, along with relatively flat production, will contribute to Henry Hub spot prices rising to an average of $3.16/MMBtu in 2022.

EIA expects that U.S. consumption of natural gas will average 82.5 billion cubic feet per day (Bcf/d) in 2021, down 0.9% from 2020. The decline in U.S. natural gas consumption reflects less natural gas consumed for electric power generation because of higher natural gas prices compared with last year. In 2021, EIA expects residential natural gas consumption to average 13.1 Bcf/d (up 0.4 Bcf/d from 2020) and commercial consumption to average 9.3 Bcf/d (up 0.7 Bcf/d from 2020). EIA forecasts industrial consumption will average 23.8 Bcf/d in 2021 (up 1.3 Bcf/d from 2020) as a result of increasing manufacturing activity amid a recovering economy. EIA estimates that total natural gas consumption in February was the highest on record, at 111.8 Bcf/d, because cold weather affected much of the United States and increased natural gas demand for heating and power generation. However, EIA expects natural gas consumption in March to decline from February levels as temperatures return closer to normal, based on forecasts by the National Oceanic and Atmospheric Administration. EIA expects U.S. natural gas consumption will average 81.6 Bcf/d in 2022.

The United States ended October 2020 with more than 3.9 trillion cubic feet (Tcf) in working natural gas storage, 5% more than the 2015–19 average and the fourth-highest end-of-October level on record. EIA estimates that inventory withdrawals were 829 billion cubic feet (Bcf) in February, the largest February withdrawal on record. The February 2021 withdrawal was significantly larger than the five-year (2016–20) average February withdrawal of 452 Bcf. In mid-February, the combination of strong natural gas demand and lower production led to the second-largest weekly storage withdrawal on record, including a record weekly withdrawal of 156 Bcf in the South Central region, which includes Texas. The large February withdrawal has resulted in end-of-month storage levels falling lower than their five-year average. EIA forecasts that natural gas inventories will end March 2021 at 1.6 Tcf, which is 13% lower than the five-year average. EIA forecasts that natural gas inventories will ultimately end the 2021 injection season (end of October) at almost 3.7 Tcf, which is 2% less than the five-year average.

EIA forecasts that U.S. production of dry natural gas averaged 87.8 Bcf/d in February, which is down from 92.4 Bcf/d in December (the most recent month that has final data). The decline in natural gas production was mostly a result of freeze-offs, which occur when water and other liquids in the raw natural gas stream freeze at the wellhead or in natural gas gathering lines near production activities. Unlike the relatively winterized natural gas production infrastructure in northern areas of the country, natural gas production infrastructure, such as wellheads, gathering lines, and processing facilities, in Texas are more susceptible to the effects of extremely cold weather. For 2021, EIA expects that overall dry natural gas production will average 91.4 Bcf/d, which is 0.9 Bcf/d more than the February STEO forecast. The higher forecast largely reflects higher forecast crude oil prices, which EIA expects will contribute to more associated natural gas production.

In February, U.S. LNG exports averaged 7.5 Bcf/d, a 2.3 Bcf/d (23%) decline from January. LNG exports were affected by the logistical constraints associated with suspending piloting services on several days at some U.S. LNG export ports located in the Gulf of Mexico because of inclement weather. In addition, several U.S. LNG export facilities (including Freeport, Cameron, and Corpus Christi) experienced lower natural gas feedstock supply in mid-February following declines in natural gas production because of extremely cold weather. EIA expects U.S. LNG exports to continue their seasonal decline from March through May, averaging 7.8 Bcf/d in this period.

Electricity, coal, renewables, and emissions

EIA forecasts that electricity consumption in the United States will increase by 2.1% in 2021 after it fell 3.8% in 2020. EIA forecasts residential sector retail electricity sales will grow by 2.7% in 2021. This increase is primarily a result of colder temperatures in the first quarter of 2021 compared with the same period in 2020. Despite rolling power outages in Texas and some other states in February, estimated U.S. residential consumption during the first quarter of 2021 is 10% higher than at the same time in 2020. EIA expects retail sales of electricity in the commercial and industrial sectors in 2021 will increase by 0.7% and 3.7%, respectively. For 2022, EIA forecasts total electricity consumption will grow by another 1.4%.

EIA expects the share of U.S. electric power generated with natural gas will average 36% in 2021 and 35% in 2022, which is down from 39% in 2020. The forecast natural gas share declines in response to a forecast increase in the price of natural gas delivered to electricity generators from an average of $2.40/MMBtu in 2020 to $3.46/MMBtu in 2021 (a 44% increase). Coal’s forecast share of electricity generation averages 23% in both 2021 and 2022, up from 20% in 2020. Electricity generation from renewable energy sources rises from 20% in 2020 to 21% in 2021 and to 23% in 2022. The nuclear share of U.S. generation declines from 21% in 2020 to 20% in 2021 and to 19% in 2022.

EIA expects U.S. coal production to total 581 MMst in 2021, 42 MMst (8%) more than in 2020. In 2022, EIA expects coal production to rise by a further 29 MMst (5%). Recent extreme cold weather in much of the country contributed to an increase in coal use for power generation. EIA expects that coal use for power generation will increase by 16% to 505 MMst in 2021. Supply for rising coal-fired generation will be partly met by draws from on-site stockpiles at power plants.

EIA estimates that U.S. energy-related carbon dioxide (CO2) emissions decreased by 11% in 2020. This decline in emissions was the result of less energy consumption related to economic contraction resulting from the COVID-19 pandemic. In 2021, EIA forecasts energy-related CO2 emissions will increase by about 6% from the 2020 level as economic activity increases and leads to rising energy use. EIA also expects energy-related CO2 emissions to rise in 2022, but by a slower rate of 2%. EIA forecasts coal-related CO2 emissions will rise by 14% in 2021 and by 2% in 2022.

-----

Earlier: