ARAMCO, RELIANCE MARRIAGE

PLATTS - 30 Jun 2021 - Saudi Aramco has moved closer in purchasing a stake in the oil-to-chemicals unit of Reliance Industries following the appointment of its chairman to the board of India's biggest private refiner, with most analysts hopeful that improved oil demand and price outlook will make it easier to close the deal before the current financial year ends in March 2022.

Analysts said the recent appointment of Aramco chairman Yasir Al-Rumayyan as an independent director to the board of Reliance Industries is a sign that the Middle Eastern oil producer has ironed out most, if not all, issues with Reliance for the deal to go ahead.

In addition, the surge in oil prices to pre-pandemic levels will also strengthen the financial muscle of Aramco to close the deal, they added.

"Current higher oil prices and improving demand would help to strengthen Saudi Aramco's financial position and provide more flexibility in spending, including signing of the deal with Reliance," said Lim Jit Yang, advisor for oil markets at S&P Global Platts Analytics.

In 2019, Reliance announced the sale of a 20% stake to Saudi Aramco, the world's top oil exporting company. But the deal could not progress in 2020 after the oil price crash and demand destruction caused by the pandemic, which saw Aramco tighten its belt. Last year, Aramco slashed its capex budget by about half, to under $25 billion, and for this year it has said it expects capex to be about $35 billion, down from original guidance of $40-$45 billion.

"The appointment of Aramco's chairman to the board of Reliance will pave the way for their oil-to-chemical partnership which had been stalled due to the pandemic. This may be followed by more ventures between two companies in the years to come as they work together as strategic partners," Lim said.

A perfect marriage

Mukesh Ambani, chairman of Reliance Industries Ltd, told shareholders at the annual general meeting recently that demand and margin environment for petrochemicals had recovered to pre-COVID levels by March, raising hopes that the company's O2C business would benefit from the strong global growth environment.

"As an important part of this vision of achieving accelerated growth, we look forward to welcoming Saudi Aramco as a strategic partner in our O2C business. I expect our partnership to be formalized in an expeditious manner during this year, after obtaining required regulatory clearances," Ambani added.

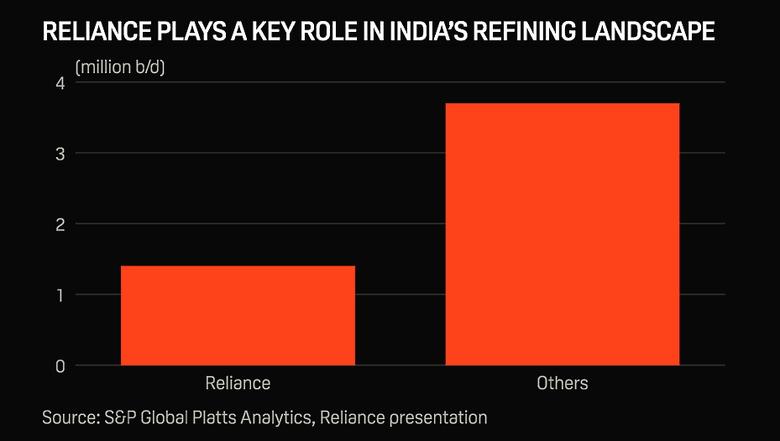

Reliance owns the largest and most complex single site refinery at Jamnagar, Gujarat with a refining capacity of 1.4 million b/d. Saudi Arabia was India's second largest crude oil supplier in 2020, but volumes declined almost 11% from 2019 at 35.91 million mt, customs data showed.

"We are hopeful that this long-awaited deal will go through in the current financial year ending March 2022," said Sumit Pokharna, vice president at Kotak Securities.

Analysts said a stake in Reliance would guarantee a stable channel for crude to Aramco as it faces competition from Iraq and the US in India. Some analysts believe that for Aramco, Reliance, which runs of one of the most modern refining projects in the world, would still be one of the best bets in Asia.

"It looks like a 20% stake sale will go ahead but the question is what's going to be the financial structure of the deal -- things like what percentage would be cash or equity swap. I am sure those things are being worked out now and there is no clarity yet," said a source who closely tracks developments on the proposed deal.

With China not on Aramco's radar for any immediate large-scale investments, their best bet is Reliance in India, given the solid business model the company has, the source added. In addition, India's oil demand is far from its peak, which will give Aramco a stable market for a long period of time.

Reorganization, cleaner fuels

Macquarie Research said in a note that Reliance's refining margins would likely improve over the next two years. "O2C stake sale to Aramco now seemingly a formality with the chairman inducted as independent non-executive director. Deal structure remains unclear," it added.

Earlier this year the management of Reliance proposed to create a wholly owned subsidiary -- called Reliance O2C Ltd. -- which will see the transfer of its refining and petrochemicals businesses to the new unit.

As part of the reorganization, Reliance's New Energy and New Materials business, which would be outside Reliance O2C, would focus on developing a green energy ecosystem and adopt new technologies to reduce carbon footprint. The aim would be to achieve net carbon zero for the group by 2035, while working along with the O2C entity, which will focus on carbon capture and hydrogen production technologies, analysts said.

Once Reliance closes the sale of stake to Aramco, it will aid in its ambition to allocate plentiful funds to push its clean fuel ambitions, analysts said.

"Reliance management has highlighted that the discussions on strategic partnership with Saudi Aramco have progressed well and the company expects to formalize it during this year, subject to regulatory approvals. We are optimistic that this deal will enable Reliance to shift its capital allocation from legacy O2C business to the new energy and materials segment," Pokharna said.

-----

Earlier: