CLEAN ENERGY NEEDS INVESTMENT GROWTH

IEA- 9 June 2021 - Financing Clean Energy Transitions in Emerging and Developing Economies

Executive summary

The world’s energy and climate future increasingly hinges on decisions made in emerging and developing economies

This very diverse grouping – spanning countries in Africa, Asia, Europe, Latin America and the Middle East1 – includes the world’s least developed countries as well as many middleincome economies, emerging giants of global demand such as India and Indonesia, and some of the world’s major energy producers. On a per capita basis, energy consumption in these countries is generally low, but expanding economies and rising incomes create vast potential for future growth. The challenge is to find development models that meet the aspirations of their citizens while avoiding the high-carbon choices that other economies have pursued in the past. The falling cost of key clean energy technologies offer a tremendous opportunity to chart a new, lower-emissions pathway for growth and prosperity. If this opportunity is not taken, and clean energy transitions falter in these countries, this will become the major fault line in global efforts to address climate change and to reach sustainable development goals.

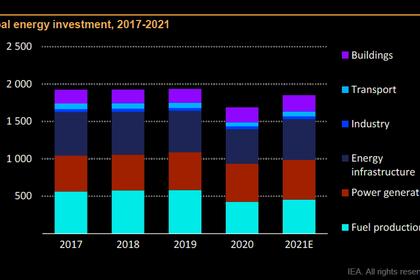

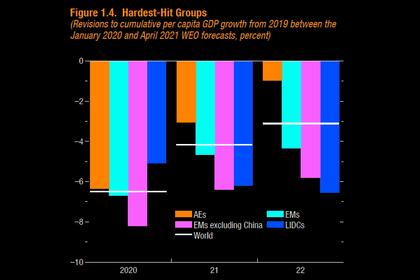

Covid-19 has widened the huge gap between investment needs and today’s flows

Developing and emerging economies account for two-thirds of the world’s population but only one-fifth of investment in clean energy – and just one-tenth of global financial wealth. Annual investments across all parts of the energy sector in developing and emerging markets have fallen by around 20% since 2016, in part because of some persistent challenges in mobilising finance for clean energy projects. The Covid-19 pandemic has weakened corporate balance sheets and consumers’ ability to pay, and put additional strains on public finances. The effects have been felt most severely in emerging and developing economies, and the impacts on public health and on economic activity are far from over, undercutting the prospects for a swift recovery and the means for a sustainable one.

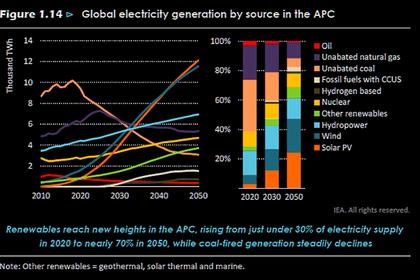

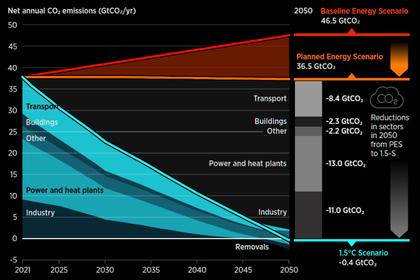

Today’s development pathway for emerging and developing economies points to higher emissions

Emerging and developing economies are set to account for the bulk of emissions growth in the coming decades unless much stronger action is taken to transform their energy systems. With the exception of parts of the Middle East and Eastern Europe, their per capita emissions are among the lowest in the world – one-quarter of the level in advanced economies. In a scenario reflecting today’s announced and existing policies, emissions from emerging and developing economies are projected to grow by 5 gigatonnes (Gt) over the next two decades. In contrast, they are projected to fall by 2 Gt in advanced economies and to plateau in China.

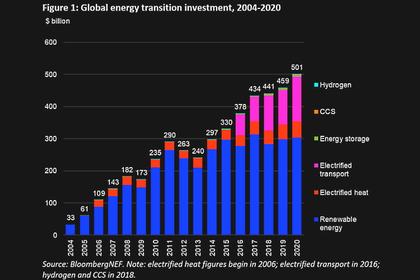

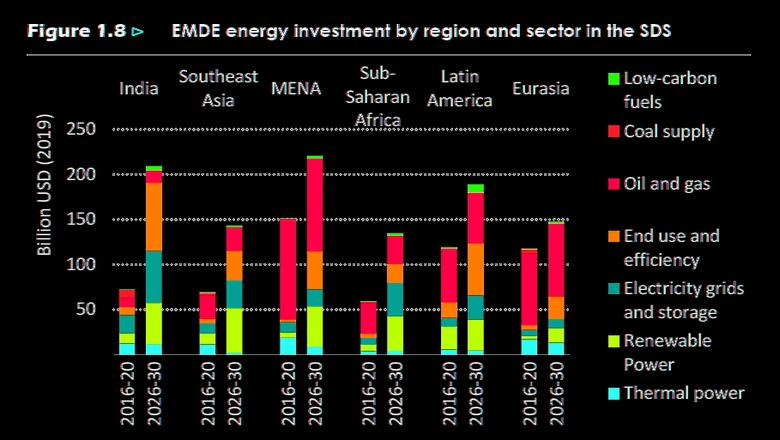

But a massive surge in clean energy investment in the developing world can put emissions on a different course

An unprecedented increase in clean energy spending is required to put countries on a pathway towards net-zero emissions. Clean energy investment in emerging and developing economies declined by 8% to less than USD 150 billion in 2020, with only a slight rebound expected in 2021. By the end of the 2020s, annual capital spending on clean energy in these economies needs to expand by more than seven times, to above USD 1 trillion, in order to put the world on track to reach net-zero emissions by 2050. Such a surge can bring major economic and societal benefits, but it will require far-reaching efforts to improve the domestic environment for clean energy investment within these countries – in combination with international efforts to accelerate inflows of capital.

The transformation begins with reliable clean power, grids and efficiency …

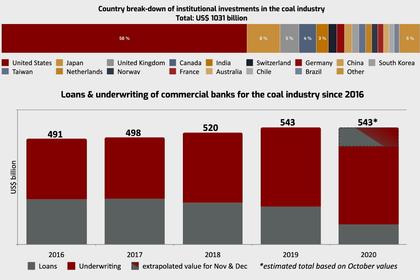

Transforming the power sector and boosting investment in the efficient use of clean electricity are key pillars of sustainable development. Electricity consumption in emerging and developing economies is set to grow around three times the rate of advanced economies, and the low costs of wind and solar power, in particular, should make them the technologies of choice to meet rising demand if the infrastructure and regulatory frameworks are in place. Societies can reap multiple benefits from investment in clean power and modern digitalised electricity networks, as well as spending on energy efficiency and electrification via greener buildings, appliances and electric vehicles. These investments drive the largest share of the emissions reductions required over the next decade to meet international climate goals. Innovative mechanisms with international backing to refit, repurpose or retire existing coal plants are an essential component of power sector transformations.

… but has to encompass all parts of fast-growing and urbanising economies

Clean power is central to development and transition strategies but cannot provide all the answers in economies undergoing rapid urbanisation and industrialisation. Transitions in fuels and energy-intensive sectors such as construction materials, chemicals and shipping are essential to achieve deep emissions reductions. This requires improvements in the efficiency of industrial equipment and heavy transport – as well as fuel switching, mainly to electricity and bioenergy but also to natural gas in areas where cleaner energy cannot yet be deployed on the scale needed. In parallel, it will be essential to lay the groundwork for a rapid scaling-up of low-carbon liquids and gases, including hydrogen, as well as carbon capture technologies, although many of these areas lack viable business models for the moment. Major fuel-importing countries, notably in Asia, stand to benefit from downward pressure on import bills. But among the world’s largest oil and gas producers and exporters, clean energy transitions create huge pressures on economic models that rely on hydrocarbon revenue, raising questions about the finance available for energy and non-energy investments alike.

Action on emissions in emerging and developing economies is very cost-effective

The average cost of reducing emissions in these economies is estimated to be around half the level in advanced economies. All countries need to bring down emissions, but clean energy investment in emerging and developing economies is a particularly cost-effective way to tackle climate change. The opportunity is underscored by the amount of new equipment and infrastructure that is being purchased or built. Where clean technologies are available and affordable – and financing options available – integrating sustainable, smart choices into new buildings, factories and vehicles from the outset is much easier than adapting or retrofitting at a later stage.

Transitions in the developing world must be built on access and affordability

Affordability is a key concern for consumers, while governments have to pursue multiple energy-related development goals, starting with universal energy access. There are almost 800 million people who do not have access to electricity today and 2.6 billion people who do not have access to clean cooking options. The vast majority of these people are in emerging and developing economies, and the pandemic has set back financing of projects to expand access. Efficiency is key to least-cost and sustainable outcomes. For example, meeting rising demand for cooling with highly efficient air conditioners will keep energy bills down for households – and minimise costs for the system as a whole. Action to provide clean cooking solutions and tackle other emissions will have major benefits for air quality: 15 of the 25 most polluted cities in the world are in emerging and developing economies, and air pollution is a major cause of premature death.

Smart use of public finance will need to come with much more private capital

Mobilising capital on a much larger scale will require a dramatic increase in the role of the private sector, and an enhanced role for international and development finance institutions will be critical to catalyse this investment. Energy investments today in emerging and developing economies rely heavily on public sources of finance, but in our climate-driven scenarios, over 70% of clean energy investments are privately financed, especially in renewable power and efficiency. Public sources of finance, including stateowned enterprises, will continue to play vital roles, especially in grid infrastructure and in transitions for emissions-intensive sectors. Provision of blended capital from development finance institutions is critical to attract private investment to markets and sectors at early stages of readiness – or in situations where the risks are hard to mitigate, such as energy access projects for vulnerable communities or in remote areas. Boosting finance to the required scale demands a wide range of instruments and approaches, including long-term local-currency debt for renewable power, corporate and consumer finance for efficiency, and risk capital to support new technologies, companies and project development

Energy transitions will need more debt financing by companies and consumers

While clean energy transitions rely on much higher levels of both equity and debt, the capital structure of investments is likely to move towards more debt. This arises mainly from a shift in investment flows towards sectors such as electricity where debt finance is more common, as well as a greater emphasis on funding models that support household purchases of electric vehicles and improvements in buildings and factories. Mobilising investment across all sectors will depend on enhancing financial flows from local sources as well as from international providers. Renewable power offers the most likely route for increased participation by international project developers, commercial banks and other relevant investors. Consumer-based investments or those coming from state-owned enterprises – in fuel supply and grids, for example – rely more heavily on domestic sources of capital, but they also need access to a wider set of fundraising options.

In a more capital-intensive energy system, the cost of capital is key

The affordability of clean energy transitions will depend on reducing the cost and improving the availability of capital. Many clean energy technologies such as wind, solar PV and electric vehicles, have relatively high upfront investment requirements that are offset over time by lower operating and fuel expenditures. The shift towards a more capitalintensive energy system means that keeping financing costs low will be critical to accelerating energy transitions while keeping them affordable. However, for the moment, capital is significantly more expensive in emerging and developing economies than in advanced economies. Nominal financing costs are up to seven times higher than in the United States and Europe, with higher levels in riskier segments. This points to a relatively high bar for projects to raise debt finance and offer sufficient returns on equity.

Global investment capital is available but needs projects and incentives to match

There is no shortage of global capital, but there is a shortfall of clean energy investment opportunities around the world that offer adequate returns to balance the risks. Coming into 2020, global financial wealth held by investors stood at over USD 200 trillion. There is strong appetite among investors to fund clean energy projects, with global issuance of sustainable debt soaring to record levels in 2020. Most of this is concentrated in advanced economies. If energy transitions are to be successful, then developers and financiers need to increase the amount of capital they allocate to two underserved asset classes – to clean energy in particular, and to emerging and developing economies more broadly. Sustainable finance frameworks should encourage both of these shifts. As things stand, the alignment of investment portfolios with net-zero emissions goals risks excluding countries with highercarbon footprints or sectors with more challenging transition pathways.

Clean energy projects struggle to grow in many parts of the developing world …

Many emerging and developing economies do not yet have a clear vision or the supportive policy and regulatory environment that can drive rapid energy transitions. Project-specific factors are compounded in many cases by broader cross-cutting issues, which undermine risk-adjusted returns for investors and the availability of bankable projects. For projects, these include the availability of commercial arrangements that support predictable revenues for capital-intensive investments, the creditworthiness of counterparties and the availability of enabling infrastructure, among other challenges. Broader issues include subsidies that tilt the playing field against sustainable investments, lengthy procedures for licensing and land acquisition, restrictions on foreign direct investment, currency risks, and weaknesses in local banking and capital markets. The financial performance of utilities can also be a major constraint, as they underpin investment in networks and serve in many instances as the buyer of renewable output. Debt burdens are on the rise in many economies and few governments in emerging and developing economies have the fiscal space to mobilise resources for a sustainable recovery.

… but unleashing clean energy investments brings multiple benefits

Energy transitions bring major new economic opportunities, notably through the creation of new jobs associated with clean energy investments and activities. Spending on more efficient appliances, electric and fuel cell vehicles, building retrofits and energy‐efficient construction provide further employment opportunities. Development in these areas can especially support the role of women and female entrepreneurs in driving change and improving gender equality. Governments need to ensure that clean energy transitions are people‐centred and inclusive, helping communities navigate the new opportunities as well as the economic burdens arising from the transition away from fossil fuels and the potential closure of emissions-intensive assets. Addressing transition challenges requires a focus on transparent public dialogue, developing programmes to boost skills in all aspects of clean energy transitions and supporting the growth of new job opportunities in more sustainable economic activities.

An international catalyst is needed to boost clean energy investment in emerging and developing economies

Transitions in these economies will falter without more international engagement and support. Actions by policy makers within their countries to address the challenges and seize the opportunities will not, on their own, generate sufficient momentum. Supportive international actions will be essential to catalyse the necessary investments in critical areas and to support longer-term reform processes, starting with the commitment by developed economies to mobilise USD 100 billion per year in climate finance. The current international financial architecture offers some support for sustainable development around the world. However, today’s strategies, capabilities and funding levels do not yet answer the call for a fundamental transformation of the energy sector in emerging and developing economies. The international financial system lacks a clear and unified focus on financing emissions reductions and clean energy – particularly in the developing world. This needs to be done across multiple aspects of energy transitions, with co-ordinated finance from donors and the provision of technical assistance on the ground. Increasing the effectiveness of the delivery channels for investments is critical.

A clear set of priority actions must guide strategies and accelerate transitions

This special report proposes a clear set of priority actions to mobilise the necessary capital to finance clean energy transitions. This is based on detailed analysis of successful projects and initiatives, including almost 50 real-world case studies – across clean power, efficiency and electrification, as well as transitions for fuels and emissions-intensive sectors – in countries ranging from Brazil to Indonesia and from Senegal to Bangladesh. The priorities focus on financing sectors that are market-ready, based on technologies at mature and early adoption stages, such as renewables and efficiency. They also examine options for financing transitions in fuels and emissions-intensive sectors where decisions taken over the next decade can lay the groundwork for the integration of new technologies – or could potentially lock in emissions for decades to come. We focus on actions that need to be taken between now and 2030 – a pivotal decade for economic recovery, for the realisation of the UN Sustainable Development Goals and for climate action.

-----

Earlier: