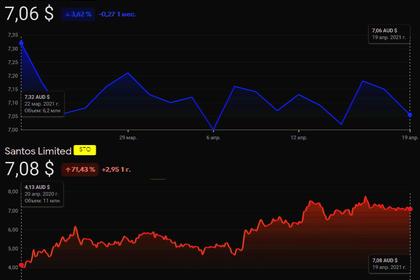

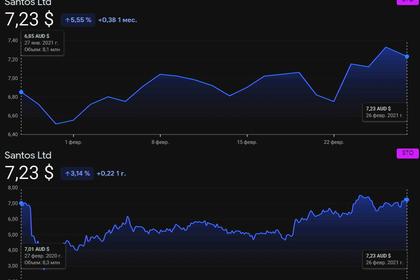

AUSTRALIA'S SANTOS REVENUE $964 MLN

SANTOS - 22 April 2021 - First Quarter Report For period ending 31 March 2021

Strong base business generated US$302 million free cash flow in first quarter

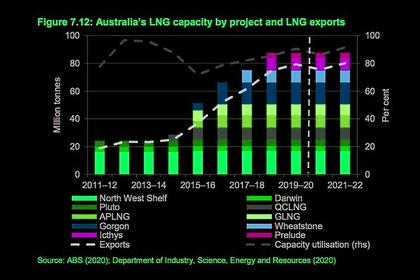

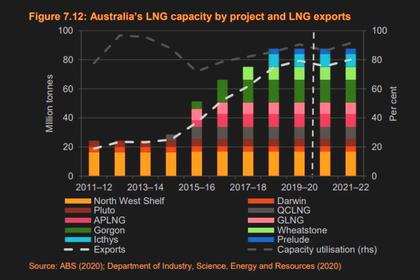

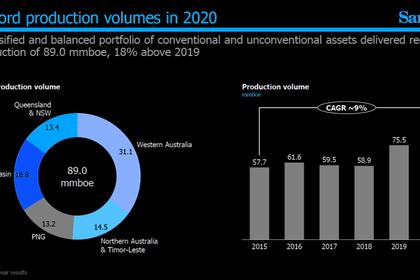

• First quarter production of 24.8 mmboe was 39 per cent above the corresponding quarter in 2020 primarily due to the ConocoPhillips acquisition which completed in May 2020

• Production was 2 per cent lower than the December quarter primarily due to lower domestic gas demand in Western Australia and unplanned maintenance in PNG, offset by strong production from Bayu-Undan

• Higher GLNG equity gas production from the Roma and Arcadia fields supported annualised LNG production of 6.4 mtpa in the quarter

• First quarter revenue of US$964 million was stronger despite the contractual 3-month lag in oil-linked LNG prices and lower overall sales volumes

• Santos generated US$302 million in free cash flow in the first quarter Balance sheet supportive of disciplined and phased growth

Balance sheet supportive of disciplined and phased growth

• Net debt at the end of the first quarter (including leases) was US$3.6 billion after payment of the US$104 million 2020 final dividend and gearing was 33.6 per cent

• S&P Global Ratings reaffirmed Santos’ investment grade credit rating with stable outlook and Fitch Ratings assigned Santos an inaugural BBB rating with stable outlook

• Final investment decision to proceed with the US$3.6 billion gross Barossa gas and condensate project to backfill Darwin LNG and the US$600 million gross Darwin LNG life extension and pipeline tie-in projects

• FEED entry planned in the coming months for the Dorado phase 1 oil project

Energy transition to clean fuels

• Moomba CCS project is FID-ready, subject to eligibility for Australian Carbon Credit Units, with the project having an estimated lifecycle breakeven cost of <US$24 per tonne of CO2

• Concept studies indicate that the production cost of zero-emissions hydrogen produced at Moomba utilising CCS would be below the Australian Government’s target of A$2/kg

Santos Managing Director and Chief Executive Officer Kevin Gallagher said Santos had delivered another strong quarter of production and sales volumes, and strong free cash flow, as the business benefited from higher commodity prices and a low free cash flow breakeven oil price. This was despite the 3-month lag in oil-linked LNG prices, which should see stronger prices in the second quarter.

“Our consistent and successful strategy combined with the disciplined, low-cost operating model continue to drive strong performance across our diversified portfolio. Free cash flow generation of US$302 million in the first quarter demonstrates our diversification and leverage to oil price. We are currently forecasting more than US$1 billion in free cash flow for the year at current oil prices.

“The strategy to grow around our five core asset hubs has not changed since 2016. As we now enter a growth phase

with FID on Barossa, we will remain disciplined in managing our major project costs, consistent with our operating model.

“It is a great achievement to have extended the life of Bayu-Undan following the approval of the infill drilling program

and taken FID on the Barossa project less than a year after we completed the ConocoPhillips acquisition.

“Last December we announced an ambitious roadmap to net-zero emissions by 2040. Our Moomba carbon capture and

storage project is FID-ready, subject to eligibility for Australian Carbon Credit Units. First injection is expected to

commence in 2024 and importantly this project represents a step-change in emission reduction,” Mr Gallagher said.

-----

Earlier: