GLOBAL LNG MARKET CHANGES

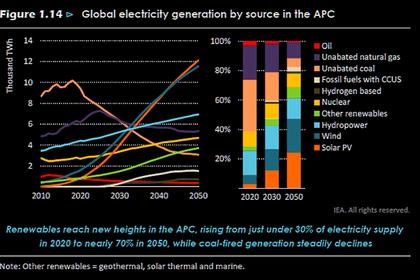

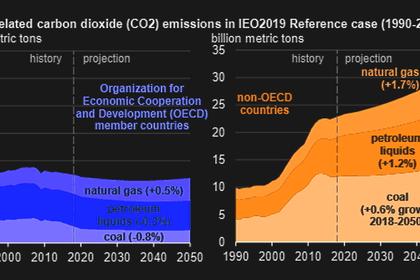

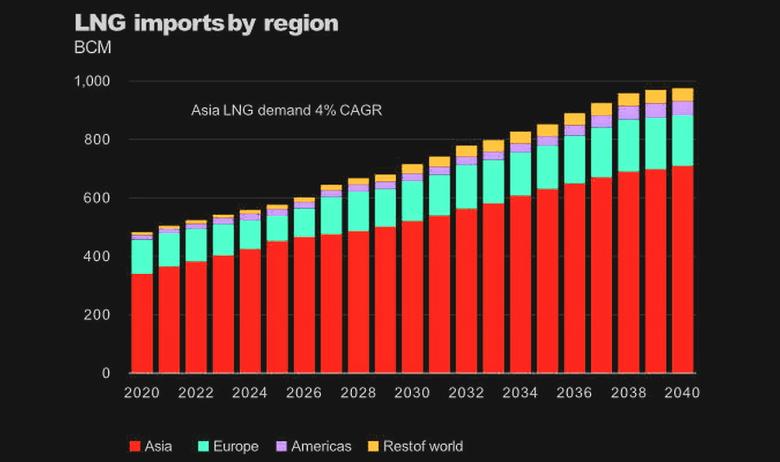

PLATTS - 09 Jun 2021 - The efforts of Asian and European countries to address climate change and transition their economies toward cleaner energy sources will reshape two key demand centers for US LNG exports.

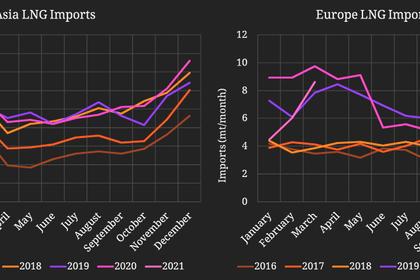

Asia provides US LNG with plenty of room to grow market share, but the opportunities hinge on the US remaining a low-cost supplier. In Europe, US gas will continue to play a supply balancing role for now, but the EU's focus on carbon intensity could pose a challenge to US imports over the longer term.

Energy transition in Asia

In Asia, net-zero carbon ambitions will likely require US LNG to arrive in the form of certified low- or carbon-neutral cargoes, according to Jeff Moore, S&P Global Platts Analytics manager for Asian LNG.

Developed economies such as Japan, South Korea and Taiwan could take the lead in aggressively pursuing long-term emissions targets for 2050, said Moore. Importers in those countries have already begun planning on a framework for long-term carbon-neutral LNG contracts. For US producers, the new trade terms could require export cargoes delivered to Asia to meet stringent new quality standards while remaining competitively priced.

Historically, key selling points of US LNG have been price-diversification and flexibility, Moore said. Those factors could continue to give US LNG a competitive edge. In Japan, recent events have served to highlight the value of US LNG to the country's power mix for those very reasons.

Over the past decade, Japan has become increasingly vulnerable to price fluctuations in the Northeast Asian LNG import market as the role of gas for power generation has expanded following the nuclear accident at Fukushima. In that context, the US LNG linkage to Henry Hub has been critical for price diversification. During the recent North Asian winter crisis of 2020-21, the Platts JKM -- the benchmark price for spot physical cargoes delivered ex-ship into Japan, South Korea, China and Taiwan -- spiked to a record high $32/MMBtu, highlighting the value of a long-term contract linkage to US LNG supply.

In other Asian countries, where natural gas is helping to eliminate coal and back up renewables, it will be difficult to discount the role of US LNG as well. Existing gas infrastructure in Asia and declining indigenous supply will make US gas fundamental to the region's market in the years ahead, Moore said.

Over the next decade, gas production from nations in South and Southeast Asia is forecast to decline by nearly 20 Bcm/year, according to Platts Analytics -– making the scope for LNG demand growth in Asia immense. The electrification of transport is only starting, and coal-backed financing is on the decline. In Japan, power and heat generation account for 68.9% of LNG demand, while in South Korea it is 53.5%. In Singapore, more importers say they are preparing to expand LNG bunkering operations.

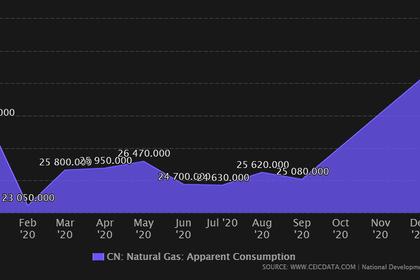

In emerging economies such as China and India, much of the new growth is expected to come from industrial demand, fertilizers, petrochemicals and city gas. In fast-growing sectors such as local gas distribution, imported LNG is expected to help displace dirtier fuels such as biomass.

A foothold in Europe

In Europe, US LNG provided a valuable alternative to traditional pipeline supply from Russia and Norway, playing an expanding role in the market since the first cargoes were delivered in 2016.

The comparatively short shipping distance from the US to Europe, and lower delivered costs, have made US LNG a valuable supply source -- particularly for nations in Western Europe. Since 2016, more than 66 Bcm of US LNG, or an average of around 13 Bcm/year, has arrived on the continent's shores.

Last year, US LNG comprised 4.8% of the European gas market, up from 0.1% in 2016 -- surpassing supply from the Netherlands at 4.1% and trailing Qatar only slightly at 5.7%, Gazprom data shows.

LNG will be important as Europe shifts from coal and nuclear power and as gas production in Europe declines, according to Platts Analytics LNG analyst Samer Mosis. That dynamic is under pressure, though, he added.

"A reality wherein the carbon-intensity of energy imports becomes a primary factor is becoming increasingly likely, and in this reality, the connection with the US could see a marked shift," Mosis said.

LNG output from Qatar, which has been expanding production as well as tending to its emissions profile, is another obstacle to US LNG taking a firmer hold in Europe.

The country is set to boost its LNG production capacity to 126 million mt/year before the end of the decade. It has been busy sealing deals in Europe, adding around 10 million mt/year worth of long-term contracts in 2020 alone. Qatar has also pledged to capture and store more than 7 million mt/year of CO2 by 2027 and offer CO2 offsets in its term contracts with buyers.

"US suppliers looking to ensure they maintain a European option for their exports in the long term will need to take the necessary steps to begin comprehensively and verifiably measuring and mitigating emissions across their value chains," Mosis said.

The European Commission plans to introduce legislation designed to reduce emissions, including a carbon-border adjustment mechanism and a tool to potentially penalize significant methane emitters.

Amid growing wariness in Europe over the carbon-intensity of US gas, France's Engie in November 2020 pulled out of talks for a long-term supply deal with US LNG company NextDecade. The French government and environmentalists had reportedly urged Engie to reject the deal because of the environmental impact of LNG sourced from gas produced using hydraulic fracturing.

The same concern prompted the Irish government to impose a moratorium on the development of LNG import infrastructure and to specifically rule out imports of LNG produced from shale gas. Ireland has no LNG import infrastructure at present, but two projects are still under development: US company New Fortress Energy's Shannon LNG terminal, and a floating import terminal project being developed by UK-listed Predator Oil and Gas.

The EU, however, doesn't see its policy goals necessarily becoming an impediment to importing US LNG in the coming years. Anne-Charlotte Bournoville, head of international relations and enlargement at the EC's energy directorate, said the EU and US were "not going in different directions."

"We both agree that we have to step up measurement, reporting and verification as a necessary condition to the reduction of methane emissions," Bournoville said in November 2020.

However, European purchasers could show a preference for "best in class" suppliers, she said.

Shell's head of integrated gas, Maarten Wetselaar, in February called on the EU and US to cooperate on emissions regulations.

"If we can get EU legislation and EU performance standards [and] a similar system in the US so we can declare equivalence between the two, [that] would really help the trade between the two in terms of LNG and would set an example for the world to follow," he said.

US trade group LNG Allies' President Fred Hutchison said the turnaround in policy direction under the Biden administration is already easing some of the pressure between Europe and the US.

-----

Earlier: