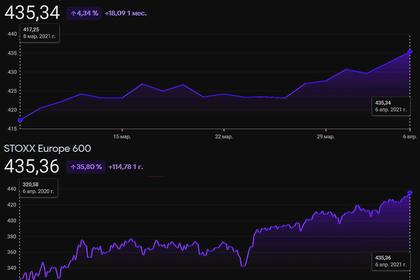

EURO BONDS YIELDS UP

REUTERS - June 24, 2021 - Government bond yields in the euro area drifted higher on Thursday, pushed up by brighter prospects for the bloc’s economy.

In Germany, the euro zone’s benchmark bond issuer, 10-year yields have risen around 12 basis points from lows hit a day after the European Central Bank’s reaffirmed its dovish policy stance at a June 10 meeting. A hawkish shift by the U.S. Federal Reserve last week added to upward pressure.

A Bank of England meeting later on Thursday could further push up bond yields if policymakers suggest that massive stimulus could be taken away sooner than expected as the economy bounces back from the COVID-19 shock.

In early trade, most 10-year bond yields were up around one basis point on the day, with Bund yields 1.2 bps higher at -0.17%.

Analysts expect signs of a strengthening economy to keep upward pressure on borrowing costs. On Wednesday, IHS Markit’s Flash Composite Purchasing Managers’ Index, seen as a good guide to economic health, jumped to 59.2 in June from 57.1, its highest reading since June 2006.

Germany’s closely-watched Ifo business sentiment survey is released later on Thursday.

“Bond markets appear to have found a new balance after the Fed-induced volatility eruption last week,” said Christoph Rieger, head of rates and credit research at Commerzbank.

“While Bunds stabilised, the long-end curve re-steepened further and (inflation) break-evens re-widened, suggesting that fundamentals are slowly taking over from positioning again.”

The five-year, five-year breakeven inflation forward, a market gauge of long-term inflation expectations in the euro area, rose to 1.56% on Wednesday.

That’s up sharply from almost two-month lows hit last week.

Elsewhere, Italy was expected to launch a new CCTeu bond, due April 15, 2029 via a syndicate of banks.

“The maturity of the new floater will be longer than usual. In our view, this reflects Italy’s objective of lengthening its debt maturity,” analysts at UniCredit said in a note.

Italy’s 10-year bond yield was last up almost one basis point at 0.90%.

-----

Earlier: