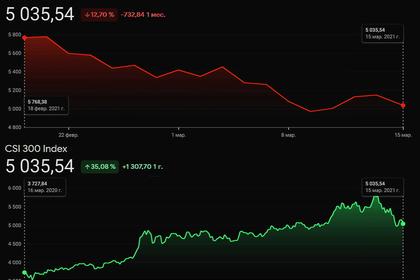

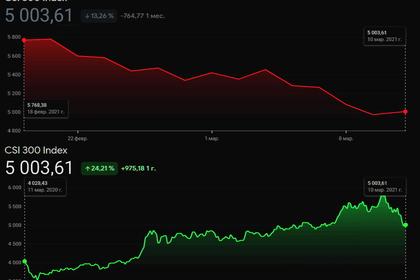

CHINA'S INDEXES DOWN

REUTERS - APRIL 9, 2021 - China stocks ended lower on Friday to post a weekly loss, as robust inflation data raised investor concerns over policy tightening, while Sino-U.S. tensions also weighed on the market.

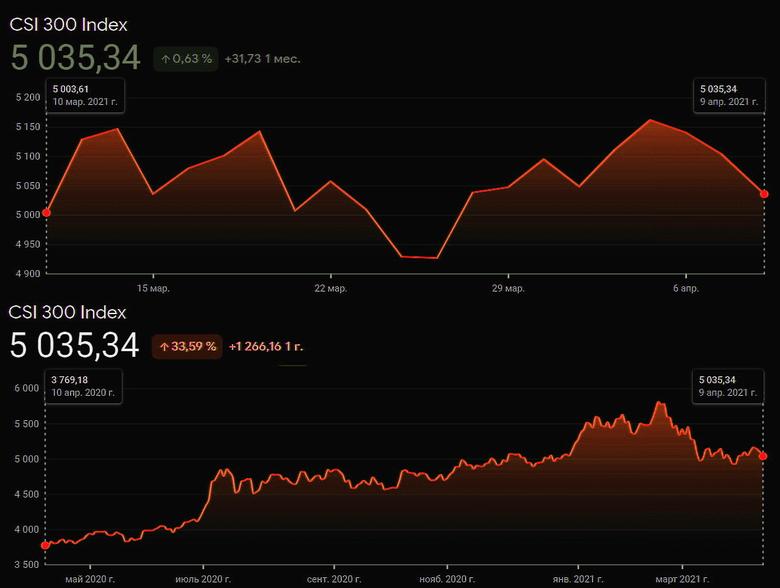

The blue-chip CSI300 index fell 1.5% to 5,035.34, while the Shanghai Composite Index eased 0.9% to 3,450.68.

For the week, CSI300 dropped 2.4%, while the SSEC shed 1%.

China’s factory gate prices rose at their fastest annual pace since July 2018 in March, official data showed on Friday, as growth in the world’s second-largest economy continued to gather momentum.

Recent economic data has been robust, but analysts warn that it could lead to concerns of inflation and policy tightening.

Adding to the downbeat sentiment were decreasing foreign inflows into the A-share market. Foreign investors’ net buying in March totalled 18.7 billion yuan ($2.85 billion), down sharply from 41.2 billion yuan in February.

Hopes of a strong U.S. economic recovery as Biden pushed forward with stimulus packages, lifted the dollar and the U.S. treasury yields, which could siphon away inflows into China, said Zheng Zichun, an analyst with AVIC Securities.

“The northbound inflows into the A-share market could remain positive this year, but would probably slow,” he added.

Sino-U.S. tensions also dampened risk appetite.

Leaders of the U.S. Senate Foreign Relations Committee introduced major legislation on Thursday to boost the country’s ability to push back against China’s expanding global influence by promoting human rights, providing security aid and investing to combat disinformation.

The U.S. Commerce Department said on Thursday that it was adding seven Chinese supercomputing entities to a U.S. economic blacklist for assisting Chinese military efforts.

As stocks remained sluggish, there were signs Chinese investors were shifting to safe-haven money market funds (MMFs).

-----

Earlier: