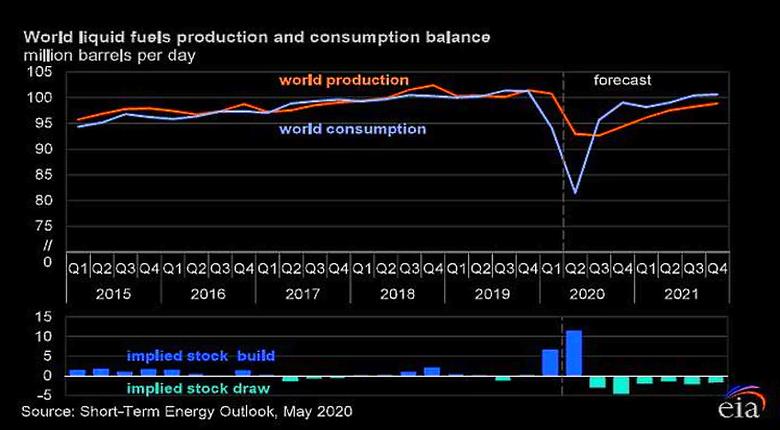

OIL DEMAND WILL UP BY 6.5 MBD

PLATTS - 12 May 2021 - The International Energy Agency on May 12 forecast a major rebound in oil demand of some 6.5 million b/d between the first quarter and the end of 2021, and said likely supply growth, by the OPEC+ group and others, would be "nowhere close" to the expected demand increase.

In its monthly oil market report, the IEA also noted oil stocks held by the OECD developed countries were returning to "more normal" levels, based on figures from April showing levels just 1.7 million barrels above the five-year average.

The IEA's bullish assessment for the year ahead came despite it lowering its overall demand growth estimate for 2021 as a whole by 270,000 b/d to 5.4 million b/d, and trimming its estimate of the "call" for OPEC crude in the second half of this year by 200,000 b/d, based on downgrades to first-quarter demand in Europe and North America, and a major reduction in India's estimated second-quarter demand, of 630,000 b/d, due to the pandemic.

The report, implying a need for OPEC+ to relax its production curbs even if sanctions against Iran are eased, also gave a lower estimate for US oil output this year compared with last month's report, with an expected contraction of 160,000 b/d, due both to lower shale activity and reduced expectations from fields in the Gulf of Mexico.

"Under the current OPEC+ production scenario, supplies won't rise fast enough to keep pace with the expected demand recovery," the IEA said. "The widening supply and demand gap paves the way for a further easing of OPEC+ supply cuts or even sharper stock draws."

-----

Earlier: