OPEC+ OIL PRODUCTION UP 450 TBD

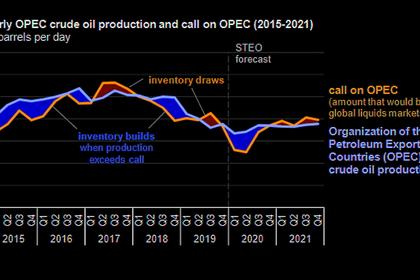

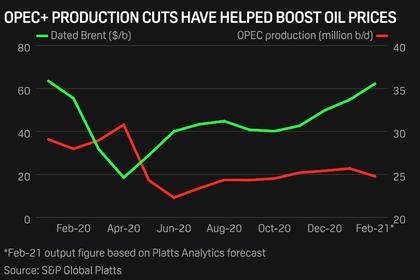

PLATTS - 09 Apr 2021 - Crude oil production from OPEC and its allies rose by 450,000 b/d in March, the latest S&P Global Platts survey found, as Russia and Iraq pumped well above their agreed caps, while quota-exempt members Iran and Libya also boosted output. In Libya's case, its production hit an almost eight-year high.

OPEC's 13 members pumped 25.20 million b/d in March up 340,000 b/d from February, while their nine non-OPEC partners, led by Russia, produced 13.08 million b/d, a rise of 110,000 b/d, the survey found.

With the production gains, OPEC+ compliance with its quotas slipped to 111% in March, compared with 113.5% in February, juiced by Saudi Arabia voluntarily cutting an additional 1 million b/d since January.

Take away the extra Saudi cut, and OPEC+ compliance would drop to 97%, the lowest since August 2020, according to Platts calculations.

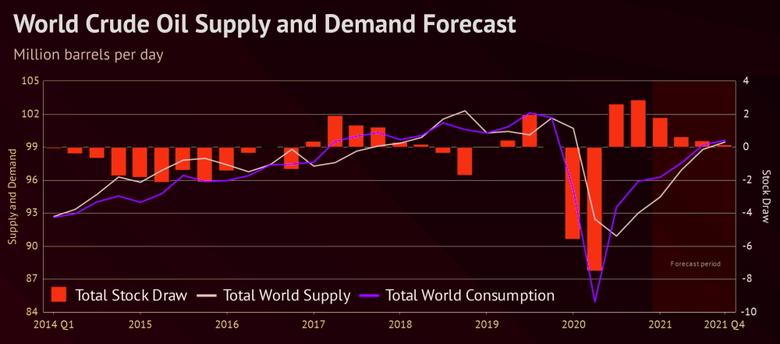

More crude will be coming from the producer alliance over the next few months, with OPEC+ agreeing to ease quotas by 1 million b/d from May to July and Saudi Arabia also unwinding its voluntary cut.

But quota compliance has already proved to be a contentious issue, with Saudi Arabia and other disciplined members expressing frustration at their overproducing counterparts, which are obliged under the OPEC+ deal to implement so-called compensation cuts to make their compliance whole.

Internal OPEC+ figures seen by Platts show Russia already owes the biggest volume of compensation cuts, 806,000 b/d as of February, followed by Iraq at 647,000 b/d.

OPEC+ ministers will meet online April 28 to review their decision to ease quotas.

Divergent paths

Saudi Arabia and Russia -- the group's two largest oil producers – have taken divergent paths with their output in 2021.

Until the most recent OPEC+ meeting on April 1, Saudi Arabia had largely prevailed on the group to maintain a cautious approach in production policy, citing the uncertain outlook for the global economy. In making its extra cut, the kingdom averaged 8.11 million b/d of production in March, its lowest level since June 2020, according to the survey.

Russian compliance, however, slipped to 95% in March as it pumped 9.34 million b/d, about 90,000 higher than its quota, having consistently pushed the alliance to chase market share. This is Russia's highest production since April 2020 when the alliance engaged in a brief price war after a breakdown in talks over pandemic strategy.

Fellow Gulf producers UAE and Kuwait kept their output unchanged, the survey found, largely in line with their March allocations.

Return of Iran, Libya

March's boost was largely attributed to ramp-ups by Iran and Libya -- both of which remain exempt from the current cuts.

Iran pumped 2.30 million b/d last month, a rise of 160,000 b/d from February, and its highest production since August 2019.

Emboldened by the softer approach of President Joe Biden's administration in the US, the sanctions-hit country is starting to turn the taps on at its southern oil fields and boosting exports to key customer China, market sources said.

Indirect talks between the US and Iran on restoring the nuclear deal started April 6 on a positive note, raising the potential of some sort of sanctions relief, though the process may take some time.

Libya's production recovery continued to gather pace, supported by the formation of an interim Government of National Unity.

The North African producer pumped 1.19 million b/d in March, its highest since June 2013, the survey found.

State-owned National Oil Corp. is planning to pump 1.45 million b/d by the end of 2021, as some eastern oil fields resume production.

Libya's oil sector has been wrecked recently by civil war, militant unrest, and terrorist attacks, but the recent political progress bodes well for the country.

However, its success may soon find it subject to an OPEC+ quota, as officials from the alliance have said they are likely to ask the country to submit to one when its production stabilizes at pre-war levels.

Iraq, Nigeria exceed quotas

Iraqi compliance fell to 88% in March, as it produced 3.95 million b/d, an increase of 60,000 b/d from the previous month.

Despite a fall in exports, its crude inventories grew, survey panelists said. The March figure is almost 90,000 b/d above its OPEC+ production quota of 3.857 million b/d.

Nigeria, which had also recently improved its compliance, saw a steady rise in its March exports.

Nigeria produced 1.57 million b/d last month, a 30,000 b/d rise from February, and 70,000 b/d above its quota.

Meanwhile, Angolan crude output recovered to 1.16 million b/d in March after its production had slumped to a 16-year low in February.

The Platts figures are compiled by surveying oil industry officials, traders, and analysts, as well as reviewing proprietary shipping, satellite and inventory data.

Notes: On April 1, OPEC and its allies decided to unwind their production cuts from May onwards and add more than 2 million b/d into the market by July.

The OPEC+ alliance will raise its collective output caps by 350,000 b/d in May, another 350,000 b/d in June, and 441,000 b/d in July.

Saudi Arabia, which has been cutting an extra 1 million b/d on top of its quota to help bolster the market, will unwind it by 250,000 b/d in May, 350,000 b/d in June and 400,000 b/d in July.

The OPEC+ coalition's next formal meeting is April 28.

The cuts are mostly determined from an October 2018 baseline production level, except for Russia and Saudi Arabia, which were given baselines of 11 million b/d. OPEC members Iran, Libya and Venezuela are exempt from the deal.

The S&P Global Platts OPEC survey, which has been published since 1988, measures wellhead crude oil production in each member country. In 2020, Platts began estimating production from the non-OPEC members of the OPEC+ alliance.

-----

Earlier: