ПРИБЫЛЬ ГАЗПРОМА 135 МЛРД. РУБ.

ГАЗПРОМ - 29 апреля 2021, - Сегодня ПАО «Газпром» представило прошедшую аудит консолидированную финансовую отчетность за год, закончившийся 31 декабря 2020 года, подготовленную в соответствии с Международными стандартами финансовой отчетности.

В таблице ниже представлены основные показатели консолидированного отчета о совокупном доходе по МСФО за годы, закончившиеся 31 декабря 2020 года и 31 декабря 2019 года. Все суммы в таблице представлены в миллионах российских рублей.

| |

За год, закончившийся

31 декабря

|

|---|

| |

2020 года

|

2019 года

|

|---|

|

Выручка от продаж

|

6 321 559

|

7 659 623

|

|---|

|

Чистый доход (расход) по торговым операциям с сырьевыми товарами на ликвидных торговых площадках Европы

|

31 349

|

(24 957)

|

|---|

|

Операционные расходы

|

(5 665 762)

|

(6 387 071)

|

|---|

|

Убыток от обесценения финансовых активов

|

(72 295)

|

(127 738)

|

|---|

|

Прибыль от продаж

|

614 851

|

1 119 857

|

|---|

| | | |

|---|

|

Финансовые доходы

|

747 400

|

654 916

|

|---|

|

Финансовые расходы

|

(1 365 518)

|

(354 835)

|

|---|

|

Доля в прибыли ассоциированных организаций и совместных предприятий

|

136 736

|

207 127

|

|---|

|

Прибыль до налогообложения

|

133 469

|

1 627 065

|

|---|

| | | |

|---|

|

Расходы по текущему налогу на прибыль

|

(75 606)

|

(327 618)

|

|---|

|

Доходы (расходы) по отложенному налогу на прибыль

|

104 544

|

(29 930)

|

|---|

|

Налог на прибыль

|

28 938

|

(357 548)

|

|---|

| | | |

|---|

|

Прибыль за год, относящаяся к:

| | |

|---|

|

Акционерам ПАО «Газпром»

|

135 341

|

1 202 887

|

|---|

|

Неконтролирующей доле участия

|

27 066

|

66 630

|

|---|

| |

162 407

|

1 269 517

|

|---|

Чистая выручка от продажи газа уменьшилась на 751 391 млн руб., или на 20%, за год, закончившийся 31 декабря 2020 года, по сравнению с годом, закончившимся 31 декабря 2019 года, и составила 3 049 339 млн руб., что в основном было вызвано снижением средних цен и объемов реализованного газа в сегменте «Европа и другие страны».

Чистая выручка от продажи газа в Европу и другие страны уменьшилась на 678 736 млн руб., или на 27%, за год, закончившийся 31 декабря 2020 года, по сравнению с годом, закончившимся 31 декабря 2019 года, и составила 1 811 636 млн руб. Это объясняется главным образом снижением средних цен (включая акциз и таможенные пошлины), выраженных в рублях, на 24% и снижением объемов продаж газа в натуральном выражении на 6%, или на 13,4 млрд куб. м. При этом средние цены, выраженные в долларах США, снизились на 32%.

Чистая выручка от продажи газа в страны бывшего Советского Союза уменьшилась на 60 848 млн руб., или на 17%, за год, закончившийся 31 декабря 2020 года, по сравнению с годом, закончившимся 31 декабря 2019 года, и составила 295 254 млн руб. Изменение было обусловлено уменьшением объемов продаж газа в натуральном выражении на 19%, или на 7,5 млрд куб. м, и снижением средних цен (включая таможенные пошлины), выраженных в рублях, на 3%. При этом средние цены, выраженные в долларах США, снизились на 13%.

Операционные расходы уменьшились на 721 309 млн руб. за год, закончившийся 31 декабря 2020 года, по сравнению с прошлым годом и составили 5 665 762 млн руб.

Основное влияние на снижение операционных расходов оказало уменьшение расходов по статье «Покупные газ и нефть» на 441 644 млн руб., или на 31%, за год, закончившийся 31 декабря 2020 года, по сравнению с прошлым годом, вызванное снижением средних цен на газ и нефть и сокращением объемов покупки газа и нефти.

Прибыль по курсовым разницам по операционным статьям за год, закончившийся 31 декабря 2020 года, составила 164 128 млн руб. по сравнению с убытком по курсовым разницам в размере 78 287 млн руб. за прошлый год. Данное изменение в основном связано с переоценкой дебиторской задолженности иностранных покупателей и займов выданных, на которую повлияло увеличение курсов доллара США и евро по отношению к российскому рублю на 19% и 31% соответственно за год, закончившийся 31 декабря 2020 года, по сравнению с уменьшением курсов доллара США и евро по отношению к российскому рублю на 11% и 13% соответственно за прошлый год.

Уменьшение статьи «Налоги, кроме налога на прибыль» на 173 426 млн руб., или на 12%, за год, закончившийся 31 декабря 2020 года, по сравнению с прошлым годом в основном вызвано снижением расходов по налогу на добычу полезных ископаемых, обусловленным преимущественно снижением цен на нефть и снижением объемов добычи газа.

За год, закончившийся 31 декабря 2020 года, сальдо курсовых разниц, отраженное в составе «Чистого финансового (расхода) дохода», сформировало убыток в размере 604 810 млн руб. по сравнению с прибылью в размере 285 581 млн руб. за прошлый год. Указанный факт оказал основное влияние на финансовый результат Группы Газпром.

За год, закончившийся 31 декабря 2020 года, величина прибыли, относящейся к акционерам ПАО «Газпром», составила 135 341 млн руб.

Приведенный показатель EBITDA (рассчитываемый как сумма операционной прибыли, амортизации, убытка от обесценения или восстановления убытка от обесценения финансовых и нефинансовых активов, за вычетом оценочного резерва под ожидаемые кредитные убытки по дебиторской задолженности и резерва под снижение стоимости авансов выданных и предоплаты) снизился на 393 138 млн руб., или на 21%, за год, закончившийся 31 декабря 2020 года, по сравнению с годом, закончившимся 31 декабря 2019 года, и составил 1 466 541 млн руб. Данное изменение в основном связано с уменьшением выручки от продаж.

Чистая сумма долга (определяемая как сумма краткосрочных кредитов и займов и текущей части долгосрочной задолженности по кредитам и займам, краткосрочных векселей к уплате, долгосрочных кредитов и займов, долгосрочных векселей к уплате за вычетом денежных средств и их эквивалентов) увеличилась на 704 848 млн руб., или на 22%, с 3 167 847 млн руб. по состоянию на 31 декабря 2019 года до 3 872 695 млн руб. по состоянию на 31 декабря 2020 года. Данное изменение в основном связано с увеличением суммы долгосрочных кредитов и займов в рублевом эквиваленте в связи с ростом курсов доллара США и евро по отношению к российскому рублю.

Более подробно с данными консолидированной финансовой отчетности по МСФО за год, закончившийся 31 декабря 2020 года, можно ознакомиться здесь.

-----

GAZPROM PROFIT RUB 135 BLN

GAZPROM - April 29, 2021 - Today PJSC Gazprom issued its audited consolidated financial statements prepared in accordance with International Financial Reporting Standards for the year ended December 31, 2020.

The table below presents the main items of the consolidated statement of comprehensive income prepared in accordance with IFRS for the years ended December 31, 2020 and December 31, 2019. All amounts are presented in millions of Russian Rubles.

| |

Year ended December 31, |

| |

2020

|

2019

|

|

Sales

|

6,321,559

|

7,659,623

|

|

Net gain (loss) from trading activity

|

31,349

|

(24,957)

|

|

Operating expenses

|

(5,665,762)

|

(6,387,071)

|

|

Impairment loss on financial assets

|

(72,295)

|

(127,738)

|

|

Operating profit

|

614,851

|

1,119,857

|

|

|

|

|

|

Finance income

|

747,400

|

654,916

|

|

Finance expenses

|

(1,365,518)

|

(354,835)

|

|

Share of profit of associates and joint ventures

|

136,736

|

207,127

|

|

Profit before profit tax

|

133,469

|

1,627,065

|

|

|

|

|

|

Current profit tax expenses

|

(75,606)

|

(327,618)

|

|

Deferred profit tax income (expenses)

|

104,544

|

(29,930)

|

|

Profit tax

|

28,938

|

(357,548)

|

|

|

|

|

|

Profit for the year attributable to:

|

|

|

|

Owners of PJSC Gazprom

|

135,341

|

1,202,887

|

|

Non-controlling interest

|

27,066

|

66,630

|

|

|

162,407

|

1,269,517

|

Net sales of gas decreased by RUB 751,391 million, or 20%, to RUB 3,049,339 million for the year ended December 31, 2020 compared to the year ended December 31, 2019, that was mainly due to a decrease in the average prices and volumes of gas sold in the “Europe and other countries” segment.

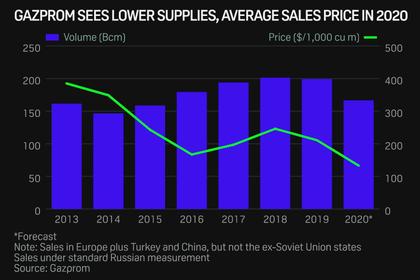

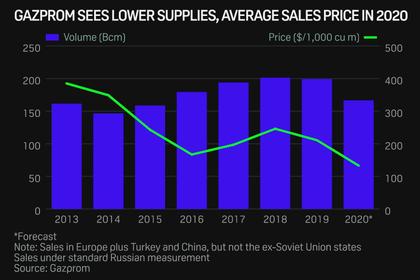

Net sales of gas to Europe and other countries decreased by RUB 678,736 million, or 27%, to RUB 1,811,636 million for the year ended December 31, 2020 compared to the year ended December 31, 2019. The change was mainly due to a decrease in average prices (including excise tax and customs duties) denominated in the Russian Ruble by 24% and a decrease in the volumes of gas sold by 6%, or 13.4 bcm. At the same time average prices denominated in the US Dollar decreased by 32%.

Net sales of gas to Former Soviet Union countries decreased by RUB 60,848 million, or 17%, to RUB 295,254 million for the year ended December 31, 2020 compared to the year ended December 31, 2019. The change was due to a decrease in the volumes of gas sold by 19%, or 7.5 bcm, and to a decrease in average prices (including customs duties) denominated in the Russian Ruble by 3%. At the same time average prices denominated in the US Dollar decreased by 13%.

Operating expenses decreased by RUB 721,309 million to RUB 5,665,762 million for the year ended December 31, 2020 compared to the prior year.

The decrease in operating expenses is primarily caused by a decrease in the item “Purchased gas and oil” by RUB 441,644 million, or 31%, for the year ended December 31, 2020 compared to the prior year due to a decrease in the average prices for gas and oil and a decrease in the volumes of purchased gas and oil.

The foreign exchange gain on operating items for the year ended December 31, 2020 amounted to RUB 164,128 million compared to the foreign exchange loss in the amount of RUB 78,287 million for the prior year. This change was mainly due to the revaluation of accounts receivable from foreign customers and loans issued, which was caused by the appreciation of the US Dollar and the Euro against the Russian Ruble by 19% and 31%, respectively, for the year ended December 31, 2020 compared to the depreciation of the US Dollar and the Euro against the Russian Ruble by 11% and 13%, respectively, for the prior year.

The decrease in the item "Taxes other than on profit" by RUB 173,426 million, or 12%, for the year ended December 31, 2020 compared to the previous year was mainly due to a decrease in mineral extraction tax expenses, mainly caused by a decrease in crude oil prices and a decrease in the volumes of gas production.

For the year ended December 31, 2020 the balance of foreign exchange differences reflected within the item “Net finance (expenses) income” produced a loss in the amount of RUB 604,810 million compared to the gain of RUB 285,581 million for the prior year. This fact had a major impact on the financial result of the Gazprom Group.

For the year ended December 31, 2020 profit attributable to the owners of PJSC Gazprom amounted to RUB 135,341 million.

Adjusted EBITDA (calculated as the sum of operating profit, depreciation, impairment loss or reversal of impairment loss on financial assets and non-financial assets, less changes of allowance for expected credit losses on accounts receivable and impairment allowance on advances paid and prepayments) decreased by RUB 393,138 million, or by 21%, for the year ended December 31, 2020 compared to the year ended December 31, 2019 and amounted to RUB 1,466,541 million. This change was mainly due to a decrease in sales.

Net debt balance (defined as the sum of short-term borrowings and the current portion of long-term borrowings, short-term promissory notes payable, long-term borrowings, long-term promissory notes payable, less cash and cash equivalents) increased by RUB 704,848 million, or 22%, from RUB 3,167,847 million as of December 31, 2019 to RUB 3,872,695 million as of December 31, 2020. This change was mainly due to an increase in the amount of long-term borrowings denominated in the Russian Ruble caused by the appreciation of the US Dollar and the Euro against the Russian Ruble.

More detailed information on the IFRS consolidated financial statements for the year ended December 31, 2020 can be found here.

-----

Earlier:

2021, April, 22, 11:50:00

GAZPROM'S HYDROGEN ENERGY

In recent times many countries are viewing hydrogen energy as an area essential for the implementation of national low-carbon development strategies. However, hydrogen is a secondary energy source, i.e. additional energy is required to produce it, which has an effect on its cost price.

2021, April, 13, 13:35:00

NORD STREAM 2 SANCTIONS FOR EVERYBODY

"We will continue to register any organization that may be involved in any sanctioned activity, and have made it clear that any company risks being penalized for participating in Nord Stream 2," Giordono-Scholz said.

2021, March, 16, 12:35:00

RUSSIA'S LNG FOR BRITAIN

Under the carbon-neutral arrangements, Gazprom and Shell in partnership offset the carbon footprint of the cargo with VCS (Verified Carbon Standards) and CCB (Climate, Community and Biodiversity) emission certificates.

2021, February, 26, 11:15:00

ALEXEY MILLER IS A HEAD OF GAZPROM

The Board of Directors reviewed the issue of electing the Chairman of the Gazprom Management Committee and unanimously resolved to reelect Alexey Miller as Chairman of the Management Committee for a 5-year term starting from May 31, 2021.

2021, February, 17, 15:45:00

GAZPROM SALES DOWN: 2020

Gazprom sold a total of 209.7 Bcm last year across all of its pipeline markets, down from 228.2 Bcm in 2019,

All Publications »

Tags:

ГАЗПРОМ,

GAZPROM