SPAIN'S ENERGY TRANSITION

IEA - Spain 2021 Energy Policy Review

Executive summary

Overview

Since the last International Energy Agency (IEA) in-depth review in 2015, Spain has solved a long-standing issue of tariff deficits in its electricity and gas sectors and closed all of its coal mines, which has allowed it to prioritise the issue of climate change on its national agenda and align its goals with European Union (EU) objectives and ambitions. In doing so, Spain has placed the energy transition at the forefront of its energy and climate change policies.

The current Spanish framework for energy and climate is based on the 2050 objectives of national climate neutrality, 100% renewable energy in the electricity mix and 97% renewable energy in the total energy mix. As such, it is centred on the massive development of renewable energy, particularly solar and wind; energy efficiency; electrification; and renewable hydrogen. This is seen as an opportunity to stimulate the economy; create jobs; modernise industry; enhance competitiveness; support vulnerable groups; improve energy security; and support research, development and innovation.

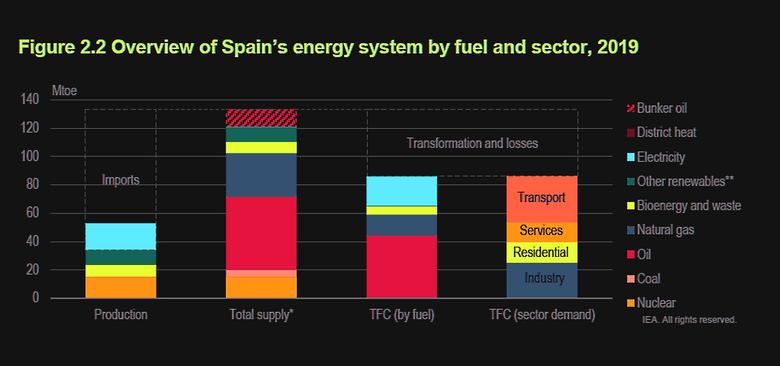

Notwithstanding its considerable progress to date on decarbonising and increasing the share of renewables in the electricity sector, Spain’s total energy mix is still heavily dominated by fossil fuels. Notably, the transport, industry and buildings sectors all have considerably more work ahead of them to meet the country’s targets for renewables penetration and decarbonisation.

Moreover, under Spain’s decentralised system of government, regional administrations have considerable authority over energy policy development and implementation, making effective co-ordination between the centre and the regions even more critical to successful enactment of energy strategies in Spain.

When all of Spain’s plans and strategies are implemented, a completely different energy sector will emerge, where fossil fuels are no longer dominant and end-user sectors are mostly electrified. Such a transformed energy landscape will come with new challenges and will provide new opportunities.

The challenges include energy security. The current system is backed up by massive stocks of oil, gas and coal that can be dispatched in a flexible way; the new system, with a large share of variable renewable generation, will require other forms of longer term backup, on top of short-term flexibility. New vulnerabilities will also arise, as electrification goes hand-in-hand with smartening of the system and digitalisation.

The opportunities are with energy system integration. The new energy system can be much more efficient than the current one, as end-use sectors can be coupled with higher electrification, the use of residual heat, waste to energy, but also using electricity to produce renewable gases like hydrogen, among others. It will be important for Spain to adapt the policy and regulatory framework, where needed, to gradually shape such a new integrated energy system.

The current post-COVID-19 recovery context presents Spain with an important opportunity to frontload its planned energy transition investments to the upcoming three years. Spain is currently working on its green recovery plan, as it will be one of the key beneficiaries of EU recovery funds. The main areas defined in the initial draft of Spain’s Recovery and Resilience Plan for the energy transition are efficiency, sustainable mobility, renewable energies, electricity infrastructure, storage and flexibility, and green hydrogen. Spain should capitalise on this opportunity to jumpstart actions outlined in its National Energy and Climate Plan (NECP).

Climate change policies

As a member of the European Union (EU), Spain is bound by EU targets for energy and climate change as part of the Energy Union. Toward this end, the central strategy document guiding Spain’s energy and climate policies over the coming decade is its NECP for the period 2021-30. It outlines a number of policy actions in various sectors that will support the country’s climate targets, including in the areas of energy efficiency, renewables and transport. Its 2030 objectives include: a 23% reduction in greenhouse gas emissions from 1990 levles; a 42% share of renewables in energy end use; a 39.5% improvement in energy efficiency; and a 74% share of renewables in electricity generation. Policies include increasing renewable power installations and boosting the use of renewable gases in the power sector, modal shifts and electrification in the transport sector, refurbishments and increasing the use of renewable heating in the residential and commercial sectors, promoting energy efficiency and fuel switching in the industry sector, and energy efficiency improvements in the agricultural sector. The government anticipates that investments of EUR 241 billion will be needed to enact the measures outlined in the NECP, out of which 80% is estimated to come from the private sector.

Domestically, the Climate Change and Energy Transition Bill places the fight against climate change and the need for an energy transition at the centre of the economy and society. Its main targets are similar to those in the NECP, also placing renewable energy and energy efficiency at the centre of the energy transition. Notably, Spain has emphasised the concept of a just transition to ensure that communities in traditional energy sectors, notably coal mining, are not left behind. To this end, Spain’s Just Transition Strategy includes measures to promote employment opportunities in the energy transition, supported by a framework of vocational training, active labour policies, support measures to the most vulnerable and economic stimulus plans for those regions most affected by the energy transition. These are executed through “just transition agreements” between the government, unions and businesses, which can serve as an example to other countries facing similar issues.

Energy efficiency

Spain’s overall energy strategy employs an “efficiency first” principle. In all sectors, Spain’s energy transition objectives hinge heavily on reducing consumption. Already, Spain has begun to decouple economic growth from energy consumption; energy intensity, the ratio of total consumption to gross domestic product, fell by 18% between 2008 and 2019. Still, more reductions will be needed across all sectors.

The Bill on Climate Change and the Energy Transition as well as the NECP outline a number of measures to improve efficiency and reduce consumption in all economic sectors, including transport, buildings and industry. The policy plans are extensive and can achieve strong results, but will need to be accompanied by a predictable, long-term regulatory framework; sufficient incentives to mobilise private investments; and adequate public financing to underpin all the programmes over the coming decade.

In addition, under Spain’s decentralised system of government, the implementation of a number of efficiency measures for transport, buildings and industry will fall on regional and local governments, making co-ordination between the central government and regional/local administrations as well as skills capacity at all levels of government essential to success.

Electricity transition

Spain is progressing toward its 2030 targets, notably in the electricity sector. After a slump in investments between 2013 and 2018 due to a lack of financial means to promote renewables, investments took off again in 2019. The share of renewables (including non-renewable waste) in the national electricity mix grew from 24% in 2009 to 38% in 2019. As such, Spain is well on track to meet its 2020 target to source 42% of its electricity from renewables.

Though Spain’s progress on ramping up renewables in its electricity mix is commendable, the future trajectory of its power mix warrants careful consideration to ensure a smooth transition. To start, Spain plans to phase out both coal and nuclear power generation. The coal phase-out appears well on track, with coal only providing around 5% of electricity generation in 2019 and even less in 2020. Nuclear power, which accounted for 22% of power generation in 2019 (and an important source of low-carbon generation), will begin shutting down from 2027. Four of Spain’s seven nuclear reactors are scheduled to close by the end of 2030, representing around 4 gigawatts of capacity. Natural gas combined-cycle plants provide around one-third of power generation, and will be crucial to balancing out a power system that is heavily dependent on variable renewables once coal and nuclear have left the market. As such, the government will need to pay special attention to prevent natural gas generation capacity from simultaneously exiting the system. In this regard, the government should thoroughly assess the cost implications for consumers of the expedited phase-out of both coal and nuclear generation.

Spain’s targets also foresee a sizeable buildout of new renewables capacity to reach 74% of electricity generation by 2030, notably wind and solar. As such, a stable, long-term remuneration framework for supporting the growth of renewables, including for storage, will be essential. Spain’s updated auction mechanisms are a step in the right direction, and investor sentiment and availability of financing appears on track. Additional help could come in the form of expedited permitting and timely issuance of auction schedules and terms to improve investment clarity.

Moreover, the trajectory will require a concerted focus on system integration of variable renewables in the coming years. The government’s strategy is centred on interconnections, storage, demand-side management and digitalisation. Public consultations and regulatory proceedings are underway in all of these areas, though timely issuance of a regulatory framework will be crucial to mobilising investments, including in next-generation technologies such as biogas and hydrogen. Co-operation with neighbouring governments on interconnection capacity will also be a key element of utilising Spain’s full production capacity on renewables, notably with France to expand connection of the Iberian peninsula with the rest of continental Europe.

Energy system transformation

Beyond the electricity sector, the government plans to expand self-consumption of renewables and distributed generation, as well as promote the use of renewables in the industry and heating sectors. It also has plans to support the production of advanced biofuels and renewable gases, as well as hydrogen.

Overall, Spain plans to move toward a full energy system transformation, the foundations of which will be laid in the coming decade. The Long-Term Strategy projects that the electrification of the economy will be over 50% by 2050. In order to integrate more renewables into other sectors of the economy, the government has a four-pronged strategy: 1) energy efficiency first; 2) renewables-based electrification; 3) storage; and 4) indirect electrification through renewable gases, mainly hydrogen. The promotion of renewable gases is a critical measure outlined in Spain’s NECP, with uses planned in mobility, industry, seasonal storage and synthetic fuels.

To this end, the government has several initiatives in place or underway to jumpstart plans and investments in the 2030 time frame, including a Hydrogen Roadmap, a Biogas Roadmap, an Offshore Wind Roadmap, a self-consumption strategy public consultation and a smart meter evolution public consultation.

As Spain looks to a future of increased electrification of end-use sectors and sector coupling – an essential element to achieve an energy transition – the competitiveness of electricity against fossil fuels will be a critical element to achieving the desired results. As such, Spain should consider changes to its taxation system, notably to incorporate the cost of carbon into end-use prices, to reduce barriers to increased uptake of clean electricity in more end uses.

Energy security

From an energy security perspective, although Spain continues to be heavily dependent (73% dependency) on foreign sources for its energy, its sources for oil and gas are relatively well diversified and the government has robust emergency response frameworks in place in the case of a disruption.

Though the new policies and increased electrification will reduce Spain’s import dependency, the rapid closure of coal and nuclear facilities over the coming decade bears watching, as it could increase the country’s call on natural gas, especially if new renewables capacity cannot be built as quickly as planned.

Interconnectivity with other European countries is also a critical element for Spain to improve security of supply. While electricity projects with Portugal are progressing, existing interconnection with France is often congested and new projects have been delayed, causing Spain to fall short of its EU interconnectivity targets of 10% by 2020 and putting at risk its 15% target by 2030.

Key recommendations

The government of Spain should:

Ensure that the National Recovery and Resilience Plan supports achieving the NECP’s targets.

Improve co-ordination with regional authorities and municipalities to implement the NECP’s measures, especially on energy efficiency, more effectively.

Reinforce efforts to create more flexibility in the electricity market and to ensure proper price signals for investments in generation, through increased interconnectivity, continued integration of regional markets, and the development of demand-side response and storage.

Review taxation to avoid excess charges and distortionary impacts on electricity relative to oil and gas consumption to promote electrification. Consider additional carbon-based taxation as well as other mechanisms to progressively redistribute electricity charges among all actors in the energy system.

-----

Earlier: