OPTIMISTIC OPEC

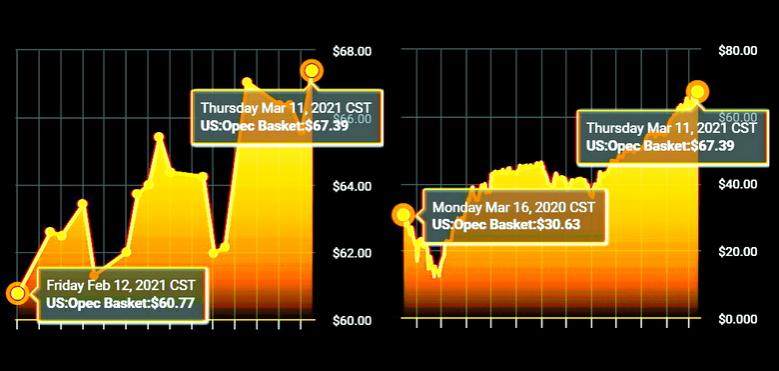

PLATTS - 11 Mar 2021 - Global oil demand will rebound strongly in the second half of 2021, but the call on OPEC crude will be lower than previously expected, the producer group's latest analysis showed, providing some backing for Saudi Arabia's decision not to relax its output cuts through April.

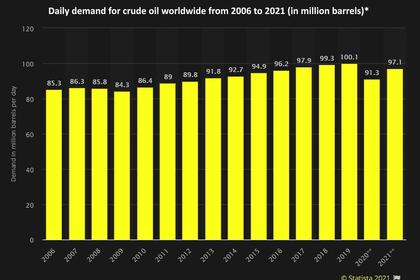

In its closely watched Monthly Oil Market Report released March 11, OPEC revised up its forecast of 2021 oil demand by 220,000 b/d to 96.27 million b/d, but said the recovery would be backloaded in the second half of the year, after disappointing data in Q1.

Estimates for Q3 and Q4 were raised by 400,000 b/d and 970,000 b/d, respectively, while Q1 and Q2 were lowered by 180,000 b/d and 310,000 b/d.

"Oil demand in 2H21 is adjusted higher, reflecting expectations for a stronger economic recovery with the positive impact of vaccination rollouts," OPEC said in the report. "Oil requirements in 1H21 are adjusted lower, mainly due to extended measures to control COVID-19 in many key parts of Europe. In addition, elevated unemployment rates in the US slowed the recovery process."

With non-OPEC supply forecast to bounce back by 950,000 b/d in 2021 to 63.8 million b/d, OPEC lowered the estimated demand for its crude by 240,000 b/d to 27.26 million b/d.

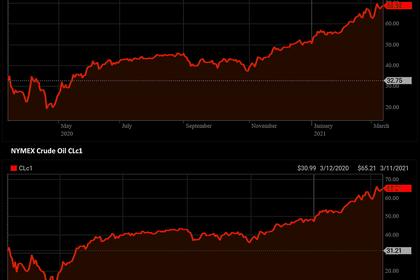

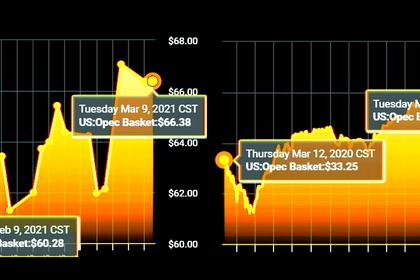

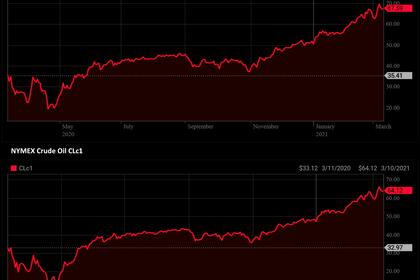

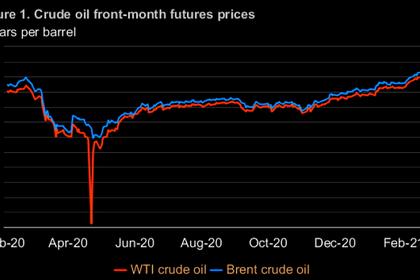

The report was released a week after OPEC and its allies decided to mostly rollover their production cuts through April, despite warnings from some analysts and consuming countries that the market was overtightening and prices were rising too quickly, while the world is still recovering from the coronavirus pandemic.

Saudi Energy Minister Prince Abdulaziz bin Salman prevailed on his counterparts to maintain production discipline, with seasonal refinery maintenance ahead and global oil inventories still elevated compared to the 2015-2019 average that the alliance is aiming for.

OECD commercial oil inventories in January declined to 3.052 billion barrels, or 92.2 million barrels above the five-year average, the lowest since May 2020, the OPEC report showed.

OPEC pumped an average of 24.85 million b/d in February, according to secondary sources used by the organization to track output.

Keeping production below the call will help OPEC and its allies induce draws from storage.

According to the agreement, the OPEC+ alliance will largely maintain its quotas, with Russia allowed a 130,000 b/d increase and Kazakhstan a 20,000 b/d rise, while Saudi Arabia said it would continue implementing its voluntary cut of 1 million b/d through April.

The kingdom, which is the largest member of OPEC, fulfilled almost all of its pledge, self-reporting February crude production of 8.147 million b/d, while secondary sources estimated 8.15 million b/d. That is about 970,000 b/d below its quota.

-----

Earlier: