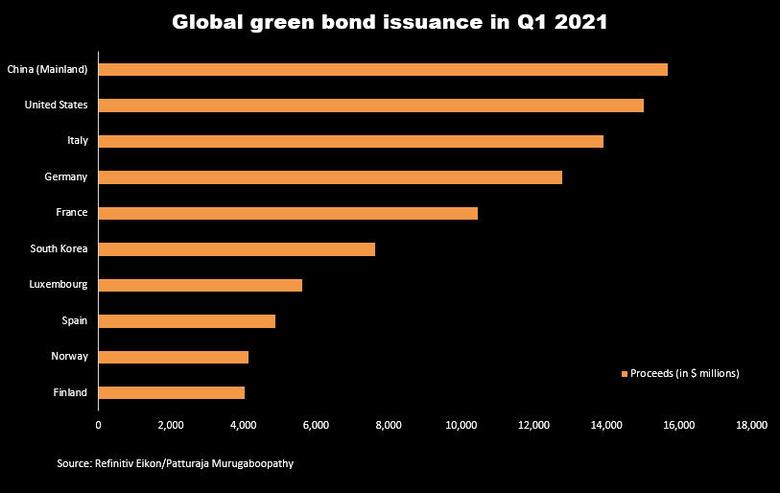

CHINA'S GREEN BONDS $15.7 BLN

REUTERS - APRIL 1, 2021 - China overtook the United States to lead a boom in global green- bond issuance in the first quarter, but analysts said it needs to do more to draw investors to help fund President Xi Jinping’s estimated $21 trillion carbon neutrality pledge.

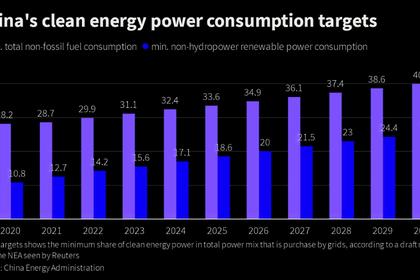

Pending tasks include raising investor awareness of the environment, harmonising fragmented rules and tackling ‘greenwashing’, or issuers’ efforts to inflate their green credentials, they said. At stake is Beijing’s goal of net zero carbon emissions by 2060.

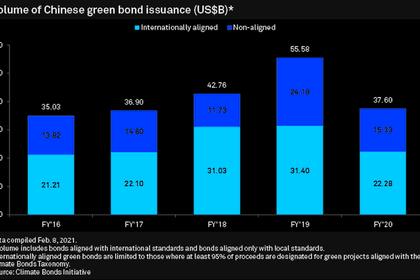

Chinese issuers including banks, property developers, power generators and railway operators sold $15.7 billion of bonds during January-March period to fund ‘green’ projects such as clean and renewable energy, according to Refinitiv data.

The volume of such bonds, mostly yuan-denominated, almost quadrupled from a year earlier, the data showed.

That exceeds the roughly $15 billion of such bonds sold by U.S. issuers in the first quarter, and helped drive a tripling of green bond issuance globally.

Green bonds blossomed “largely thanks to China’s recovery from the coronavirus,” said Nathan Chow, strategist at DBS. “In addition, the Chinese government is going all out to develop this market this year.”

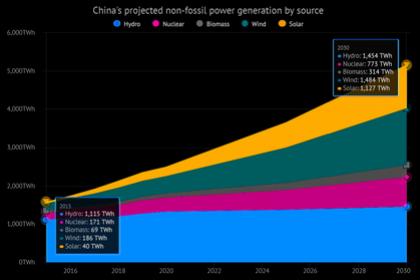

China, the world’s biggest emitter of carbon dioxide, needs 140 trillion yuan ($21.33 trillion) of debt financing over the next 40 years to meet its net-zero emissions target, investment bank China International Capital Corp (CICC) estimates.

With roughly 800 billion yuan of green bonds outstanding, China is already the world’s second-biggest green bond market after the United States. However, green bonds account for less than 1% of China’s $18 trillion bond market.

At this stage, “companies have no cost advantages issuing green bonds... and there’s not enough market support for many green projects which take a long time to complete and are seen as risky,” said CICC economist Zhou Zipeng.

Highlighting such headwinds, China’s first batch of “carbon neutral” bonds, launched in February, met tepid demand.

Several fund managers said green bonds are not yet on their investment radar.

“The only thing Chinese investors currently look at is yield. So obviously if green bonds cannot offer the extra returns, they ask the government, ‘what can you do to help me?’,” said Ricco Zhang, Asia-Pacific director of the International Capital Market Association (ICMA).

A brokerage source said state-owned companies were motivated to issue green bonds to align with government priorities, but investors lacked incentives to buy them.

Authorities are aware of the problems. Earlier this month, Chinese central bank governor Yi Gang called for incentives to boost private participation in meeting Beijing’s carbon goals.

Moving closer to international standards by excluding coal from the green market would widen the potential foreign investor base, Chow of DBS said.

ICMA’s Zhang said regulators also need to harmonise different domestic standards. Currently, China’s central bank, securities regulator and the state planner have separate rules for green bonds issued under their supervision.

“Sometimes it’s hard for international investors to have a granular understanding of different (Chinese) green bonds. This brings challenges for green investors to identify the right target for investment,” he said.

-----

Earlier: