ASIA'S LNG DEMAND UP

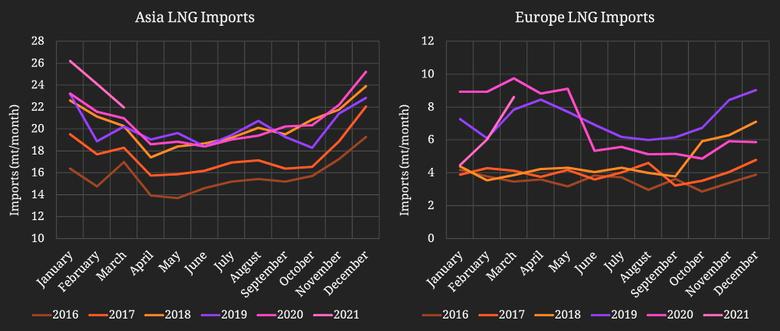

PLATTS- 26 May 2021 - Strong Asian LNG demand for summer and tight supply amid maintenance and outages at multiple terminals have helped the market absorb the spot LNG cargoes rejected by India due to its COVID-19 related lockdowns, according to traders and market participants.

This has muted the market impact of the diversions and enabled Indian gas importers and their suppliers to find alternate destinations for contracted LNG volumes without any force majeure notices being issued or triggering any major disputes, they said.

In contrast, during India's first nationwide coronavirus lockdown in late March 2020, its gas demand plunged and gas companies Gujarat State Petroleum Corp. and GAIL Ltd. had to issue force majeure notices to their suppliers for March-April delivery cargoes to LNG terminals like Dahej, Mundra and Dabhol, which exerted downward pressure on regional LNG prices.

This time around, LNG sellers were able to offer the diverted term cargoes in the spot market -- and fetch a higher price -- amid sustained high spot LNG price levels. The S&P Global Platts JKM was assessed at $10.47/MMBtu on May 21, nearly five times the assessment on May 22, 2020, at $2.15/MMBtu.

A Singapore-based trader said that a term cargo priced at a 13% slope to Dated Brent, which works out to around $8.60/MMBtu, could be sold at a 15% slope or more than $10/MMBtu in the spot market, making it profitable for traders to divert unwanted LNG. "It's a win-win for diversions from India," the trader said.

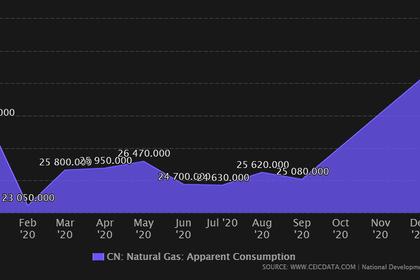

Asia's spot LNG market is being supported by unprecedented LNG demand from North Asia, especially China, where economic activity has been relatively robust in 2021 on the back of recovery from the pandemic.

"The market is quiet about the diversions from India, which have not affected the market at all," an Atlantic Basin LNG supplier said.

Several LNG carriers headed for Indian ports have been diverted in recent weeks; the South Korea-flagged HL Ras Laffan was diverted from Dahej to South Korea on May 15-16, and other vessels were previously diverted to Fujian, Europe and the Middle East, according to shipbrokers and vessel tracking data.

India's state gas company GAIL was heard seeking an LNG cargo for June 11-13 delivery to Hazira terminal, but this was due to disruptions at ONGC's offshore gas production platform on the west coast due to Cyclone Tauktae, which recently damaged offshore vessels, killing dozens.

COVID-19 impact

India's gas-fired power generation has dropped as economic activity remains affected in several states by restrictions to stem the coronavirus resurgence.

"India's power generation from gas-fired power plants averaged 4.7 GW for the first half of May, which is 1.5 GW lower year on year. This is equivalent of a decline in gas demand of about 10 million cu m/day," said Andre Lambine, Senior Power Analyst at S&P Global Platts Analytics.

While Indian gas importers have largely backed away from the heavy spot market procurement seen earlier this year, the reduction in buying interest is also partly due to the high spot prices.

Citigroup in a May 24 update said that various firms in India have requested canceling or delaying some of their LNG deliveries, particularly for June, but at the same time the Indian market was also highly sensitive to high LNG prices, both spot and oil-indexed, that have reduced its appetite for LNG.

"Although such cancelations or delays, if realized, would make available more LNG for the rest of the market globally, the actual number of cargoes freed up might not be large," Anthony Yuen, Managing Director and Head of Commodities Strategy for Pan-Asia at Citi, said in the report.

To put Indian volumes into context, Yuen said India has been importing about 3 Bcf/d of LNG in recent months, with around 2.6 Bcf/d believed to be under contract, and cutting 0.5 Bcf/d of LNG imports for a month might only amount to about 15 Bcf, or 0.42 Bcm.

"To illustrate the relative size of this development, total natural gas storage in much of Europe is about 13 Bcm below the 5-year average. The price impact, using European coal-to-gas switching as a sensitivity, might only be about $0.05/MMBtu," Yuen added.

COVID-19 induced demand destruction in India threatens some of the upside to Asian LNG prices, but overall Indian growth is still positive at more than 29 million cu m/d, keeping Asia-Pacific LNG imports over 90 million cu m/d stronger year on year, Chris Durman, Head of LNG Analytics at S&P Global Platts, said earlier in May.

"But continued further strength in the JKM is likely to cause end-users to retreat to the sidelines," Durman added.

-----

Earlier: