RELIABILITY OF RUSSIAN GAS

PLATTS - 31 Mar 2021 - Russia is set to remain the dominant gas supplier to Europe up to 2040, according to the latest long-term European gas outlook from S&P Global Platts Analytics.

Russia's market share in Europe is expected to remain above 30%, rising close to 40% by 2040, as domestic European gas production and supplies from Norway dwindle.

The share of global LNG supplies in Europe's energy mix is expected to increase to 2040 to partly offset the decline in indigenous output, but still lags Russian deliveries throughout the forecast period.

In the report, Platts Analytics said Russian pipeline gas supply to northwest, central and eastern Europe, and Italy would rise from around 130 Bcm/year in 2020 to around 150 Bcm/year by 2040.

"By 2035 we expect a record Russia market share of 38%," it said.

The EU has made it a policy pledge to reduce dependence on Russian gas through support for new supply sources -- such as from Azerbaijan -- and through new LNG import infrastructure.

However, Russian gas remains competitive for European buyers given its low-cost production base and long-term reliability.

Norwegian piped gas supply to Europe, meanwhile, is seen gradually falling to around 100 Bcm by 2025 from around 110 Bcm/year at present, and then more quickly, dropping to just 60 Bcm by 2040, according to the report, due to natural field decline.

LNG supplies to Europe are expected to pick up by 2025 to around 90 Bcm, and peaking in 2030 at some 130 Bcm, before dropping back to 100 Bcm in 2040.

China pivot

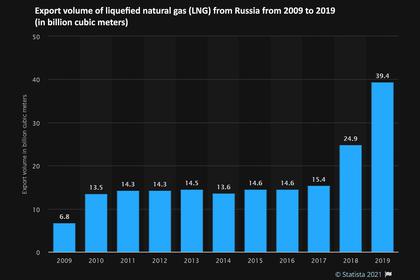

Russian gas output, meanwhile, is expected to grow significantly as Moscow also increasingly targets exports to China and focuses on building out its LNG export capacity.

Total Russian gas production is forecast to increase from around 650 Bcm/year in 2020 to 750 Bcm/year by 2025 and further to 810 Bcm/year by 2040, Platts Analytics said.

"Overall, Russian gas exports will grow significantly, from 240 Bcm/year in 2020 to around 390 Bcm/year in 2040," it said.

Of the increase in production to 2040, 65 Bcm/year will supply LNG projects, with an equal amount of supply being exported to China.

Gazprom began gas exports to China via the Power of Siberia pipeline in December 2019 and plans to ramp up to its 38 Bcm/year capacity in the coming years.

China is seen as a growing market for Russian pipeline gas, especially against the background of the accelerating energy transition in Europe.

"Reluctance in Europe to increase dependence on Russian gas and demand risk from the energy transition provide a strong incentive for Russia to diversify its export portfolio," Platts Analytics said.

The Power of Siberia 2 pipeline via Mongolia with a planned capacity of 50 Bcm/year would connect the Yamal region, currently supplying Europe directly, with the growing Chinese demand and could come online in the second half of the decade, it said.

"The Power of Siberia 2 pipeline would see Europe in direct competition with China for gas, while providing Gazprom with insurance against energy transition demand risk in Europe," it said.

A large proportion of Russian output growth will come from the Yamal Peninsula, Platts Analytics said, where increased production from the Bovanenkovo field and other smaller fields is expected to significantly outpace the decline of fields coming to the end their lifetimes such as Yamburg.

The Yamal Peninsula's estimated total gas reserves are assumed at around 26.5 Tcm, and Gazprom alone expects to ultimately produce 360 Bcm/year out of the region.

This production base is closer to the Nord Stream corridor to Europe. Platts Analytics said it expects Nord Stream 2 to be completed in 2022, adding a further 55 Bcm/year export capacity to Europe.

European demand uncertainty

While Russia is expected to continue its dominance on the European market, the outlook for European gas demand generally remains uncertain.

Platts Analytics forecasts that demand for gas in the more mature markets of northwest Europe will decline by 50 Bcm/year by 2040.

"The drivers for this drop are remaining heating efficiency gains potential, electrification, and renewables generation growth displacing baseload gas-for-power demand," it said.

The biggest drop is in residential demand, while industrial gas sector consumption is expected to see a smaller drop because of challenges in electrification.

Hydrogen -- including blue hydrogen made using natural gas – could also open new sectors to gas demand, including steel production, it said.

The steepest percentage fall in demand, though, is expected in the power sector as the EU looks to reduce carbon emissions by 55% by 2030 compared to 1990 levels.

Platts Analytics said it was also forecasting strong growth in both green hydrogen and biomethane production.

"We assume that together these will account for 10% of gas demand by 2040," it said.

Blue hydrogen, hydrogen produced from natural gas with carbon capture and storage may see substantial upside because of its lower cost compared to green hydrogen.

However, it said, "political momentum for this has yet to emerge."

-----

Earlier: