OIL PRICES RISKS

PLATTS - Russia views a potential oil output increase by producers that are not part of the OPEC+ agreement as one of the uncertainties that prevail in the global market amid higher prices and falling inventories, deputy prime minister Alexander Novak said March 10.

Novak shared his concerns presenting the results of the most recent OPEC+ meeting held last week to President Vladimir Putin. Russia was granted permission to increase oil production by 130,000 b/d in April, while other OPEC+ countries, except for Kazakhstan, would hold production at January levels.

"As uncertainty, we note a possible increase in production by countries that are not members of OPEC+, as a result of rising prices," Novak said at the meeting with Putin, who praised his "efficient work" protecting Russia's share in the market.

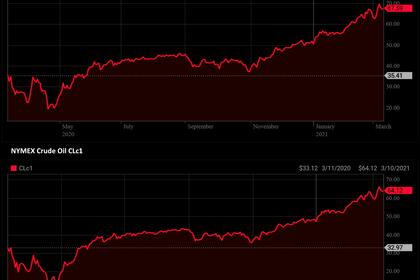

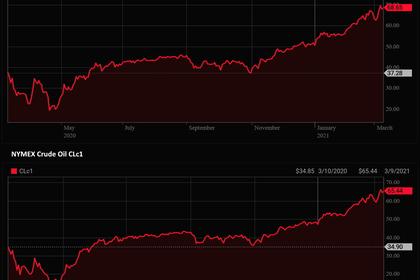

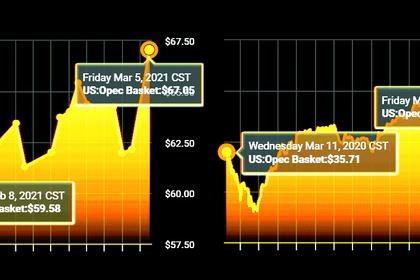

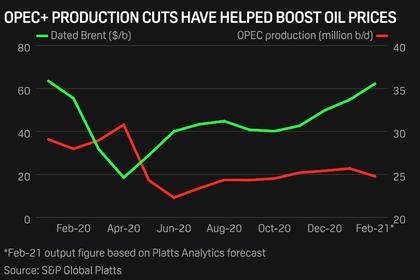

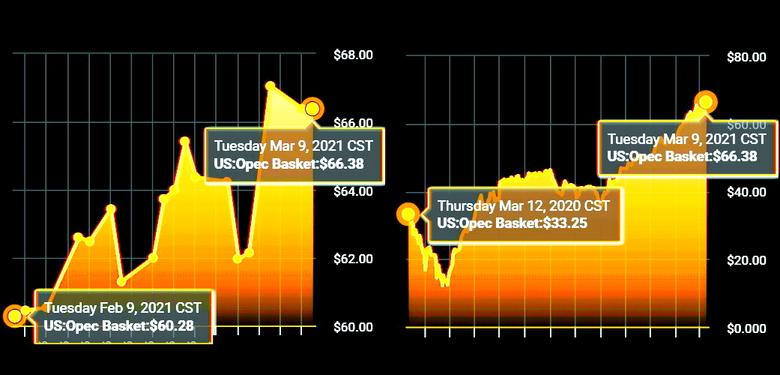

Brent averaged $60/b since the beginning of the year and was trading at $68/b earlier in the day, he noted.

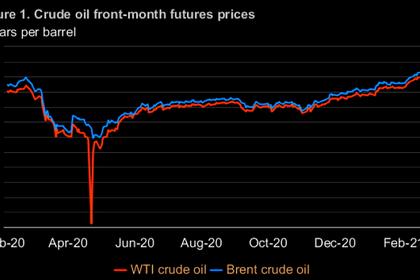

Since May 2020, when output levels were most severely hit by the coronavirus pandemic and OPEC+ quotas, Russia itself managed to recover output by 890,000 b/d, according to Novak.

"This is 45% of the maximum level of reduction, which was in May-June last year. We will restore almost half of production already in April," he said.

In February, Russia produced 38.56 million mt of crude and condensate, equivalent to around 10.1 million b/d, according to the ministry data.

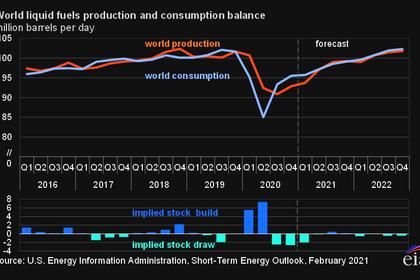

Global oil supply deficit stood at 1 million-2 million b/d, which continued to contribute to oil inventories dropping to 140 million barrels above the five-year average, Novak said.

"This is approximately 70 to 100 days to the five-year average level and then we can assume that the market has recovered," Novak said.

Russia estimates oil demand to increase by 5.5 million b/d in 2021, while full recovery is expected only in 2022, according to the energy ministry's data.

-----

Earlier: