RUSSIA'S OIL WILL UP

PLATTS - 14 Apr 2021 - Russia's revised oil strategy will focus on maximizing monetization from crude exports before hitting peak production in 2027-2029 and seeing world demand drop, according to a draft document on the development of the sector up to 2035 being reviewed by the State Duma and set to be approved by the government April 22.

"The main thesis in this strategy is the monetization of current reserves and resources -- that is, the maximum monetization of exports," Pavel Zavalny, head of the energy committee at the Duma, said at the presentation of the document April 14.

"Everything that can be produced should be produced while there is still demand to sell it," he added.

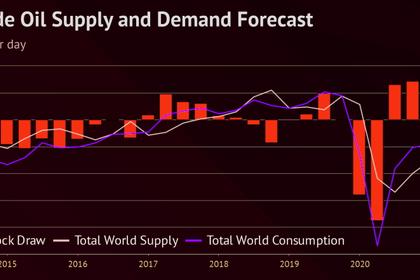

The draft document, which is prepared by the energy ministry and revised annually, takes into account the consequences of the ongoing pandemic, as well as accelerated decarbonization trends globally, which may cause world oil demand to peak earlier than 2030.

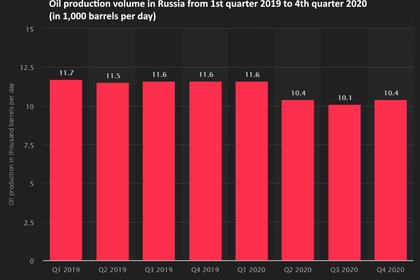

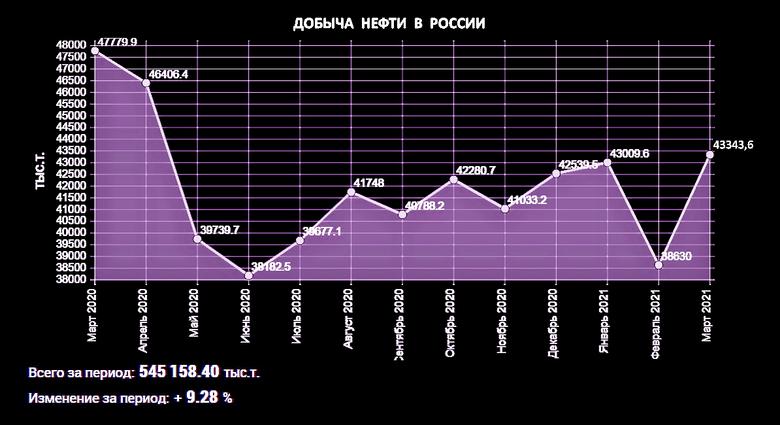

The ministry forecast crude oil output to total 478 million mt, or 9.6 million b/d, in 2021, practically unchanged from 2020 levels.

Russia outlined protection of its market share in the international market as one of its main goals for 2021.

"[We should] undoubtedly stand up for the interests of our country, where we have a competitive advantage," Deputy Prime Minister Alexander Novak said April 13 at the ministry's board meeting.

Since January, Russia has successfully advocated for gradual increases of its output quota under the OPEC+ agreement, which currently stands at 9.379 million b/d, excluding condensate, through April.

According to the revised oil strategy, Russia's pipeline exports of crude should rise from 208 million mt in 2020 to 212-286 million mt by 2030.

Production peak

Going forward, production levels will depend on the amount of investment and tax incentives, as well as Russia's commitments under the OPEC+ deal.

"In all scenarios, we forecast a decline in oil production without gas condensate after peaking in 2027-2029," the draft document reads.

Under four various scenarios, Russia's crude output could peak at 504-590 million mt in 2027-2029 before decreasing to 414-494 million mt in 2035.

Keeping OPEC+ restrictions beyond April 2022 will see Russia's production peak later than currently expected, the strategy suggests.

In all scenarios, Russia sees gas condensate output rising steadily from 36.4 million mt in 2020 to 57 million mt in 2035, supported by the increasing role of gas and LNG in the Russian energy mix.

At the same time, Russian crude production capacity is forecast to hit 693 million mt, or 13.9 million b/d, in 2029, which "can be produced in favorable economic conditions or if the homeland orders it," the ministry's oil refining department head Anton Rubtsov said.

If Russia fails to adapt financial instruments over time or its economy stagnates, Russian crude output risks not ever returning to 2019 record levels of 525.5 million mt.

Additional measures supporting high-viscosity oil projects in Russia are already being studied and should be presented before May 1.

Tax breaks and technology investment will be critical not only for supporting production at mature and hard-to-recover fields, but also to develop the Arctic region.

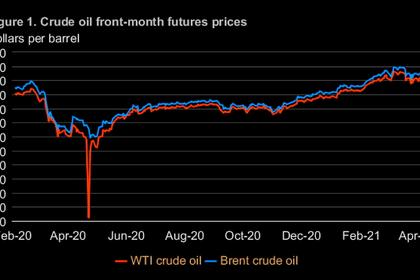

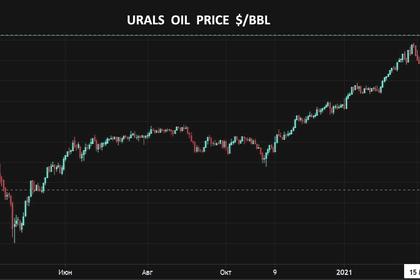

Russia's Arctic reserves will play a key role closer to 2035, but for now they are profitable only at Brent prices over $80/b.

The ministry forecast Brent's value at $68/b in 2025 and $73/b in 2035.

-----

Earlier: