ASIA'S INDEXES UP ANEW

REUTERS - June 30, 2021 - Asian shares rose and a gauge of global equities hovered near record highs on Wednesday after rising consumer confidence in economic recovery boosted the Nasdaq index to its highest-ever closing level.

MSCI's global share index (.MIWD00000PUS) was set for a fifth straight month of gains on Wednesday. Its index tracking Asian shares outside Japan (.MIAPJ0000PUS) was set for a small monthly loss, but still on course for a fifth straight quarterly rise, its longest such streak since 2006-2007.

The Asian index was last up 0.33% on the day.

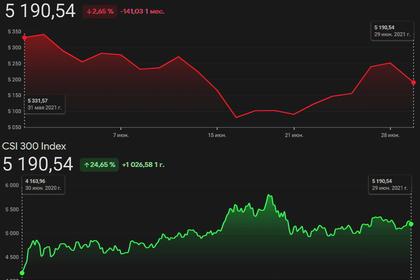

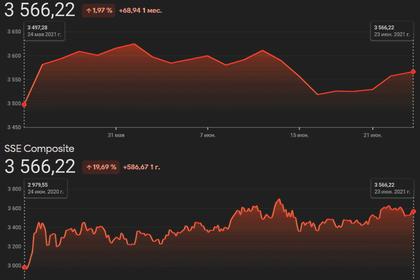

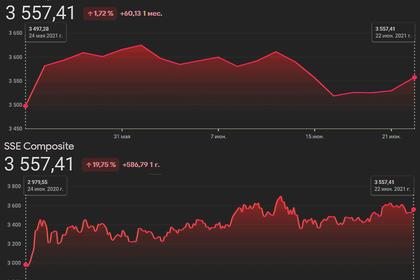

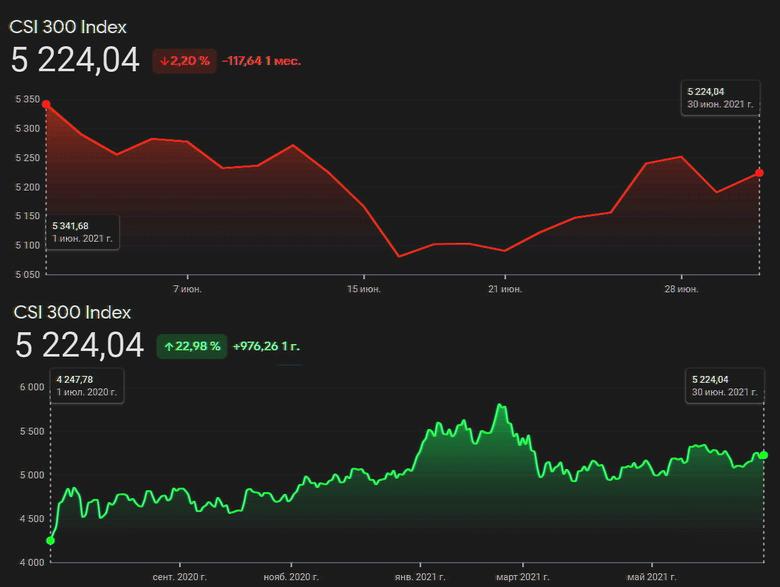

Chinese blue-chips (.CSI300) added 0.1%, Australian shares (.AXJO) were up 0.58% and set for a ninth straight month of gains, and Seoul's Kospi (.KS11) rose 0.35%. Japan's Nikkei (.N225) edged up 0.06%.

Still, Steven Daghlian, market analyst at CommSec in Sydney, said that following the global run-up in equities, markets were "on edge" ahead of the release of U.S. non-farm payrolls data on Friday, the results of which could influence Federal Reserve policy.

Economists polled by Reuters are expecting a gain of 690,000 jobs for June, up from 559,000 in May.

"(It looks like) five straight months of gains in the U.S ... still around record highs as well, and the end of the month and quarter as well. So that can also create just a little bit more volatility," said Daghlian.

On Monday, Richmond Federal Reserve President Thomas Barkin said the U.S. central bank has made "substantial further progress" toward its inflation goal in order to begin tapering asset purchases.

The market's continued focus on Fed plans for tapering come as the world's largest economy continues to rebound from pandemic lockdowns.

U.S. consumer confidence jumped to its highest level in nearly one and a half years in June as growing labour market optimism amid a reopening economy offset concerns about higher inflation. That came even as the Federal Housing Finance Agency house price index shot up a record 15.7% in April from a year ago, corroborating soaring house price inflation.

Overnight on Wall Street, the Dow Jones Industrial Average (.DJI) and S&P 500 (.SPX) gained or 0.03%, and the Nasdaq Composite (.IXIC) added 0.19%, hitting its record high close.

At the same time, some investors remain worried about the economic impact of the highly infectious Delta variant of the virus that causes COVID-19.

Indonesia, Malaysia, Thailand and Australia are all battling outbreaks and tightening restrictions, and Spain and Portugal announced restrictions for unvaccinated British tourists.

Underlining the impact of even small flare-ups of new COVID-19 cases, new data showed activity in China's services sector grew at a slower pace in June as curbs from a resurgence in cases in southern China restrained a rebound in consumption.

The currency market was more focused on the potential impact of new virus outbreaks, with the dollar edging down from one-week peaks. The dollar index was last down 0.04% at 92.026, with the yen firming slightly to 110.48 and the euro up 0.08% at $1.1904.

"Month-end rebalancing flows may also be at play, but with U.S. equities outperforming in June and in the quarter, the bias would be for USD selling rather than buying," Rodrigo Catril, senior FX strategist at National Australia Bank, said in a note.

Sterling was last trading at $1.3857, up 0.17% on the day.

Meanwhile U.S. Treasury yields were slightly lower. The benchmark 10-year note last yielded 1.4765%, down slightly from 1.48% late on Tuesday.

The 30-year bond last yielded 2.0891%, down from 2.097%.

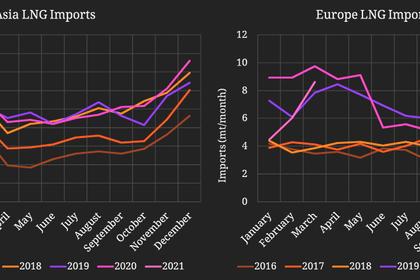

Oil prices remained higher as hopes for a demand recovery persisted despite the new Delta variant outbreaks.

Brent crude futures settled 0.56% at $75.18 per barrel and U.S. crude gained 0.79% to $73.56.

Spot gold rose 0.15% to $1,763.66 an ounce.

-----

Earlier: