GLOBAL ENERGY INVESTMENT WILL UP TO $1.9 TLN

IEA - World Energy Investment 2021

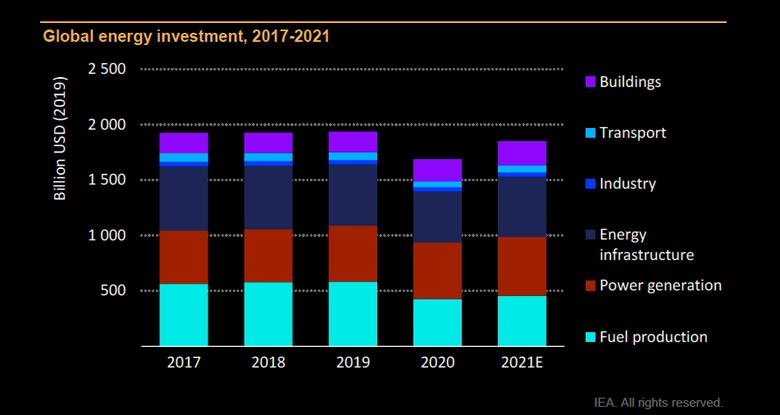

Global energy investment is set to rebound by around 10% in 2021, reversing most of the drop caused by the pandemic In 2021, annual global energy investment is set to rise to USD 1.9 trillion, rebounding nearly 10% from 2020 and bringing the total volume of investment back towards pre-crisis levels. However, the composition has shifted towards power and end-use sectors – and away from traditional fuel production.

Prospects for investment have improved markedly along with economic growth, although there are significant country-by-country variations. Global energy demand is set to increase by 4.6% in 2021, more than offsetting the 4% contraction in 2020, according to the latest IEA estimates. While many energy companies remain in a fragile financial state, there are signs developers are using the window provided by accommodative monetary policy and government backing to plan infrastructure developments and investments in new projects.

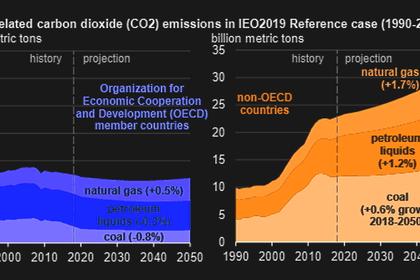

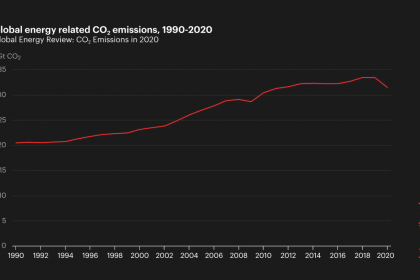

The anticipated upswing in investments in 2021 is a mixture of a cyclical response to recovery and a structural shift in capital flows towards cleaner technologies. But despite an urgent need to shift to a more sustainable energy pathway, global carbon dioxide (CO2) emissions are again on the rise, following the largest-ever annual decline in 2020.

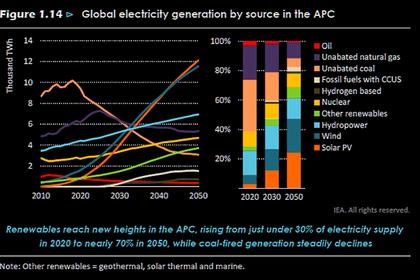

Electricity, led by buoyant spending on renewable power, continues to take the largest share of overall supply investment After staying flat in 2020, global power sector investment is set to increase by around 5% in 2021 to more than USD 820 billion. Renewables dominate investment in new power generation and are expected to account for 70% of 2021’s total of USD 530 billion spent on all new generation capacity. Investment in grids and storage makes up the remainder. Thanks to rapid technology improvements and costs reductions, a dollar spent on wind and solar photovoltaic (PV) deployment today results in four times more electricity than a dollar spent on the same technologies ten years ago.

Renewable investment has thrived in markets with well-established supply chains where lower costs are accompanied by regulatory frameworks that provide cash flow visibility – and where lenders and financiers that understand these sectors well are seeking sustainable projects to support. Demand from the corporate sector for clean electricity to meet sustainability targets has also played a role.

Much of the spending resilience in 2020 was concentrated in a handful of markets, most notably the People’s Republic of China (hereafter, “China”), which saw a remarkable year for wind power investment, as well as the United States and Europe. For the fifth consecutive year, capital spending in the power sector in 2020 was higher than for oil and gas supply.

Electrification was also a major driver of investment spending by final consumers. Electric vehicle sales continue to surge along with a proliferation of new model offerings by automakers, supported by fuel economy targets and zero-emissionsvehicle mandates.

Policies remain a crucial driver for many energy investments, with the impact of recovery plans becoming visible in some countries In economies where governments have more fiscal space and are able to borrow at low rates, recovery strategies offer a major opportunity to boost investment in infrastructure, efficiency and clean energy technologies. In the case of infrastructure, after declining for the fourth consecutive year in 2020, spending on electricity grids is expected to rise in 2021, led by China and Europe. Proposed infrastructure spending in the United States, if approved, would add to this momentum.

Spending on energy efficiency improvements is set to increase in 2021 by nearly 10% in response to renewed economic growth and initial effects of recovery programmes. However, against a backdrop of relatively low fuel prices, growth is heavily concentrated in markets and sectors with clear government policies, such as the buildings sector in Europe. Policies and stimulus spending are spurring projects in new areas such as low-carbon hydrogen and carbon capture utilisation and storage (CCUS).

Yet despite these encouraging signs, stimulus spending on clean energy technologies is falling well short of what is needed to ensure a sustainable recovery from the Covid-19 crisis. Many developing countries lack the means to pursue expansive recovery strategies, and early signs of inflation in some economies has led to questions about how long the current environment of low interest rates will last.

Momentum from net zero pledges and sustainable finance is yet to translate into large increases in actual spending on clean energy projects Over the last year, there has been a proliferation of commitments by governments, companies and financial institutions to achieve net zero emissions by 2050 or soon thereafter. The financial community in many advanced economies has rallied around sustainable finance, launching funds and initiatives to channel growing appetite from capital markets and to comply with new disclosure rules. Sustainable debt issuance has risen rapidly, reaching a record USD 600 billion in 2020, and the mainstreaming of green bonds is increasingly accompanied by new types of securities and performance-based instruments to support more complex transitions.

Clean energy companies have performed well on financial markets, with renewable power companies outperforming both listed fossil fuel companies and public equity market indices in recent years, and with lower volatility. Valuations remain high after a particularly strong run-up in prices in the second half of 2020, even though there was some pullback in early 2021.

Even if spending on clean energy is set to rise in 2021 by around 7%, financial flows have grown more rapidly than actual capital expenditures. There is a shortage of high-quality clean energy projects. This is compounded by inadequate channels to guide available funds in the right direction and a lack of intermediaries capable of matching surplus capital with the sustainability needs of companies and consumers.

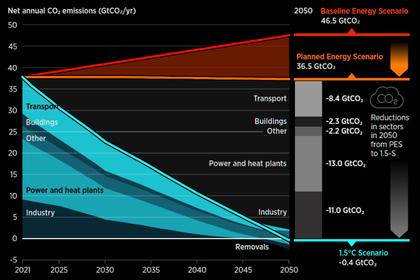

Clean energy investment is on a moderate upswing, but remains far short of what will be required to avoid severe impacts from climate change The USD 750 billion that is expected to be spent on clean energy technologies and efficiency worldwide in 2021 remains far below what is required in climatedriven scenarios. Clean energy investment would need to double in the 2020s to maintain temperatures well below a 2°C rise and more than triple in order to keep the door open for a 1.5°C stabilisation. Moving to a climate-aligned energy pathway hinges on a broad range of government actions, including attention to the financial architecture that can accelerate direct investments in market-ready solutions and promote innovation in early-stage technologies. As emphasised in the new IEA Roadmap to Net Zero by 2050, policies need to drive a historic surge in clean energy investment this decade.

Clear policy signals from government would not only reduce uncertainties associated with clean energy but also avoid potential costs from investing in assets that risk being underutilised or stranded. Mismatches in the speed of adjustment can create risks, for example, if a slow pace of grid investment leads to bottlenecks for wind and solar PV, or if oil and gas suppliers transition away from hydrocarbons faster than do their consumers. As financial regulators work to align capital flows with climate goals, slower progress in the real economy can lead investors to over-value some sectors while penalising others, creating a volatile ride along the way.

The gap between today’s investment trends and a sustainable pathway is larger in emerging market and developing economies In contrast to advanced economies and China, investment in emerging market and developing economies (EMDEs) is set to remain below pre-crisis levels in 2021, in large part because their twin public health and economic crises are more prolonged. EMDEs outside China account for nearly two-thirds of the global population but only one-third of global energy investment and just one-fifth of clean energy investment.

These EMDEs need to achieve a large increase in investment from a starting point of less fiscal space and more constrained access to sources of finance than advanced economies. Financial pressures on utilities and other major investment players in EMDEs have been exacerbated by the pandemic, which has also resulted in setbacks in the drive to expand access to modern energy. This is a major fault line in global energy transitions, which we will examine in detail in a major new IEA special report, entitled Financing Clean Energy Transitions in Emerging Market and Developing Economies.

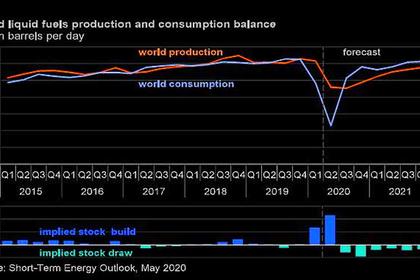

The balance of investment in fossil fuels is shifting towards state-owned companies Upstream oil and gas investment is expected to rise by about 10% in 2021 as companies recover financially from the shock of 2020, but spending remains well below pre-crisis levels. Firmer demand and higher oil and gas prices have led to diverging investment strategies. Cost control remains a common theme, but some major national oil companies are looking to invest counter-cyclically to gain market share. Qatar’s decision to move ahead with the world’s largest liquefied natural gas (LNG) expansion, and to include carbon capture in its development plans, is a strong statement of intent to maintain a leadership position in LNG.

There are strong pressures on private companies to keep oil and gas portfolios in check. Despite higher prices, the major oil companies are holding aggregate oil and gas spending flat in 2021, and their share of overall upstream spending is now at 25%, compared with nearly 40% in the mid-2010s. The shale sector is, for the moment, sticking to its newfound commitment to capital discipline, using higher revenues in 2021 to pay down debt and return money to shareholders rather than to increase output.

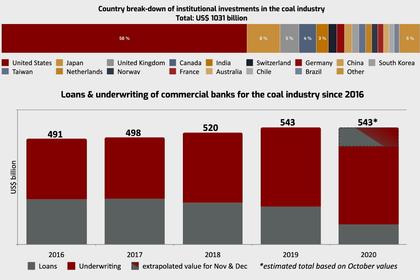

The predominance of state-owned companies is also visible in coal supply, with investment dynamics largely determined by what happens in China and India. In China, the policy priority is to modernise the sector by shutting down small, inefficient mines and investing instead in large, fully mechanised mines. In India, the main driver behind domestic investment is to reduce coal imports.

Overall, the overwhelming bulk of fuel supply investment in 2020 went into fossil fuels – 84% to oil and gas and 14.5% to coal (which is a much less capitalintensive sector). Around 1.3% was spent on low-carbon fuels. Today’s investment spending on fuels appears caught between two worlds: neither strong enough to satisfy current fossil fuel consumption trends nor diversified enough to meet tomorrow’s clean energy goals.

An uptick in investment decisions for new coal-fired power plants underscores that coal is down, but not out The rising share of renewables in new power generation investment has been accompanied by a sharp drop in approvals for new coal-fired power plants, which are some 80% below where they were five years ago. However, there was a slight increase in go-aheads for new coal-fired projects in 2020. This was largely due to China, where the government lowered restrictions on building new plants, giving a green light for construction in more provinces. Cambodia, Indonesia and Pakistan were other countries where coal-fired final investment decisions (FIDs) picked up in 2020. Those three countries together approved almost 5 gigawatts (GW) of new coal capacity in total. In India, the amount approved dropped below 1 GW, its lowest level in a decade.

China’s coal-fired FIDs in 2020 were about 25% their 2010 level, India’s less than 5%. FIDs for gas-fired power plants edged down globally in 2020 but were still more than double those of coal (50 GW versus 20 GW). A large reduction in FIDs for new gas-fired capacity in the United States more than offset growth in parts of Asia (outside China and India).

From a low base, investments by the oil and gas industry in clean energy technologies are starting to pick up. Oil and gas companies are coming under increasing pressure to adapt their investment strategies to the needs of clean energy transitions. This takes different forms, including commitments to reduce emissions resulting from oil and gas supply or to invest into new areas such as clean electricity or sustainable fuels.

In 2020, clean energy investments by the oil and gas industry accounted for only around 1% of total capital expenditure. However, our tracking suggests that commitments to diversify investment, led by large European companies, are already starting to have an impact. If performance so far in 2021 is maintained for the full year, the share of capital investment by the oil and gas industry going to clean energy investments could rise to more than 4% in 2021. Project financing for offshore wind – closely aligned with industry strengths – was considerably higher in the first quarter of 2021 than in the whole of 2020.

Support for innovation is a key pillar of net zero plans, but 2020 saw diverging trends between government and corporate spending on energy research & development Public spending on energy research & development (R&D) continued to rise in 2020, with the share of low-carbon technologies in the total rising to 80%. However, energy R&D spending by the private sector dropped by around 2% as the pandemic caused cuts to corporate budgets. Governments have a key role to play in ensuring that the world’s capacity to bring new technologies to market is not disrupted by the pandemic.

The signals for investment in low-carbon energy innovation in early 2021 are broadly positive. Major economies have highlighted innovation and increased funding as part of their drive to net-zero emissions. In total, we estimate that through 2030, over USD 50 billion of public funds could be available for major demonstration projects for large-scale low-carbon energy technologies, including CCUS and other ways to mitigate industrial emissions. Another source of optimism is the observed resilience in 2020 of early-stage venture capital funding for lowcarbon energy technologies.

-----

Earlier: