GLOBAL OIL DEMAND WILL UP BY 6.0 MBD TO 96.5 MBD

OPEC - 11 May 2021 - OPEC OIL MARKET REPORT

Oil Market Highlights

Crude Oil Price Movements

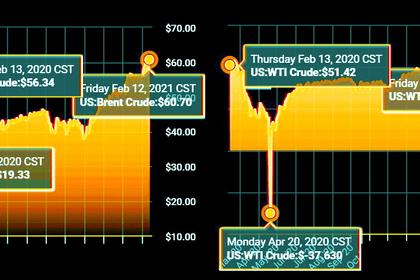

Spot crude prices fell in April for the first time in six months, with North Sea Dated and WTI easing m-o-m by 1.7% and 1%, respectively. Similarly, the OPEC Reference Basket price declined $1.32, or 2.0%, in April, to settle at $63.24/b. However, year-to-date, the ORB was 41.6%, or $17.91, higher than the same period in 2020 at $60.97/b. Crude oil futures prices fell on both sides of the Atlantic, with the ICE Brent front month down 37¢, or 0.6%, to average $65.33/b, and NYMEX WTI front month fell by 65¢, or 1.0%, to average $61.70/b.

Consequently, the Brent-WTI spread widened in April to an average of $3.62/b. The backwardation structure of all three major oil futures benchmarks lessened across the month. Hedge funds and other money managers slightly raised long positions in crude, recovering part of their net long positions from the sell-off seen in March, with gains concentrated mainly in Brent.

World Economy

Stimulus measures in the US and accelerating recovery in Asian economies are expected to continue supporting the global economic growth forecast for 2021, now revised up by 0.1 pp to reach 5.5% y-o-y. This comes after a 3.5% y-o-y contraction estimated for the global economy in 2020. However, global economic growth for 2021 remains clouded by uncertainties including, but not limited to, the spread of COVID-19 variants and the speed of the global vaccine rollout. In addition, sovereign debt levels in many regions, inflationary pressures and central bank responses are key factors to monitor. After a contraction of 3.5% in 2020, US economic growth in 2021 is now expected to reach 6.2%. The economic growth forecast for the Euro-zone in 2021 is lowered to stand at 4.2%, following a contraction of 6.8% last year. Similarly, Japan’s economic growth forecast is lowered to 3.0% for 2021, following a contraction of 4.9% in 2020. After growth of 2.3% in 2020, China’s economic growth forecast in 2021 is revised up to 8.5%. Given the ongoing COVID-19 related challenges, India’s 2021 economic growth forecast is revised slightly down to 9.7%, compared to a contraction of 7.0% in 2020. Brazil’s growth forecast for 2021 remains unchanged at 3.0%, after a contraction of 4.1% in 2020. Russia’s economic growth forecast for 2021 remains at 3.0%, after contracting by 3.1% in 2020.

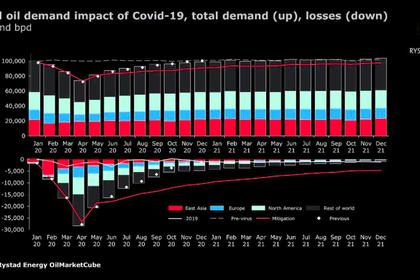

World Oil Demand

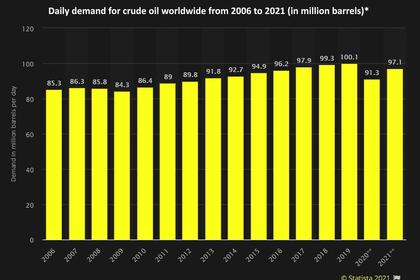

World oil demand is assumed to have dropped by 9.5 mb/d in 2020, unchanged from last month’s assessment, now estimated to have reached 90.5 mb/d for the year. For 2021, world oil demand is expected to increase by 6.0 mb/d, unchanged from last month’s estimate, to average 96.5 mb/d. Slower than anticipated demand in OECD Americas during 1Q21, together with the resurgence of COVID-19 cases in India and Brazil, caused the 1H21 oil demand data to be revised downwards. However, positive transportation fuel data from the US, and acceleration in vaccination programmes in many regions provides further optimism in 2H21. The assumed return to some degree of normality and improved mobility is also expected to positively affect regions such as the Middle East and Other Asia in 2H21.

World Oil Supply

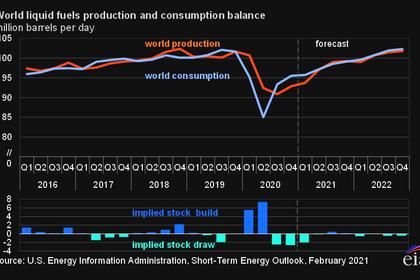

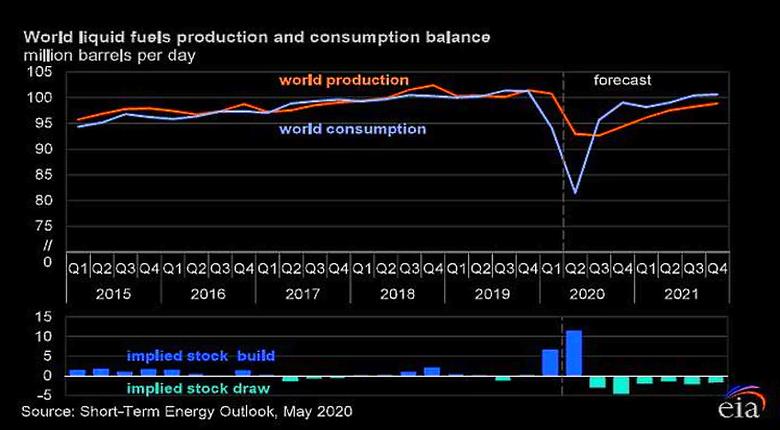

Non-OPEC liquids supply in 2020 is estimated to average 62.9 mb/d, a contraction of 2.5 mb/d y-o-y. Non-OPEC liquids supply for 2021 is revised down by 0.2 mb/d from last month’s assessment, and is forecast to grow by 0.7 mb/d to average 63.6 mb/d. This mainly due to the US liquids production outage of 2.2 mb/d seen in February, following the winter storms and freeze. Moreover, the supply forecast in Norway and Canada was also revised down, due to extensive seasonal maintenance. The main drivers for supply growth in 2021 are anticipated to be Canada, Brazil, China, and Norway, while US liquid supply is expected to decline by 0.1 mb/d y-o-y. OPEC NGLs are forecast to grow by around 0.1 mb/d y-o-y in 2021 to average 5.2 mb/d, following an estimated contraction of 0.1 mb/d in 2020. OPEC crude oil production in April increased m-o-m by 0.03 mb/d, to average 25.08 mb/d, according to secondary sources.

Product Markets and Refining Operations

Refinery margins in April further extended the trends witnessed in March, with positive performance seen in the Atlantic Basin. In the US Gulf Coast (USGC), margins rose slightly, but in Europe margins increased more markedly with most of the strength derived from the gasoline and jet/kerosene segments as transportation fuel markets in both regions continued to benefit from the heavy turnarounds registered the previous month. This contributed to product tightness and hence supported prices. In contrast, margins in Asia performed negatively as refining economics exhibited losses with pressure coming mainly from the bottom of the barrel as the region remained well supplied and amid demand-side weakness resulting from rising COVID-19 cases in India.

Tanker Market

Dirty tanker rates declined in April, as the improvement seen last month in the Suezmax and Aframax classes proved temporary and VLCCs rates moved sideways. Rates fell as gains in the Atlantic Basin triggered by the fallout from the February freeze in the USGC subsided. Clean rates rose across the board, except on the North West Europe-to-US East Coast route where rates fell back from the relatively strong levels seen in the prior two months. Dirty tanker rates are not expected to pick up until 2H21 or even 2022, with the latter date more likely. In contrast, the outlook for clean rates is slightly more positive.

Crude and Refined Products Trade

US crude imports rose 0.2 mb/d in April to reach 6.0 mb/d, the highest in 10 months. US crude exports declined to the lowest since December 2018, averaging 2.6 mb/d. US product imports remained near a 19-month high while product exports rose to the highest since the February freeze disrupted USGC refineries. Japan’s crude imports declined in March after three months of healthy levels, as winter heating demand dissipated. Product imports dropped back from a three-year high, averaging 1.1 mb/d. In China, crude imports remained near a four-month high in March, averaging 11.7 mb/d, while product exports continued moving higher, reaching a ten-month high of 1.7 mb/d, driven by a strong performance of gasoil and jet. India’s crude imports fell to a five-month low in March, averaging 4.3 mb/d. India’s product imports slipped further, while product exports jumped 32% m-o-m, driven by strong outflows of gasoil.

Commercial Stock Movements

Preliminary data shows total OECD commercial oil stocks increased by 10.0 mb, m-o-m, in March. At 2,987 mb, they were 13.5 mb higher than the same time a year ago, 37.8 mb above the latest five-year average and 73.0 mb above the 2015–2019 average. Within the components, crude and products stocks rose m-o-m by 6.7 mb and 3.3 mb, respectively. With this, OECD commercial crude stocks stood at 3.4 mb above the latest five-year average and 16 mb above the 2015–2019 average, while product stocks exhibited a surplus of 34.4 mb above the latest five-year average and were 57.0 mb above the 2015-2019 average. In terms of days of forward cover, OECD commercial inventories declined m-o-m by 0.6 days in March to stand at 67.4 days. This is 11.7 days lower than the year-ago level, 1.5 days above the latest five-year average, and 5.1 days above the 2015–2019 average.

Balance of Supply and Demand

Demand for OPEC crude in 2020 remained unchanged from the previous month’s assessment at 22.5 mb/d. This is around 6.8 mb/d lower than in 2019. For 2021, demand for OPEC crude was revised up by 0.2 mb/d from the previous month’s assessment to stand at 27.7 mb/d. This is 5.2 mb/d higher than in 2020.

-----

Earlier: