BIG OIL RENEWABLE INVESTMENT UP

By GARETH FOULKES-JONES Chief Strategy Officer IGR Green

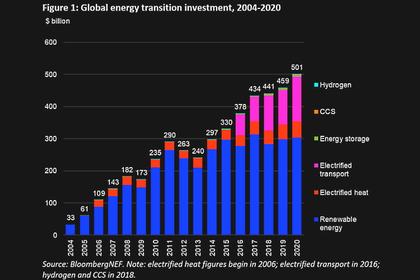

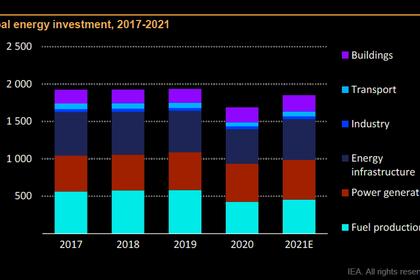

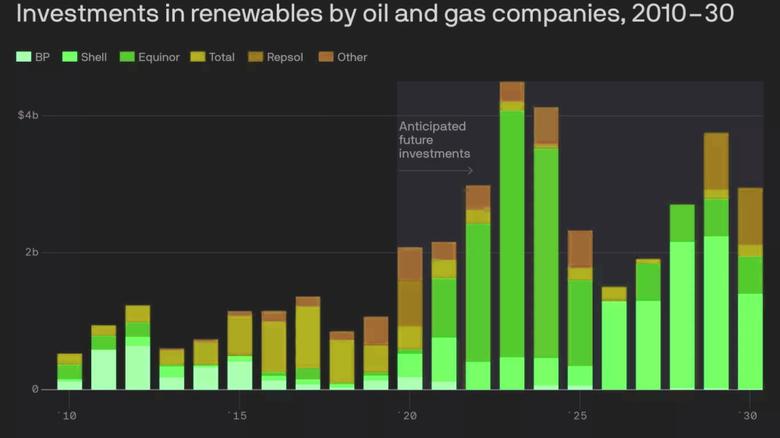

ENERGYCENTRAL - Jun 10, 2021 - 2020 proved a momentous years in the world of big oil. This is ironically despite an overall reduction of circa 6% in the overall global energy consumption. However, Oil & Gas (O&G) companies in fact increased their overall investment into various forms of clean energy by over 30% according to Capital Economics during the same time.

In concrete terms, this equated to an investment of nearly US$9 billion compared to some US$6.5 billion just one year prior.

The sample group utilised by Capital Economics consisted of over a dozen of the world’s O&G industry leaders. It is noteworthy that of this sample group, 10 indicated their intention to achieve a net zero emission status by the end of 2020. Unfortunately, at the time of writing, the author has been unable to verify how many of the aforementioned organisations were able to fulfil this undeniably ambitious, but evidently daunting pledge.

One point is self-evident from these exciting trends however. The sheer combined economic and political might that these goliaths of industry wield, unquestionably have the means to reshape the global socio-economic landscape. Through not only making a more liveable world, but one, which if properly executed can create countless sustainable jobs, thus further contributing meaningfully to the promotion of a more economically stable and harmonious global community

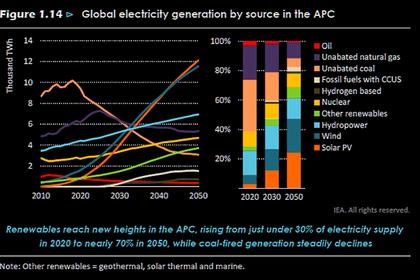

Assuming such a trajectory is maintained, CMS research has projected that peak oil will occur by approximately 2030. Assuming the figures and associated trajectories stand up to scrutiny, this would surely encourage the late adopters of the O&G industry to seriously reconsider their current business models lest they wish to risk inevitable redundancy.

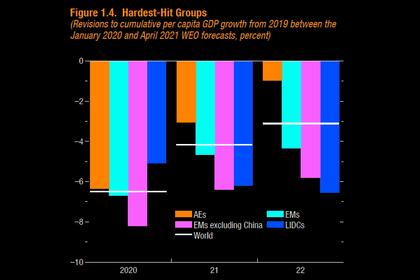

Furthermore, it was observed that in the aforementioned report that the Covid-19 pandemic may have in fact acted as an accelerator underscoring the inordinate urgency for major corporates to meet the ambitions goals of the Paris climate accord. This was similarly acknowledged by Mr. Bob Henderson, the general counsel to Royal Dutch Shell.

Whilst on this particular point, Royal Dutch Shell should be credited with being the single largest investor into renewables over the past fiscal year at some US$2 billion. With TotalEnergies emerging as a close second.

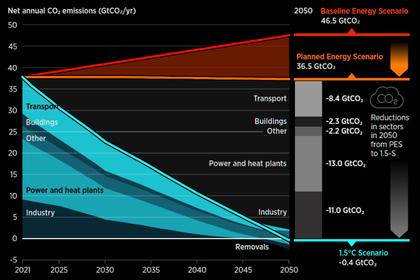

These trends appear also appear to fall conveniently in line with the climate legislation issued by the European Union issued in April 2020. Under this new mandate industry is obliged to reduce its greenhouse gas emissions to net-zero by 2050, with a milestone figure of 55% reduction to be enforced by 2030. Under this new energy mix, O&G consumption would need to be reduced by in excess of 30% and 25% respectively within the next decade, using their 2015 levels as the benchmark by which their performance is to be measured.

However, despite the evident improvements, CMS has cautioned that the transition is still too slow in order to adequately stem the rise in global temperatures above the 2 degrees Celsius threshold, as outlined by the Paris Climate Accord.

Whilst, it is undeniable that many O&G majors have clearly made a significant improvement, organisations such as the Climate Change Group have made calls for significantly more ambitious and radical action to be taken in order to have a reasonable hope of stemming the tide of ecological and climatic disaster.

The Climate Change Group avoided committing to a precise figure of investment needed to address this critical environmental issue. But was confident in asserting that said quantum would be several multiples of what is currently being expended as of the 2020 levels.

In conclusion, in order to better drive major O&G’s diversification strategies, a more rapid route would be to combine their considerable economic resources with the tried and tested track records of already established clean tech and renewable energy market players. BP has used this strategy with considerable success with the likes of the bp Pulse initiative by way of example.

Certainly to achieve such ambitious goals within the very stringent time lines many market participants have set themselves, the route of mergers with pre-existing market participants is clearly the most feasible and expedient solution to this globally critical challenge.

-----

This thought leadership article was originally shared with Energy Central's Clean Power Community Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Clean Power Community today and learn from others who work in the industry.

-----

Earlier: