SAUDI ARAMCO NET INCOME $49 BLN

SAUDI ARAMCO - Dhahran, Saudi Arabia, March 21, 2021 – The Saudi Arabian Oil Company (“Aramco” or “the Company”) today announced its full-year 2020 results, demonstrating exceptional resilience despite the macroeconomic impact of COVID-19 and delivering on its intended dividend payments to shareholders.

Commenting on the results, Aramco President & CEO Amin H. Nasser, said:

“In one of the most challenging years in recent history, Aramco demonstrated its unique value proposition through its considerable financial and operational agility. Our exceptional performance during such testing times owed much to the unwavering spirit and resilience of our employees, who set operational records and continued to meet the world’s energy needs both safely and reliably.

“As the enormous impact of COVID-19 was felt throughout the global economy, we intensified our strong emphasis on capital and operational efficiencies. As a result, our financial position remained robust and we declared a dividend of $75 billion for 2020.

“At the same time, the accelerated deployment of digital technologies across the company significantly enhanced our performance and we continued to make progress on breakthrough low-carbon solutions.

“Looking ahead, our long-term strategy to optimize our oil and gas portfolio is on track and, as the macro environment improves, we are seeing a pick-up in demand in Asia and also positive signs elsewhere. We remain confident that we will emerge on the other side of this pandemic in a position of strength.”

Financial Highlights

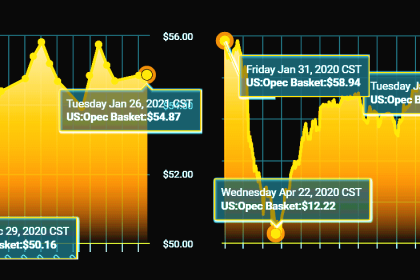

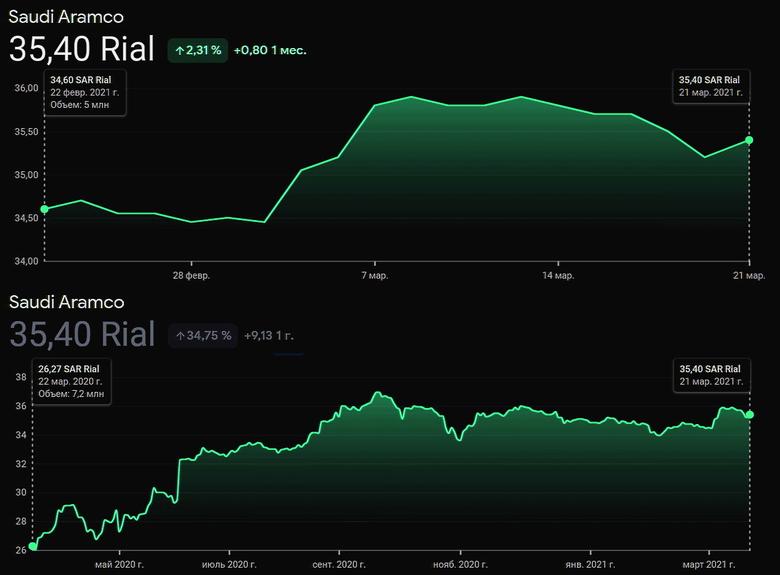

Aramco achieved a net income of $49 billion in 2020, one of the highest earnings of any public company globally. The Company displayed strong financial resilience in one of the most challenging periods for the industry, during which revenues were impacted by lower crude oil prices and volumes sold, and weakened refining and chemicals margins.

Aramco declared a dividend of $75 billion for the year, which reflects the outcome of the Company’s strong performance. The Company continues to preserve a strong balance sheet and its gearing ratio at December 31, 2020, was among the lowest in its industry. Meanwhile, its ROACE of 13.2% was the highest in the industry.

Through its flexible capital program and prudent financial management, the Company was able to adjust spending and focus on high-return opportunities. Capital expenditure in 2020 was $27 billion due to the implementation of optimization and efficiency programs, representing a significant saving on capital expenditure of $33 billion in 2019.

The Company continues to assess its capital expenditure and efficiency programs, and expects capital expenditure for 2021 to be around $35 billion, significantly lower than the previous guidance of $40-$45 billion.

Aramco’s international bond issuance in the fourth quarter achieved record demand for a 50-year tranche and was 10 times oversubscribed compared to its initial offering size. This global investor interest demonstrated market confidence in the Company’s long-term strategy and performance outlook.

Operational Highlights

In 2020, Aramco’s average hydrocarbon production was 12.4 million barrels per day of oil equivalent, including 9.2 million barrels per day (mmbpd) of crude oil.

In April, Aramco achieved the highest single day crude oil production in its history of 12.1 million barrels per day. The Company achieved another milestone in August, producing a single-day record of 10.7 billion standard cubic feet per day (bscfd) of natural gas from its conventional and unconventional fields. Both records were achieved despite lower capital expenditure in 2020.

Aramco continued its strong track record of supply reliability, despite disruptions caused by COVID-19, by delivering crude oil and other products with 99.9% reliability in 2020.

Aramco’s ambition to further expand its downstream business took a significant step forward with the acquisition of a majority stake in SABIC in June, transforming the Company into a major global petrochemical player with operations in more than 50 countries. In 2020, Aramco also announced a Downstream reorganization intended to maximize value from its global network of assets.

Technology and innovation are key to delivering more energy with fewer emissions. Aramco continued to make advances in cutting-edge technology and received a company record of 683 U.S. patents in 2020 - among the highest in its industry.

Aramco maintained one of the lowest upstream carbon footprints in the industry, achieving an estimated upstream carbon intensity of 10.5 Kg of CO2 per barrel of oil equivalent in 2020. The Company’s estimated upstream methane intensity was 0.06%. These accomplishments are the result of the Company’s decades-long reservoir management and production approach, which includes leveraging advanced technologies and minimizing emissions and flaring.

The Company is well positioned to capitalize on developments in hydrogen, given the Company’s scale, infrastructure, low costs and low upstream carbon intensity.

One promising area is the conversion of hydrocarbons to hydrogen and then to ammonia, while capturing the CO2 created during the process. In August, Aramco exported the world’s first shipment of high-grade blue ammonia to Japan for use in zero-carbon power generation, a significant step towards sustainable hydrogen usage.

In January 2020, Aramco joined the Hydrogen Council as a steering member. The organization promotes collaboration between governments, industry and investors to provide guidance on accelerating the deployment of hydrogen solutions globally.

-----

Earlier: