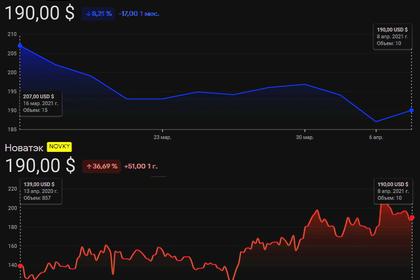

ПРИБЫЛЬ НОВАТЭК 75,8 МЛРД. РУБ.

НОВАТЭК - Москва, 28 апреля 2021 года. ПAO «НОВАТЭК» сегодня опубликовало консолидированную промежуточную сокращенную финансовую отчетность за три месяца, закончившихся 31 марта 2021 г., подготовленную в соответствии с Международными стандартами финансовой отчетности (МСФО).

Основные финансовые показатели деятельности по МСФО

(в миллионах российских рублей, если не указано иное)

|

|

I кв. 2021 г.

|

I кв. 2020 г.

|

|

Выручка от реализации нефти и газа

|

240 749

|

182 595

|

|

Прочая выручка

|

3 834

|

1 967

|

|

Итого выручка от реализации

|

244 583

|

184 562

|

|

Операционные расходы

|

(178 819)

|

(146 535)

|

|

Прочие операционные прибыли (убытки), нетто

|

(622)

|

(33 236)

|

|

Прибыль от операционной деятельности

нормализованная*

|

65 142

|

38 901

|

|

EBITDA дочерних обществ нормализованная*

|

76 625

|

45 383

|

|

EBITDA с учетом доли в EBITDA

совместных предприятий нормализованная*

|

143 836

|

100 668

|

|

Доходы (расходы) от финансовой деятельности

|

1 608

|

141 453

|

|

Доля в прибыли (убытке) совместных предприятий

за вычетом налога на прибыль

|

14 847

|

(145 231)

|

|

Прибыль до налога на прибыль

|

81 597

|

1 013

|

|

Прибыль (убыток), относящаяся к

акционерам ПАО «НОВАТЭК»

|

65 152

|

(30 680)

|

|

Прибыль, относящаяся к акционерам

ПАО «НОВАТЭК», нормализованная* без учета эффекта от курсовых разниц

|

75 773

|

53 547

|

|

Прибыль на акцию нормализованная*

без учета эффекта от курсовых разниц (в руб.)

|

25,23

|

17,80

|

|

Денежные средства, использованные на оплату

капитальных вложений

|

41 446

|

41 143

|

* Без учета эффектов от выбытия долей владения в дочерних обществах и совместных предприятиях (признания прибыли от выбытия и последующей неденежной переоценки условного возмещения).

COVID-19 и макроэкономическая ситуация

Распространение коронавируса COVID-19 и ужесточение карантинных мер в ряде стран продолжили оказывать дестабилизирующее влияние на глобальную экономическую активность, в результате чего участники ОПЕК+ сохраняли курс на ограничение целевых уровней добычи на протяжении первого квартала. Данные ограничения, а также увеличение потребления углеводородов на фоне резкого похолодания в Европе, Азии и Северной Америке привели к значительному росту мировых цен на углеводороды в первом квартале 2021 года, что соответственно отразилось на ценах реализации наших углеводородов.

Дальнейшее развитие ситуации с распространением COVID-19 остается неопределенным и находится вне контроля менеджмента Группы, масштаб и продолжительность этих событий трудно оценить. Несмотря на эти неопределенности Группа продолжает демонстрировать высокие операционные результаты и реализовывать свои инвестиционные проекты согласно утвержденной корпоративной стратегии. Руководство Группы внимательно следит за текущей ситуацией и макроэкономической конъюнктурой и при необходимости предпринимает соответствующие меры.

Выручка от реализации и EBITDA

Наши показатели выручки от реализации и нормализованной EBITDA с учетом доли в EBITDA совместных предприятий увеличились до 244,6 млрд руб. и 143,8 млрд руб., или на 32,5% и 42,9% соответственно по сравнению с аналогичным периодом 2020 года. Рост выручки и нормализованного показателя EBITDA в основном связан с ростом мировых цен на углеводороды, а также увеличением добычи природного газа и газового конденсата в результате запуска газоконденсатных залежей Северо-Русского блока в третьем квартале 2020 года.

Прибыль (убыток), относящаяся к акционерам ПАО «НОВАТЭК»

В первом квартале 2021 года мы отразили прибыль, относящуюся к акционерам ПАО «НОВАТЭК», в размере 65,2 млрд руб. (21,70 руб. на акцию) по сравнению с убытком в размере 30,7 млрд руб. в аналогичном периоде 2020 года.

Нормализованная прибыль, относящаяся к акционерам ПАО «НОВАТЭК» (без учета эффектов от курсовых разниц и выбытия долей владения в дочерних обществах и совместных предприятиях), увеличилась до 75,8 млрд руб. (25,23 руб. на акцию) с 53,5 млрд руб. (17,80 руб. на акцию) в первом квартале 2020 года.

Основными факторами увеличения нормализованной прибыли Группы в первом квартале 2021 года стали благоприятная макроэкономическая ситуация, которая привела к росту цен реализации наших углеводородов, а также увеличение объемов добычи природного газа и газового конденсата (см. выше).

Капитальные вложения

Денежные средства, использованные на оплату капитальных вложений, составили 41,4 млрд руб. по сравнению с 41,1 млрд руб. в аналогичном периоде 2020 года. Значительная часть наших инвестиций в основные средства была направлена на развитие наших СПГ-проектов, продолжающееся освоение и запуск месторождений Северо-Русского блока (Северо-Русского, Восточно-Тазовского, Дороговского и Харбейского месторождений), разработку нефтяных залежей Восточно-Таркосалинского и Ярудейского месторождений и разведочное бурение.

Полная PDF версия

-----

NOVATEK PROFIT RUB 75.8 BLN

NOVATEK - Moscow, 28 April 2021. PAO NOVATEK today released its consolidated interim condensed financial statements for the three months ended 31 March 2021 prepared in accordance with International Financial Reporting Standards (“IFRS”).

IFRS Financial Highlights

(in millions of Russian roubles except as stated)

|

|

1Q 2021

|

1Q 2020

|

|

Oil and gas sales

|

240,749

|

182,595

|

|

Other revenues

|

3,834

|

1,967

|

|

Total revenues

|

244,583

|

184,562

|

|

Operating expenses

|

(178,819)

|

(146,535)

|

|

Other operating income (loss)

|

(622)

|

(33,236)

|

|

Normalized profit from operations*

|

65,142

|

38,901

|

|

Normalized EBITDA of subsidiaries*

|

76,625

|

45,383

|

|

Normalized EBITDA including share in

EBITDA of joint ventures*

|

143,836

|

100,668

|

|

Finance income (expense)

|

1,608

|

141,453

|

|

Share of profit (loss) of joint ventures, net of income tax

|

14,847

|

(145,231)

|

|

Profit before income tax

|

81,597

|

1,013

|

|

Profit (loss) attributable to

shareholders of PAO NOVATEK

|

65,152

|

(30,680)

|

|

Normalized profit attributable to

shareholders of PAO NOVATEK*,

excluding the effect of foreign exchange gains (losses)

|

75,773

|

53,547

|

|

Normalized basic and diluted earnings per share*,

excluding the effect of foreign exchange gains (losses)

(in Russian roubles)

|

25.23

|

17.80

|

|

Cash used for capital expenditures

|

41,446

|

41,143

|

* Excluding the effects from disposal of interests in subsidiaries and joint ventures (recognition of a net gain on disposal and subsequent non-cash revaluation of contingent consideration).

COVID-19 and Macro-Economic Environment

The impacts from the COVID-19 virus spread and stricter quarantine measures enforced by some countries continued to have a destabilizing effect on global economic activities, resulting in maintaining restricted production targets by the OPEC+ participants during the first quarter. These restrictions as well as an increase in hydrocarbons consumption due to the severe cold winter weather in Europe, Asia and North America has led to a significant increase in benchmark hydrocarbons prices in the first quarter 2021, which correspondingly impacted our hydrocarbons sales prices.

Further developments surrounding the COVID-19 virus spread remain uncertain and are outside of the Group’s management control, and the scale and duration of these developments are difficult to assess. Despite these uncertainties, the Group continues to demonstrate strong operating results and implement its investment projects in accordance with the Group’s approved corporate strategy. The Group’s management continues to assess the current situation and present macro-economic environment and takes appropriate actions if deemed necessary.

Revenues and EBITDA

Our total revenues and Normalized EBITDA, including our share in the EBITDA of joint ventures, increased to RR 244.6 billion and RR 143.8 billion, or by 32.5% and 42.9%, respectively, as compared to the corresponding period in 2020. The increases in total revenues and Normalized EBITDA were largely due to an increase in global commodity prices for hydrocarbons, as well as an increase in natural gas and gas condensate production from the launch of gas condensate deposits of the North-Russkiy cluster in the third quarter 2020.

Profit (loss) attributable to shareholders of PAO NOVATEK

In the first quarter 2021, our profit attributable to shareholders of PAO NOVATEK amounted to RR 65.2 billion (RR 21.70 per share) as compared to a loss of RR 30.7 billion in the corresponding period in 2020.

Normalized profit attributable to shareholders of PAO NOVATEK (excluding the effects from foreign exchange differences and the disposal of interests in subsidiaries and joint ventures) increased to RR 75.8 billion (RR 25.23 per share) from RR 53.5 billion (RR 17.80 per share) in the first quarter 2020.

The main factors positively impacting the Group’s Normalized profit in the first quarter 2021 were improved macroeconomic conditions, which resulted in an increase in our hydrocarbons sales prices, as well as an increase in natural gas and gas condensate production volumes (see above).

Cash used for capital expenditures

Our cash used for capital expenditures aggregated RR 41.4 billion as compared to RR 41.1 billion in the corresponding period in 2020. A significant portion of our capital expenditures was attributable to the ongoing development of our LNG projects, further development and the launch of the fields within the North-Russkiy cluster (the North-Russkoye, East-Tazovskoye, Dorogovskoye and Kharbeyskoye fields), the development of crude oil deposits of the East-Tarkosalinskoye and Yarudeyskoye fields, and capital spent on exploratory drilling.

Full PDF version

-----

Earlier:

2021, April, 13, 12:45:00

NOVATEK PRODUCTION +5.3%

In the first quarter 2021, NOVATEK’s hydrocarbon production totaled 158.1 million barrels of oil equivalent (boe), including 20.15 billion cubic meters (bcm) of natural gas and 3,129 thousand tons of liquids (gas condensate and crude oil), resulting in an increase in total hydrocarbons produced by 7.9 million boe, or by 5.3% as compared with the first quarter 2020.

2021, April, 8, 11:20:00

NOVATEK NEED INVESTMENT $11 BLN

Novatek seeks to raise $11 billion in external financing and has said it planned to get the funds by the first half of this year.

2021, February, 18, 12:15:00

NOVATEK PROFIT RUB 67.8 BLN

PAO NOVATEK released its audited consolidated financial statements for the year ended 31 December 2020 prepared in accordance with International Financial Reporting Standards (“IFRS”).

All Publications »

Tags:

НОВАТЭК,

NOVATEK