FRAGILE OIL DEMAND

OPEC - 31 March 2021 - Brief high-level remarks by OPEC Secretary General

Delivered by HE Mohammad Sanusi Barkindo, OPEC Secretary General, at the 28th Meeting of the Joint Ministerial Monitoring Committee (JMMC), 31 March 2021, via videoconference.

Excellencies,

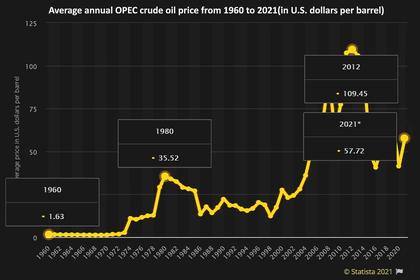

One year ago, we were on the precipice of heading into the dark month of April 2020. It would be a harrowing month for the oil industry, with economies in lockdown, oil demand dropping by more than 20 mb/d and WTI plummeting negative.

The month of April 2020, however, also saw the landmark production adjustments from the Declaration of Cooperation (DoC). The commitment that this group of producers has shown to this decision, with strong conformity to the adjustments, as well as support for the compensation mechanism, has been front and centre in the recovery.

In the first three months of 2021, we have witnessed further positives for the recovery in terms of vaccine rollouts, as well as from fiscal stimulus, most recently the huge $1.9 trillion package in the US.

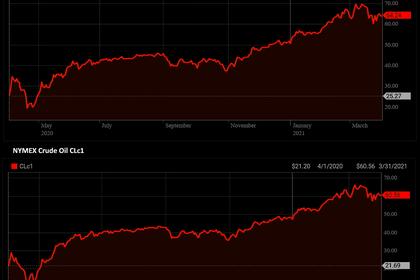

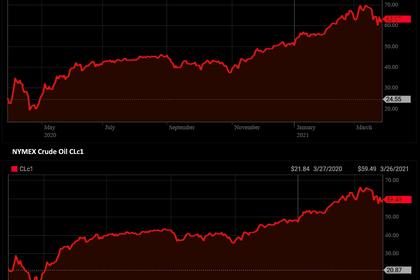

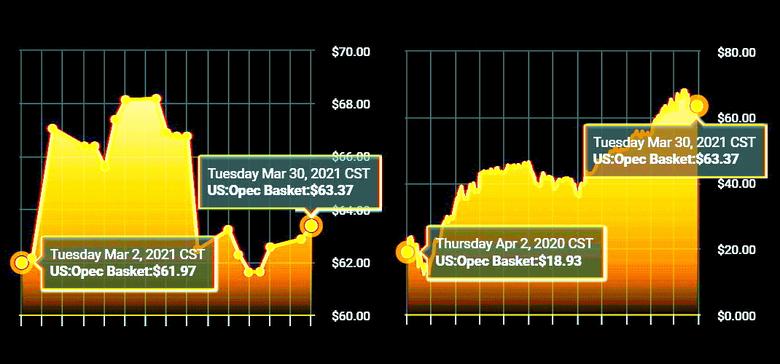

The positives offer hope, but we need to remember that the environment remains challenging, complex and uncertain, with the market volatility we have witnessed in the last two weeks of March a reminder of the fragility facing economies and oil demand.

These monthly meetings are vital for the DoC, and with this in mind, allow me to give you a brief overview of developments in the key metrics since we last met.

Expectations for global economic growth in 2021 are now higher at 5.1%, compared to 4.8% at our last meeting. This positive impetus is driven by the additional US stimulus measures, as well as a continued acceleration in the recovery in Asian economies, although we have recently seen a temporary stalling of the rebound in India.

However, we should not be out smelling the flowers just yet, and this forecast may be revisited. It is surrounded by uncertainties, including the prevalence of COVID-19 variants; the uneven rollout of vaccines; further lockdowns and third waves in several countries; and inflationary pressures and central bank responses.

Moreover, we have also seen crude futures flip into a contango for the first time since mid-January, although they returned again to backwardation as markets digested the blockage of the Suez Canal.

Global oil demand in 2021 is revised slightly to stand at 5.6 mb/d, and we need to keep in mind that demand contracted by a huge 9.6 mb/d in 2020.

There is also a continuing divergence between the first and second half of 2021. The first half has again been adjusted lower, mainly due to extended measures and new lockdowns in many key parts of Europe. In contrast, oil demand prospects in the second half have remained relatively steady, reflecting expectations for a stronger economic recovery and positive impact of vaccination rollouts.

On the supply side, non-OPEC liquids for 2021 is forecast to grow by almost 1 mb/d, compared to expectations of 0.7 mb/d at our last meeting. It is also interesting to note that the US liquids supply forecast remains unchanged, with growth of 0.16 mb/d in 2021.

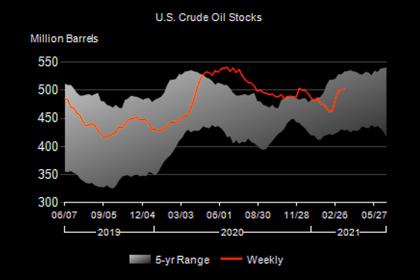

From the perspective of inventories, preliminary data for February 2021 shows a further drawdown of around 45 mb in OECD commercials, following a drop of around 14 mb in January. The February level is 95 mb higher that the same time one year ago, and 58 mb above the average for the period 2015-2019.

It is important to note that the February stock draw is attributed mainly to products, particularly in the US market, as product inventories moved sharply lower on the back of very low refinery runs as a result of severe winter weather.

The realignment of inventories is also been driven by the excellent conformity to the production adjustments from DoC participants, and here we should again acknowledge the large and generous additional commitment of 1 mb/d for February, March and April from the Kingdom of Saudi Arabia.

This leadership, this goal-focused commitment is summed up wisely by Jalāl ad-Dīn Muhammad Rūmī:

“If you want the moon, do not hide from the night; if you want a rose, do not run away from the thorns.”

The guidance and advice from this JMMC, ably supported by the JTC and the OPEC Secretariat, continues to be vital to the DoC decision making process. It is our task again today to review the current situation and provide feedback for tomorrow’s OPEC and non-OPEC Ministerial Meeting as we navigate a course for the rest of the second quarter of 2021 and beyond.

Thank you.

-----

Earlier: