THE TEXAS FINANCE MESS

By Rakesh Sharma Journalist Freelance Journalist

ENERGYCENTRAL - Mar 3, 2021 - As Texas plunged into darkness last month, its power markets turned to chaos. High power prices and supply disruptions for natural gas played havoc with its grid and pipelines, leaving wide swathes of the state without electricity for several days. The financial repercussions of that chaos are becoming apparent now.

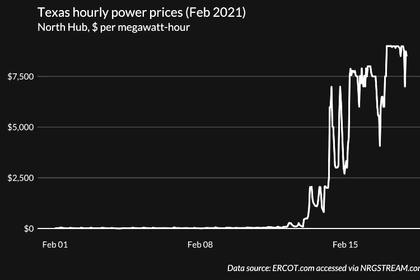

The main culprit of the power outages was surge pricing. Often described as a feature (and not a bug) of Texas’s power markets, surge pricing lasts for a couple of hours each summer to allow grid participants to make money. Last month, $9,000 MW/h power prices lasted for a week and resulted in $51 billion worth of power being sold in Texas’s power markets. Entities participating in the markets hemorrhaged cash all around. The Electricity Reliability Council of Texas (ERCOT) owes money to generators while retail electric providers (REPs) owe it money.

A series of hearings and recent reports detail the extent to which the power crisis, which resulted in a week of high prices at ERCOT, damaged the finances of utilities and regulators alike. It is likely that customers will pay the price of the outages. Whether will they end up with reforming of the Texas power markets, however, is still open to question.

A Cascade of Bills

“The magnitude of money owed (to generators and retail electric providers) is enormous,” ERCOT CEO Bill Magness told lawmakers during hearings yesterday. He said combined payments to generators hit $10 billion one day during the blackouts and $9.5 billion on another. While ERCOT was able to pay back some of the amount, it still owes money - $1.3 billion, according to latest estimates – to generators and utilities. That shortfall is a complicated cascade of bills from utilities and REPs alike.

For example, Denton Municipal Electric claims to have already paid $207 million for the $9,000 MW/h supply of electricity during the outage but it is yet to be paid for the power it generated during the outage. “We are concerned that because of potential bankruptcy of retail providers we will not be paid,” Terry Naulty, Assistant General Manager at the utility told the hearings. The utility also owes $20 million to natural gas providers.

Meanwhile, Brazos Electric, Texas’s largest and oldest co-operative utility, made news by filing for bankruptcy. According to its filing, the utility owes $1.8 billion to ERCOT and $480 million to the Bank of America. The company had revenues of $1 billion and reported $3 billion in assets last year. CPS Energy, San Antonio’s municipal utility, has estimated that it spent $1 billion on purchasing power and gas during the one week of outages. It paid $200 million to ERCOT for surge pricing charges and $800 million to natural gas providers for fuel. CPS reported $2.6 billion in revenues last year.

If all of this didn’t sound bad enough, Texas utilities may also find it difficult to raise money from bond markets. Fitch Rating has placed all 19 Texas utilities in its coverage universe that use ERCOT for a possible downgrade. The ratings agency writes that the outages triggered its concerns “regarding funding requirements and liquidity in the near term, and cost recovery and the potential for increased financial leverage over the medium term for its rated issuers.”

Are Bankruptcies on the Horizon?

Several experts and economists are predicting a wave of bankruptcies in the aftermath of last month’s events. But it is still too early to make such predictions.

Retail electric providers are fighting ERCOT and threatening lawsuits to stave off bankruptcies and their payment obligations from the February fiasco. They claim that prices were “artificially inflated” during the outage. (There is some truth to their claim since the PUCT ordered ERCOT to maintain the maximum price cap to reflect scarcity). The pandemic and a moratorium on electric bill payments have already laid the groundwork for a faceoff between retail electric providers and ERCOT. For example, Patrick Woodson, CEO of ATG Energy, filed a letter with PUCT detailing measures that the agency could take to mitigate the effect of lost revenue. Among them were extension of payment deadlines to TDUs and to ERCOT and the availability of working capital loans to retail electric providers.

This is not the first time that a Texas electric utility has filed for a bankruptcy due to high power prices. As early as 2003, a year after REPs began offering services to Texas customers, Texas Commercial Energy (TCE) ran out of funds after it failed to properly hedge its exposure to high power prices through forward contracts or contracts between generators and utilities that promise power at fixed prices for an extended period, such as 12 to 18 months. In many ways, TCE was the first reported casualty of surge pricing because it ran out of funds during a period of high prices, equal to $990MW/h, that lasted several hours. The problem, at that time, was not with the market’s structure but the absence of sufficient planning for hedges to high prices. Previous bankruptcies of electric utilities have resulted in their restructuring, splitting between generation and distribution entities.

In the near-term, two potential solutions have emerged. The first one is the state “clawing back” some of the costs from power producers who profited from surge pricing. There is precedent for that from 1975, when natural gas provider Lo-Vaca gas utility was forced to honor its cheap contracts to industrial customers by the Texas Railroad Commission. But Dr. Joshua Rhodes, energy researcher at UT-Austin, says it will require political will.

The more probably outcome to the current state of affairs is that customers will end up shouldering most of the bill. After almost two decades of some of the lowest prices for electricity in the country, Texas customers might have to reset their expectations for prices.

-----

This thought leadership article was originally shared with Energy Central's Utility Management Community Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Utility Management Community today and learn from others who work in the industry.

-----

Earlier: