U.S. OIL FOR INDIA UP ANEW

PLATTS - 18 Mar 2021 - India's dramatic surge in US crude inflows has helped the exporter to displace Saudi Arabia for the first time, as refiners queued up for lighter feedstock anticipating robust demand for gasoline and other products, while staying away from Middle Eastern supplies following OPEC-led output cuts.

While the surprise twist in buying pattern -- that saw US crude imports jumping to the second spot in February, from fifth in 2020 -- stems partly from evolving demand trend, analysts told S&P Global Platts, it also signals New Delhi's objection to the surprise production cuts, which has prompted the country to aggressively diversify its import basket.

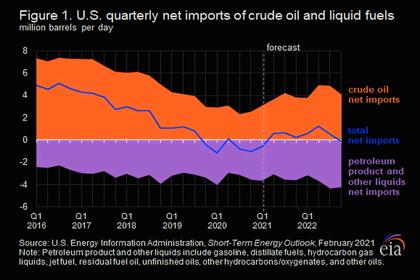

"India's displeasure with rising oil prices in general and Saudi production cuts in particular has created a market opportunity for US crude at a time when US demand is still reeling from the pandemic -- and indeed may be permanently crippled by the wave of refinery closures triggered by COVID-19," said Antoine Halff, adjunct senior research scholar at Columbia University's Center on Global Energy Policy.

"What remains to be seen is whether this marriage of convenience can last and whether Saudi Arabia will willingly cede market place to the US for the longer term," said Halff, who is also the founding partner and chief analyst at Kayrros.

US crude imports by India stood at 12.69 million mt in 2020, up nearly 29% from a year earlier, helping the country move up to fifth position from sixth in 2019, data from GAC Shipping (India) Private Ltd. showed.

But in February, inflows from the US was 2.11 million mt, about 32% higher than 1.61 million mt inflows from Saudi Arabia. This pushed US to the second spot. Iraq retained its position as the top supplier, with shipments of 2.89 million mt in the same month.

A cocktail of factors

"The displacement can be seen a result of a combination of factors, including prevailing oil market dynamics and weaker crude demand in other markets," said Anupama Sen, senior research fellow and executive director at the Oxford Institute for Energy Studies.

"However, it also reflects a longer-term strategic attempt by Indian policymakers to encourage diversification in all imported energy sources, and particularly in oil, especially with higher or rising prices," she added.

Analysts said even though this may not be a permanent trend, it is a signal that Indian refiners are getting increasingly comfortable with US crude.

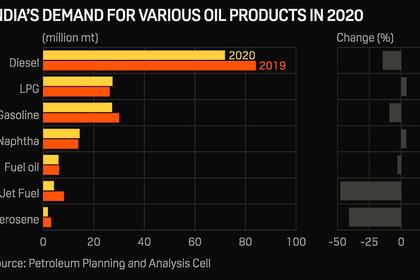

"India's demand for lighter products such as LPG, naphtha and gasoline has been doing a lot better than middle distillates such as gasoil, kerosene and jet fuel. So it made good sense to source light sweet crude from the US, especially as arbitrage economics was viable," said Lim Jit Yang, adviser for oil markets for Asia-Pacific at Platts Analytics.

Gasoline consumption in February fell for the second straight session to 2.435 million mt, down 6.73% on the month and 3.03% on the year, latest data from the Petroleum Planning and Analysis Cell showed. January's consumption snapped a five-month uptrend to fall 3.54% on the month to 2.61 million mt, after demand in December hit a 20-month high of 2.704 million mt.

But looking at the broader recovery trend since late last year, refiners have been booking a lot of US cargoes as gasoline yields from the US crude oil is relatively higher.

"On the flip side, supply cuts from OPEC+ spooked buyers like India and they had to count higher on alternate oil supply sources like the United States. It is also a diversification strategy to avoid any supply shocks and build healthy relations with other key suppliers," said Sumit Pokharna, vice president at Kotak Securities.

Vulnerable to price shocks

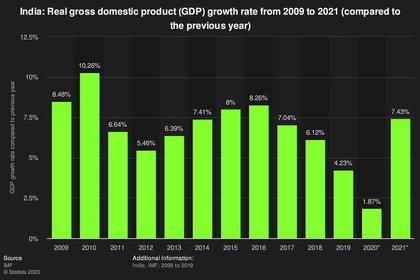

There are expectations that India's demand for middle distillates would rebound strongly, driven by a more broad-based pickup in economic activity amid the vaccination rollout, and it would be more desirable for refiners to turn back to medium-to-heavy grades of crude, Lim added.

However, the recent rebound in oil prices to pre-pandemic levels of over $70 a barrel is already adding to the pain of Asia's oil importers.

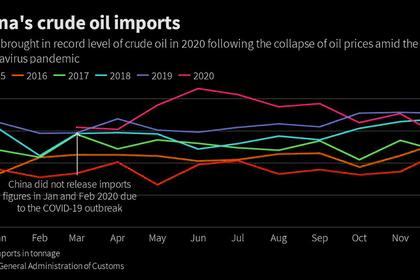

Halff said like China, India had made a strong recovery in refinery demand from COVID-19, but Indian refiners could have done better in taking advantage of last year's low prices while they lasted.

Indian crude stocks are marginally above last year's level at this time of year but below those seen at this time of year in each of the previous three years, and are just four million barrels above their pre-COVID lows, he added.

"While India has successfully achieved some diversification on energy imports in other areas -- for instance with respect to LNG imports by rebalancing its portfolio to include a higher proportion of spot and short-term LNG -- effective longer-term diversification is likely to be a more complex task in relation to managing crude oil imports," Sen said.

-----

Earlier: